One of the most notable portfolio realignments in medtech this year comes from Johnson & Johnson MedTech, as the company prepares to separate its legacy orthopedics unit into a standalone business.

The move caps nearly two years of internal restructuring and aligns with a wider industry pattern: leading strategics such as Stryker and Medtronic have been rebalancing their portfolios, spinning off slower-growth or non-core segments to focus resources on high-growth therapeutic markets.

At first glance, divesting an operation as large and historic as Johnson & Johnson’s orthopedics business might appear counterintuitive. But a closer look at the numbers and competitive context reveals why the company views this as a strategic reset rather than a retreat.

A Market Leader Ready for Independence

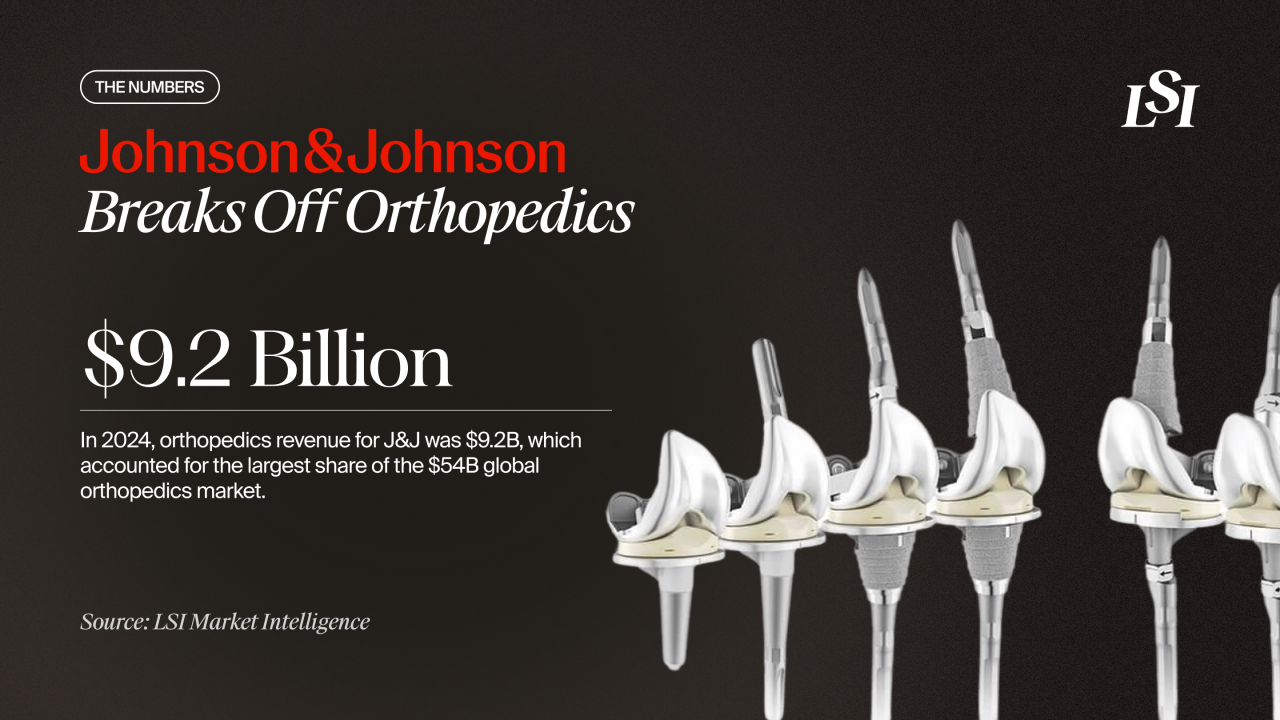

J&J’s orthopedics division generated ~$9.2 billion in revenue in 2024, representing the single largest share of the ~$54 billion global orthopedics market, according to LSI Market Intelligence.

That performance placed the company slightly ahead of key rivals:

- Stryker: $9.1 billion in 2024 orthopedic revenue

- Zimmer Biomet: $7.7 billion

By comparison, business units divested by other major players, such as Medtronic’s diabetes business ($2.5 billion) and Stryker’s Spine unit ($1.3 billion), were far smaller in scale. Yet all three divestments share a similar strategic logic: narrow focus, higher innovation velocity, and stronger margins in faster-growing medtech segments.

J&J’s orthopedics portfolio, though formidable, has shown modest growth relative to the broader market. In 2024, the division expanded 2.4% year over year, while the overall global orthopedics market grew 4.3%.

This lag underscores a key motivation behind the spin-out: allowing each business to pursue distinct goals. The new standalone orthopedics company will compete as a pure-play market leader, while J&J MedTech concentrates on higher-growth verticals such as cardiovascular, oncology, and neuroscience.

Context Within the Broader Medtech Landscape

Orthopedics remains a foundational pillar of medtech, but it is increasingly viewed as a mature segment. Post-pandemic growth has been steady rather than explosive, particularly when compared with markets such as cardiovascular, which grew 6.3% from 2023 to 2024 and continues to attract strong investment.

For J&J, this reorganization is part of a strategic pivot toward markets with greater scalability and stronger technology leverage.

Still, the separation of Johnson & Johnson’s orthopedics business does not suggest decline; rather, it reflects the need for autonomy to accelerate innovation cycles and pursue robotics integration on its own terms.

Market Dynamics and Margin Pressures

Several macroeconomic factors continue to weigh on orthopedic manufacturers:

- Pricing and reimbursement pressure: Value-based care models, particularly in China, are pushing prices down.

- Shift to outpatient settings: The migration of joint replacement procedures to ambulatory surgery centers (ASCs) in the United States is compressing margins and altering buying patterns.

- Supply constraints: Tight supply for certain implant materials has limited production flexibility.

The Robotics Race: A Defining Competitive Battleground

If there is one area where the contrast between J&J, Stryker, and Zimmer Biomet is most visible, it’s in surgical robotics. The ability to integrate robotic guidance with proprietary implants has become a key differentiator and a driver of market share shifts.

J&J’s VELYS Robotic-Assisted Solution remains a newer entrant, and while the company has not released exact installation figures, estimates from analyst research put the global install base at approximately 500 systems.

Competitors have established stronger footholds:

- Stryker’s MAKO: roughly 2,700 systems installed globally

- Zimmer Biomet’s ROSA: around 2,000 installations

Note: Install base figures are estimates from analyst research.

That adoption gap has direct implications for revenue growth. Stryker’s orthopedic business, bolstered by MAKO, has consistently outperformed the market:

- 2022: $7.6 billion

- 2023: $8.4 billion (+10.5%)

- 2024: $9.1 billion (+8.3%)

If current trends persist, Stryker could overtake J&J as the top orthopedic player by 2026. Zimmer Biomet’s momentum in robotics has also strengthened its position, leaving J&J to play catch-up in a category it once dominated.

The spin-out could help the new orthopedics entity focus on closing that gap by dedicating more resources to robotic integration, trauma care, hips, knees, and extremities.

Strategic Rationale: Why Now?

For Johnson & Johnson MedTech, this decision marks a clear strategic shift toward six higher-growth franchises: oncology, immunology, cardiovascular, neuroscience, surgery, and vision.

For the new orthopedics company, independence could bring freedom to accelerate product development, expand its robotics footprint, and streamline decision-making.

For the broader orthopedics market, the move reinforces the perception of the segment as stable but slower-growing.

And for investors and startups, it signals continued opportunity. The trend of large strategics “unbundling” their portfolios creates space for emerging robotics innovators, digital orthopedic platforms, and novel biologics companies to gain traction.

17011 Beach Blvd, Suite 500 Huntington Beach, CA 92647

714-847-3540© 2026 Life Science Intelligence, Inc., All Rights Reserved. | Privacy Policy