The medtech M&A landscape continued its fast pace this week, adding four more transactions to an already crowded deal calendar. As investors, founders, and strategics prepare for the final stretch of the year, the latest activity provides a clear window into how established players are positioning themselves for 2026.

In this edition, we recap the newest acquisitions, revisit the year’s deal numbers, and explore what these transactions reveal about the direction of the medtech industry.

A Busy Week for Medtech M&A Activity

November delivered another burst of dealmaking intensity, culminating in four transactions announced within days. If your inbox was flooded or you were heads-down at industry events, here is a streamlined summary of everything that happened.

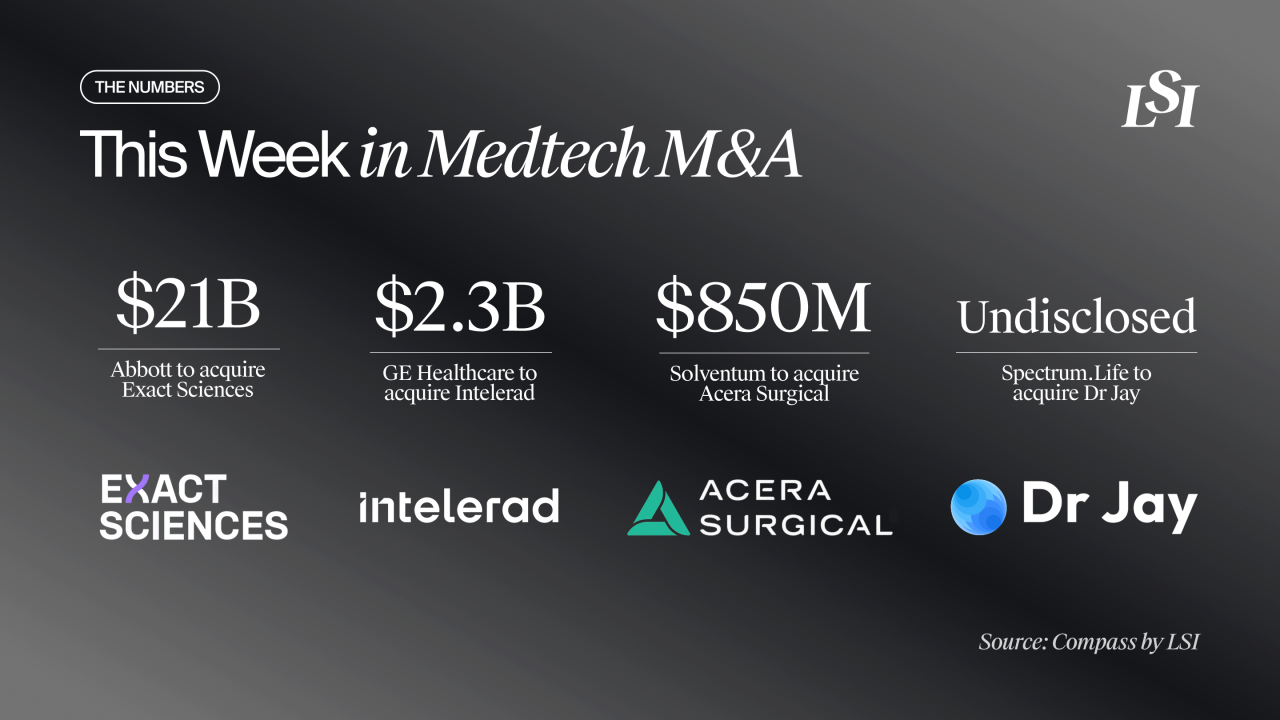

Abbott to Acquire Exact Sciences for $21 Billion

The largest deal of the week came from Abbott, which will acquire Exact Sciences for $21 billion. The transaction now ranks among the ten biggest medtech M&A deals on record. Exact Sciences brings a robust suite of cancer diagnostics, generating approximately $3 billion in annual revenue. The acquisition also strengthens Abbott’s diagnostics segment, which the company noted was down 5% in the first nine months of the year. This move delivers both scale and strategic reinforcement in one stroke.

Solventum to Acquire Acera Surgical for up to $850 Million

Solventum continued its consistent strategy of targeted tuck-in acquisitions by purchasing Acera Surgical. The deal, valued at up to $850 million, expands Solventum’s offerings in advanced wound care. This segment is considered one of the fastest-growing subsegments in wound management.

GE HealthCare to Acquire Intelerad for $2.3 Billion

GE HealthCare announced its second major acquisition of the year with a $2.3 billion agreement to acquire Intelerad, a cloud-first enterprise imaging company. The deal brings AI workflow orchestration, cloud PACS, and a strong recurring revenue base into GE’s portfolio while expanding its reach into high-growth outpatient and ambulatory imaging settings.

Spectrum.Life acquires Dr Jay

Spectrum.Life’s acquisition of Dr Jay strengthens its digital mental health portfolio by integrating Dr Jay’s validated AI therapy companion into Cara, the company’s clinically governed support platform. The addition enhances Spectrum.Life’s ability to deliver scalable, human-centered mental health tools across workplaces, universities, and healthcare networks.

Taking Stock of the Numbers Behind the Surge

The pace of medtech M&A has been climbing all year, and this week’s activity pushed 2025 further into record-breaking territory. At Greenlight Guru’s Future of Medtech Virtual Summit earlier this week, Nicholas Talamantes, LSI’s Director of Market Research, highlighted key deal trends. Only a few days later, several of those numbers had already become outdated.

As of November 21, 2025, medtech M&A activity officially surpassed last year’s total.

Here is where things stand:

- 42 deals announced or completed, compared to 41 in 2024

- 2.4% increase in deal volume

- $39.3 billion in total disclosed value

- $1.6 billion average deal size for 2025

The three-year trendline shows a steep climb:

- 2023: 30 deals, $7.8 billion disclosed value

- 2024: 41 deals, $21.8 billion disclosed value

- 2025: 42 deals, $39.3 billion disclosed value

One transaction skews the totals significantly. Abbott’s acquisition of Exact Sciences exceeds the combined value of all other 2025 deals. When removed:

- Total disclosed value becomes $18.3 billion

- Average deal size adjusts to $795.1 million, nearly half of 2024’s average

Even with that adjustment, 2025 remains one of the most active deal years in recent memory.

What Is Driving This Year’s Medtech M&A Momentum?

The newest round of deals continues a pattern that has defined most of 2025. Large multinational strategics are leaning heavily into smaller, capability-focused acquisitions that strengthen core business units without the complexity of integrating larger companies.

These transactions share several common characteristics.

Commercial-Ready Targets

- Exact Sciences: roughly $3 billion revenue projected for 2025

- Acera Surgical: approximately $90 million in expected 2025 revenue

- Intelerad: estimated first-year contribution of around $270 million

- Dr Jay: already deployed within Spectrum.Life’s customer network

The appetite for commercial-ready technologies reflects a broader industry shift. High clinical and regulatory hurdles have made early-stage acquisitions harder to justify, so strategics are concentrating on assets with immediate revenue impact.

Emphasis on High-Growth Segments

Buyers are honing in on markets that show clear expansion potential.

- AI-enabled imaging remains one of GE HealthCare’s top priorities

- Cancer diagnostics represent a global $20 billion opportunity, reinforcing Abbott’s interest

- Advanced wound care is among the fastest-growing wound management categories, with an expected 7% CAGR from 2024 to 2029

Most Active Strategic Buyer: Boston Scientific

Although not involved in this week’s transactions, Boston Scientific remains the busiest strategic acquirer of 2025. Its deals reflect a highly targeted expansion strategy:

- Bolt Medical: $443 million upfront with additional milestone payments

- SoniVie: $360 million upfront plus milestone potential

- Elutia: $88 million for its bioenvelope product lines

- Nalu Medical: $533 million for the remaining stake

What This Means for the Year Ahead

With only a few weeks left in 2025, the market has sent a clear message. This year has delivered a steady increase in the number of transactions and strong alignment between strategic priorities and acquisition targets.

The trajectory of medtech M&A suggests that precision, targeted capability-building, and efficient integration will remain the defining pillars of dealmaking moving forward.

As inflation, regulatory complexity, and capital costs remain elevated, the incentive to acquire proven platforms rather than invest heavily in earlier-stage innovation continues to grow. At the same time, the strategic upside in fast-growing categories ensures that the deal pipeline remains active.

The year is not over, and more announcements may still be on the horizon. For now, 2025 will be remembered as a year when medtech M&A reasserted itself as one of the strongest engines for growth in the industry.

Schedule an exploratory call

Request Info17011 Beach Blvd, Suite 500 Huntington Beach, CA 92647

714-847-3540© 2026 Life Science Intelligence, Inc., All Rights Reserved. | Privacy Policy