This weekend marked the start of the American Heart Association’s Scientific Sessions, one of the most anticipated gatherings of cardiovascular experts each year. The meeting arrives right on the heels of the Transcatheter Cardiovascular Therapeutics (TCT) conference, creating a two-week stretch filled with major updates across cardiology. With so much happening at once, this edition of The Numbers brings a deeper look at the data and market signals shaping the cardiovascular devices market and the trends attracting the most attention from investors, clinicians, and industry leaders.

A Growing Market Anchored by Scale

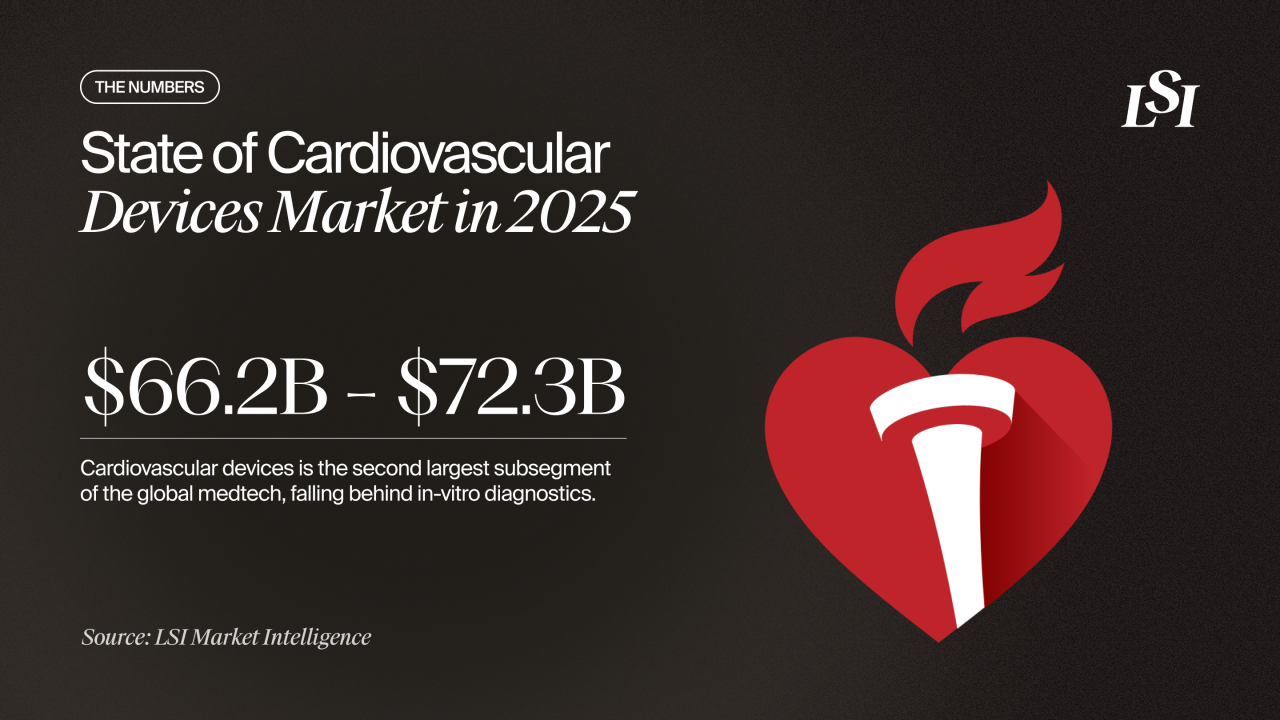

Among all medtech sectors, cardiovascular devices remain one of the largest and most strategically important. This segment represents the second-largest share of global medtech revenue, surpassed only by in-vitro diagnostics. Current estimates place the value of the market between $66.2 billion and $72.3 billion. Annual growth holds steady around 6%, which positions the market to pass the $100 billion threshold in the early 2030s.

Across LSI’s work with founders, strategics, and investors, one recurring question always surfaces: where is meaningful innovation occurring within medtech today? Cardiovascular devices consistently recur in that discussion. The category blends mature, high-volume clinical needs with a rapid wave of new solutions in diagnosis, intervention, and continuous care. That combination has created one of the most dynamic competitive landscapes in the industry.

Below are three segments that currently stand out.

Heart Failure: A High-Need Market Accelerating Innovation

Heart failure remains one of the most challenging and costly cardiovascular conditions. More than 60 million people across the world live with heart failure, and the prevalence is rising as populations age and survival improves for other cardiovascular diseases. Despite therapeutic advances, many patients continue to face significant symptoms, frequent hospitalizations, and high mortality rates.

Because heart failure is often the final stage of other cardiac disorders, the condition demands more effective tools to identify risk earlier and intervene more precisely. The response from industry has been significant. Companies are advancing new diagnostic technologies, expanding remote monitoring capabilities, and developing interventional approaches that complement pharmaceutical therapy.

Strategics have played a major role in this shift. Organizations such as Edwards Lifesciences and Johnson & Johnson MedTech have strengthened their pipelines through targeted partnerships and acquisitions. (Also see: Johnson & Johnson Acquisitions in Cardiovascular Devices.) Venture activity mirrors this movement as well. According to Compass by LSI, heart failure companies secured more than $500 million in 2025.

Heart failure represents a $6 billion global opportunity with high single-digit to low double-digit annual growth. The condition’s complexity has not discouraged innovation. Instead, it has inspired new ways to diagnose, monitor, and manage one of the costliest diseases in healthcare.

Renal Denervation: A Decade of Persistence Paying Off

If there is one story that illustrates the long arc of medtech innovation, it is renal denervation. After more than ten years of mixed trial results, device iteration, and intense scientific debate, the field has reached a turning point. Recent clinical evidence has demonstrated that carefully targeted renal nerve ablation can produce meaningful and sustained reductions in blood pressure for select patients.

Today’s global renal denervation market is valued at roughly $60 million. LSI projects significant expansion over the next five years, supported by a compound annual growth rate of 17.2%. This rate of growth makes renal denervation one of the most rapidly expanding areas within the broader cardiovascular devices market.

The segment received a major boost this week when CMS approved nationwide Medicare coverage for eligible patients, creating a critical reimbursement foundation that had previously limited adoption.

The clinical need is substantial. More than 150 million people worldwide struggle to maintain blood pressure control with medications alone, and hypertension affects over 1 billion individuals globally. Three-year data from Medtronic and Recor Medical, presented at TCT, showed office systolic blood pressure reductions exceeding 15 mmHg and an associated 30% drop in major cardiovascular events. These data points validate the durability of the therapy.

Next-generation approaches are also advancing. SoniVie, which was acquired by Boston Scientific, and DeepQure are among the companies expanding technical modalities within the field.

At LSI USA ‘24, leaders Christopher Cleary, Howard Levin, and David Hochman discussed the challenging early days of the category and the persistence required to shape a new therapy class during a panel discussion. The conversation during a workshop at LSI Asia ‘25, where Jie Wang of SyMap and Chris Eso analyzed clinical progress, global scale, and strategic investments. Both events highlighted how far the field has come and what remains possible.

Momentum is clearly shifting in favor of renal denervation, supported by evidence, policy, and economic incentives.

Diagnostics and Monitoring: The New Connected Cardiovascular Workflow

The next major force reshaping cardiology is the transformation of diagnostics and monitoring. Devices that once delivered limited snapshots of cardiac activity have evolved into connected platforms that track, analyze, and predict clinical risk in real time.

Artificial intelligence has become central to this transformation. While radiology still accounts for most FDA clearances involving AI, cardiovascular technologies are quickly rising and now rank second. AI is being integrated into tools for arrhythmia detection, ischemia assessment, heart failure prediction, and more. These insights now reach patients through everyday devices such as smartwatches as well as specialized handheld systems that deliver near-clinical-grade output.

This shift is already influencing care models. During an LSI USA 2025 Signature Series, AHA leader Asif Ali, M.D., and CardiaCare CEO Amir Soltanianzadeh discussed where cardiac wearables are headed next. They focused on inclusivity in data and device design, from PPG performance across all Fitzpatrick skin tones to AI models trained on diverse patient populations. The discussion also highlighted the need for seamless, “stickier” wearables that fit into daily life, turn raw signals into clear action for patients and clinicians, and connect into interoperable dashboards that avoid “death by data” while moving care from episodic sick care toward continuous, personalized management.

Beyond the Core: Surgical Robotics in Cardiovascular Care

Although still in early development, surgical robotics is beginning to influence cardiovascular intervention. Progress remains gradual, but the technology’s potential to improve precision and safety has attracted considerable interest. As systems advance and expand into more cardiac procedures, robotics may emerge as a significant area of investment and clinical adoption.

Schedule an exploratory call

Request Info17011 Beach Blvd, Suite 500 Huntington Beach, CA 92647

714-847-3540© 2026 Life Science Intelligence, Inc., All Rights Reserved. | Privacy Policy