Goodbye, 2025. Hello, 2026.

From all of us at LSI, thank you for showing up week after week as fellow collaborators in advancing medtech through sharper insights, better conversations, and a shared commitment to improving healthcare. As the industry eases out of the holiday haze, we wanted to take one step back before charging ahead. This edition is our look at medtech industry trends in 2025, drawn from the 46 editions of The Numbers we published this year and shaped by what you engaged with most.

To build this recap, we paired newsletter engagement signals with the themes that consistently surfaced across the year. The result is not a comprehensive list of every headline, but a clear snapshot of what mattered, what persisted, and what may help guide how we navigate 2026.

Medtech Industry Trends 2025

Strategics Slim Down And Sharpen Their Focus

Across 2025, nearly a dozen divestments were announced or completed, a sign that portfolio reshaping is no longer an occasional tactic. It is a core strategy.

The most attention-grabbing headline was Johnson & Johnson’s plan to divest its orthopedics business. While the news may have surprised some, the strategic direction had been visible for years. Underneath that announcement sits a bigger question that echoed throughout the year: why are medtech giants letting go of legacy assets?

The simplest answer we kept hearing was focus. Management teams want more exposure to faster-growing segments, and divestments can turn broad conglomerates into more specialized businesses with clearer narratives. Investor pressure is often the accelerant. Slower-growth segments can weigh on overall performance and, by extension, sentiment around valuation. When legacy lines dampen the average growth rate of the broader portfolio, the stock price can feel it.

There is also a practical catalyst: capital. Selling non-core assets frees up resources to redeploy into higher-growth areas. And in 2025, buyers were not hard to find. Private equity has been a consistent source of demand, making the timing attractive for sellers who want to act while competition for assets remains healthy.

Beyond Johnson & Johnson, other companies that announced or completed divestitures of parts of their business included Stryker, Medtronic, Teleflex, and BD.

Our view heading into 2026: we do not think portfolio optimization is finished. Investor expectations remain high, and private equity still has capital to put to work. Two predictions from our team captured this sentiment.

- Bold prediction: Philips divests its respiratory and sleep business.

- Less bold prediction: Hologic sells off non-core divisions following its privatization move driven by private equity.

Heart Failure Draws Capital

Heart failure remains one of the most burdensome disease categories globally. Prevalence is rising, the clinical trajectory can be unforgiving, and the economic impact is enormous. That combination keeps innovation pressure high, and it also keeps investors and acquirers paying attention.

One theme we saw throughout the year was breadth. Funding activity spanned companies working on monitoring as well as those targeting longer-term management and disease progression. On the monitoring side, the goal is straightforward: reduce avoidable hospitalizations, which are both costly and common in heart failure care.

In the U.S., each hospitalization is estimated to cost between $13,000 and $15,000. In total, we estimate roughly $17 billion in hospitalization costs for heart failure alone. Those economics explain why technologies that measurably reduce admissions continue to attract support. If a solution can keep patients stable, keep clinicians informed, and keep care moving upstream, the value case can become compelling quickly.

We are equally interested in where the category is going, not just where it is today. Current approaches lean toward managing disease and slowing progression. The next generation aims higher: solutions that can potentially reverse progression, not simply monitor decline.

Our view heading into 2026: we expect acquisition volume to increase in this segment of the cardiovascular devices market. That volume will likely skew toward companies building and commercializing heart failure monitoring solutions for heart failure progression, where the commercial path can be clearer today. Device-based companies may be a bit further out, but several names stood out to our team as ones to watch: Corvia Medical, EBR Systems, and Reprieve Cardiovascular.

Medtech M&A Momentum Stays Steady

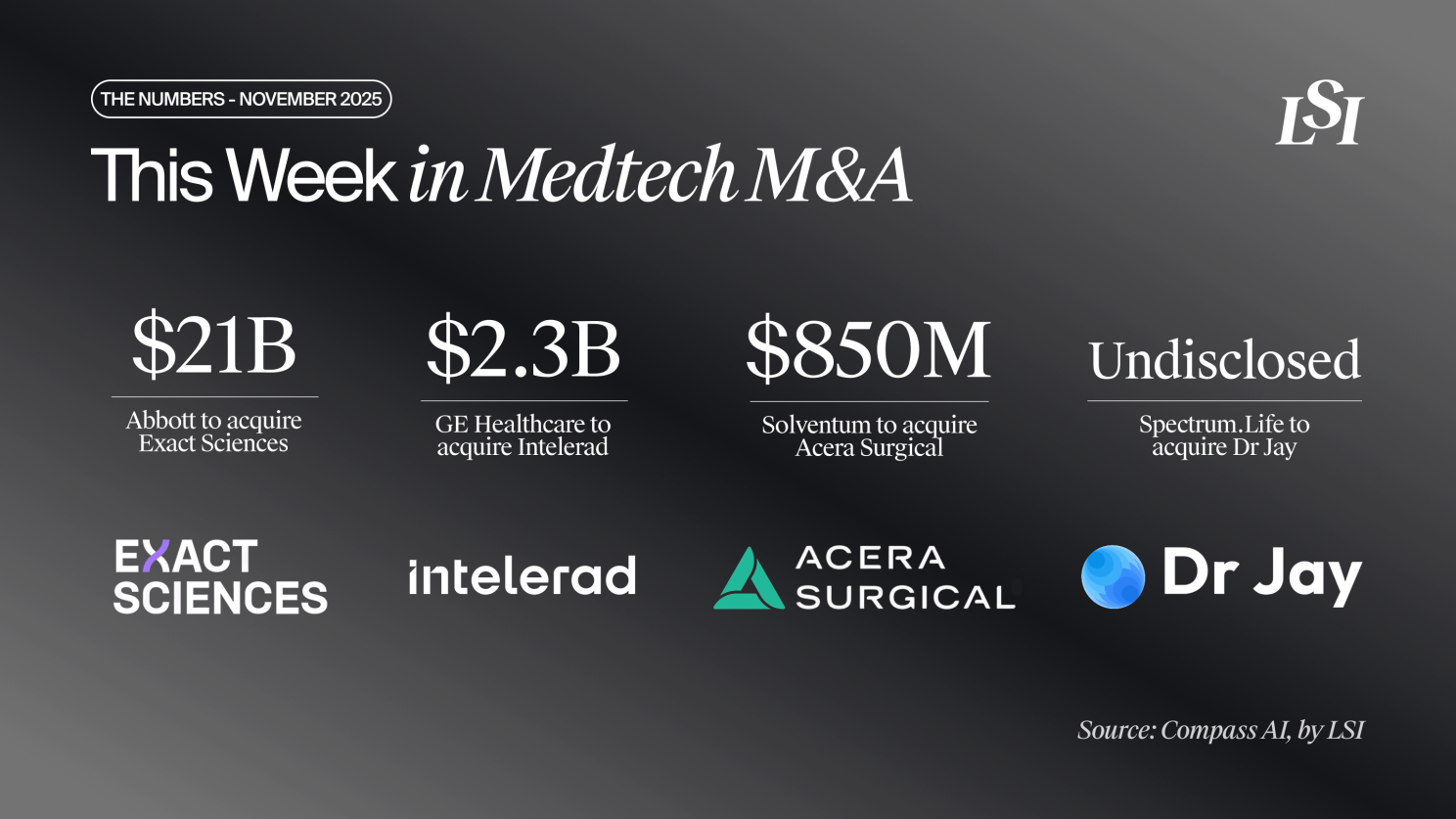

Deal activity kept its footing. In 2025, there were 42 medtech M&A deals announced, extending the momentum we saw in 2024.

The range was wide, from transformative transactions to a steady stream of tuck-in acquisitions. One of the largest was Abbott’s historic $21 billion acquisition of Exact Sciences. Corporate strategics remained the predominant buyers, and Boston Scientific led amongst its strategic peers with four acquisitions. Alcon and GE HealthCare were also active, along with private equity.

Two deal dynamics consistently stood out as we tracked the year:

- Targets skewed commercial or commercial-ready. Buyers showed less appetite for earlier-stage speculation on disruptive assets without evidence of traction. Proof points mattered, and commercial validation carried weight.

- M&A aligned to high-growth portfolio priorities. For startups, that reinforces the importance of articulating how your technology can serve as a growth driver within a strategic acquirer’s roadmap. The exit story increasingly needs to map to the buyer’s growth narrative, not just the novelty of the innovation.

Our view heading into 2026: acquisition volume remained flat across 2024 and 2025, which leaves room for a modest decline if buyer selectivity increases. Conditions are still favorable to buyers, though, and we hope the temperature does not cool meaningfully.

Changes in Medtech Funding

A full funding review is still in progress from our team, but the headline is clear: 2025 was a strong year for fundraising, particularly in total disclosed dollars.

Based on disclosed rounds in the Compass database, more than $11 billion was raised in 2025. For comparison, we estimate around $10 billion in 2024. On paper, that is progress, especially against the tighter capital environment that defined 2022 and 2023.

Looking deeper, we saw several patterns that help explain what is really happening beneath the topline:

- Capital concentration is real. Many investors, particularly in venture, remained risk-averse. With the time to exit not shrinking meaningfully, more capital is flowing toward established players that can de-risk the near-term story.

- Mega-rounds surged. $100M+ rounds increased by more than 50% compared to 2024. With over 30 of these mega-rounds in 2025, the number of acquirable, commercial-ready assets have been vetted for at least the short-term.

- Early-stage has not disappeared, but it has changed. The easy capital of the pandemic era is gone, and traditional risk-takers are more selective. At the same time, alternative sources are more present, including family offices, academic-affiliated venture arms, and strategics participating earlier.

Early-stage innovators should not mistake selectivity for disinterest. Support for new innovation is critical to the health of medtech and the broader mission of better healthcare. The hunt is still on, but the rules and routes are evolving.

Our view heading into 2026: if macroeconomic factors stabilize after the volatility we saw in early 2025, we expect another record year in medtech funding, with a meaningful uptick in early-stage activity.

Looking Ahead

As always, you can expect additional quarterly coverage and Q4 insights in future editions of The Numbers. Looking back, 2025 delivered no shortage of signals, and it offered a clear preview of where the industry may be heading next: deeper diligence, fewer leaps of faith, more proof of commercial pathways, and sharper alignment to growth. Thank you for reading, sharing, and building alongside us.

Schedule an exploratory call

Request Info17011 Beach Blvd, Suite 500 Huntington Beach, CA 92647

714-847-3540© 2026 Life Science Intelligence, Inc., All Rights Reserved. | Privacy Policy