In this edition of The Numbers, we’re combining our look at Q4’25 and 2025 as a whole to explore this question: “Was 2025 a boom or bust year for medtech fundraising?”

All of the insights below are powered by Compass AI, LSI’s medtech-focused research platform built to track deal activity, capital flows, and investment trends across the global medtech landscape.

Let’s break down what 2025 really delivered.

2025 Medtech Fundraising: Capital Was Up, Deal Volume Was Not

By the top-line numbers, 2025 was undeniably a major year for capital deployment.

An estimated $10.7 billion was raised across 434 total deals, spanning everything from grants through post-IPO common stock sales.

When compared to 2024, the year showed a mixed but revealing story:

- Total funding increased 7% year over year

- The number of deals declined 33.2%

So does that make 2025 a bust? Not completely.

While more money continued flowing into the sector, the decline in deal count signals something important: capital was concentrated deeper in the funnel, and early-stage companies faced a more difficult environment.

That imbalance matters. If fewer young companies receive funding to reach maturity, the downstream impact is slower innovation and fewer future exits.

Still, by several key measures, 2025 stands out as one of the strongest post-COVID fundraising years so far.

Record Signals Beneath the Surface

Despite pressure at the earliest stages, 2025 hit several notable milestones:

- Overall capital deployed rose 7.0%

- Total M&A deal volume increased 7.3%

- 33 deals exceeded $100 million

Much of the year’s momentum was front-loaded. Strength carried over from late 2024 into the first half of 2025, followed by a slowdown in Q3 that extended into Q4.

To understand where things ended, we need to look closely at the final quarter.

Q4’25 Recap: A Late-Year Rebound

The last quarter of 2025 delivered a meaningful pickup in capital raised.

In Q4’25, medtech companies raised an estimated $2.41 billion across 71 deals, excluding M&A and IPOs. Including the quarter’s single IPO, total fundraising reached $2.56 billion.

Quarter-by-quarter totals for the year came in as follows:

- Q1: $3.60 billion

- Q2: $2.73 billion (*including the $650 million Neuralink Series E funding round in June 2025)

- Q3: $2.28 billion

- Q4: $2.56 billion

While Q4 did not match the unusual surge of Q4’24, it marked a clear rebound relative to the slower summer period.

For comparison, Q4’24 delivered $2.64 billion across 156 deals, an outlier quarter in deal count.

This late-year lift may reflect several converging forces: firms deploying capital raised during 2020 and 2021, internal deadlines tied to annual budgets, and corporate strategics moving before year-end balance sheet resets.

Early-Stage Capital Held Steady in Q4’25

One encouraging signal from Q4 was that early-stage activity remained consistent.

In some cases (grants and Seed rounds), there was an increase in the number of these deals compared to Q3. Additionally, a number of rounds were announced without traditional labels, but resembled Seed-stage fundraising in size and structure.

If that pattern holds into 2026, it could provide some relief for companies at the earliest and most fragile stages of development.

Two final deal metrics further highlight Q4’s shift:

- Average deal size rose to $37.7 million, up 24% compared to Q3

- Median deal size increased to $12.9 million, up 17.3% compared to Q3

Q4’25 Winners: Where Funding Clustered

Neurotech and Brain-Computer Interfaces

The strongest funding signal of the quarter came from neurotech and brain-computer interfaces (BCIs).

BCI companies like Synchron, Coherence Neuro, and Precision Neuroscience are a few standouts.

Even as parts of the BCI space remain experimental, investor interest continues to build, especially as companies pursue expansion into new applications, including cancer-related indications.

Surgical Robotics Remained a Consistent Draw

Surgical robotics once again proved durable, carrying over momentum from Q3.

Emerging and established companies continue to pull in capital, including Distalmotion and Cornerstone Robotics.

A notable highlight was Affluent Medical, now operating as Carvolix following its acquisitions of Caranx Medical and Artedrone. The company is positioned within the increasingly active endovascular robotics market.

Oncology and Cardiovascular Technologies Stayed Strong

Technologies for the diagnosis and treatment of cancer and cardiovascular disease remained core areas of investor focus throughout 2025.

Notable deals included:

- Petal Surgical (developing an incisionless surgery platform)

- HistoSonics (advancing non-invasive sonic beam therapy for solid tumors)

- Xeltis (developing bioabsorbable, restorative vascular and valve implants)

- Impulse Dynamics (advancing electrical therapies for heart failure)

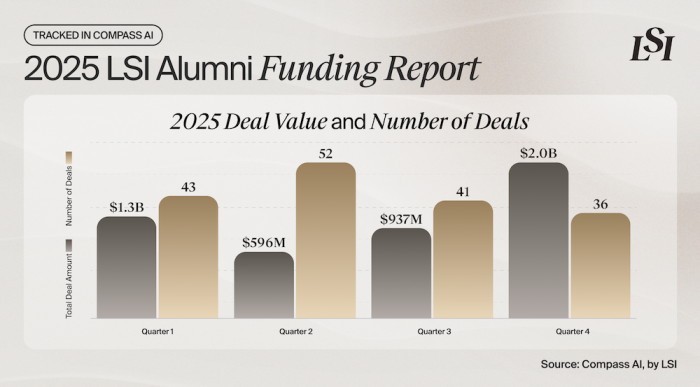

2025 LSI Alumni Funding Activity

2025 was also a major year for the LSI Alumni ecosystem.

Across more than 170 deals, LSI Alumni companies raised over $4.8 billion, including:

- 14 M&A transactions

- Two IPOs

All of this activity is captured in the 2025 LSI Alumni Funding Report, which consolidates fundraising and deal activity across emerging company Alumni from LSI’s global summits, along with the investors backing them.

Here’s a high-level overview of what you’ll find inside:

|

Quarter |

Number of Deals |

Amount Transacted |

|

Q1’25 |

43 |

$1.3 billion |

|

Q2’25 |

52 |

$596 million |

|

Q3’25 |

41 |

$937 million |

|

Q4’25 |

36 |

$2.0 billion |

A Shifting Era for Medtech Fundraising

So, was 2025 a boom or bust?

The answer is more nuanced than the headline implies.

More capital was deployed than in recent years, but the distribution of that capital leaned heavily toward later-stage and bottom-of-funnel opportunities. Early-stage companies remain under pressure, even as Q4 offered some signs of stability.

What is increasingly clear is that the capital landscape is evolving. Traditional venture firms may be more risk-averse, but alternative funding pathways are emerging, and founders will need sharper visibility into where money is flowing.

Tools like Compass AI help bring clarity to that complexity, and they will be essential as the industry continues adapting in 2026.

One thing is certain: medtech fundraising is no longer just about momentum. It is about precision, data, and knowing how to survive in a tighter innovation economy.

Schedule an exploratory call

Request Info17011 Beach Blvd, Suite 500 Huntington Beach, CA 92647

714-847-3540© 2026 Life Science Intelligence, Inc., All Rights Reserved. | Privacy Policy