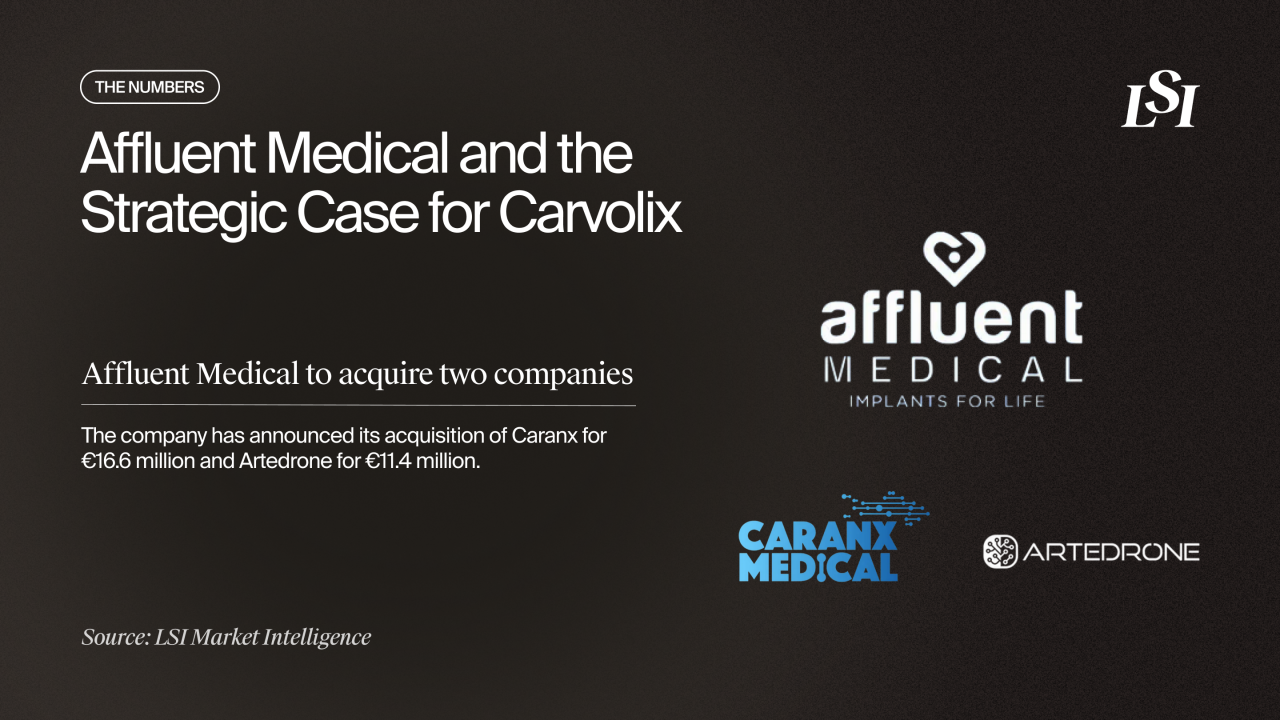

As 2025 comes to a close, Affluent Medical announced a transaction that meaningfully reshapes its trajectory. The clinical-stage French medtech company shared plans to acquire Caranx Medical and Artedrone and combine all three businesses into a new company called Carvolix.

If you missed the announcement during the final weeks of the year, the deal is worth a closer look. It brings together mini-robotic, AI, and implant technologies that aim to transform heart valve replacement and emergency stroke care.

Below, we break down what happened and why the numbers behind this consolidation matter.

What Was Announced

Affluent Medical will acquire Caranx Medical for €16.6 million and Artedrone for €11.4 million. Both transactions are being completed through the issuance of new Affluent shares and include potential earn-out payments tied to future milestones.

Once the transactions close, the three companies will operate together as Carvolix.

Each business contributes a distinct capability:

- Caranx Medical brings TAVIPILOT Software, an FDA-cleared AI-driven guidance system for transcatheter aortic valve replacement, along with the TAVIPILOT Robot. The robotic system has already been used successfully in two patient procedures.

- Artedrone is developing a robotic platform focused on stroke treatment.

- Affluent Medical contributes experience in minimally invasive biomimetic devices, including Kalios for mitral annuloplasty, Epygon for transcatheter mitral valve replacement, and Artus for stress urinary incontinence.

Affluent Medical, Caranx Medical, and Artedrone are all part of the Truffle Capital portfolio. The transaction is bolstered by up to €30 million in financing, including a €10 million first tranche from Truffle Capital and Edwards Lifesciences.

The Numbers: Structural Heart Procedure Volumes

This transaction is closely tied to the continued expansion of transcatheter valve procedures.

In 2025, almost 300,000 valve procedures are expected to be performed in the United States. Over the 2024 to 2029 forecast period, total valve procedures across surgical and transcatheter approaches are projected to grow at a 5.0% CAGR. These estimates include aortic, pulmonary, mitral, and tricuspid valve procedures.

Transcatheter approaches now account for roughly 75% of eligible valve procedures. For the majority of patients, this means a cardiothoracic surgical robot is unlikely to be utilized. The future is clearly minimally invasive.

Device Market Growth Tells a Clear Story

Growth rates for transcatheter valve devices further highlight why this space remains attractive.

Five-year growth rates for select transcatheter devices are projected as follows, based on global sales:

- Transcatheter aortic valves: 9.9%

- Transcatheter mitral valves: 23.1%

- Transcatheter tricuspid valves: 16.6%

- Transcatheter pulmonary valves: 21.4%

These are meaningful growth rates. Taken together, there is roughly $15 billion in annual implant sales at stake across valve replacement and repair. As seen in other surgical robotics markets, companies that influence the procedural approach often gain leverage over downstream implant and consumable revenue.

Edwards Lifesciences’ Investment in Carvolix

One of the more notable aspects of this transaction is Edwards Lifesciences’ participation in the financing.

Within the broader surgical robotics landscape, relatively few companies are focused on catheter-based robotic platforms for structural heart procedures. While a number of companies are developing catheter robotics, only a small subset are targeting, or signaling to target, structural heart procedures specifically.

Capstan Medical is the most visible example, having raised more than $140 million with backing from Intuitive. Other efforts, such as Moray Medical’s microfluidic robotic system, appear to have stalled.

Against this backdrop, Edwards’ investment in Carvolix stands out. Much of Carvolix’s combined portfolio aligns closely with Edwards’ leadership position in structural heart disease, particularly around transcatheter valve therapies.

The Carvolix Commercial Plan

Building a surgical robotics business requires significant capital and long development timelines. Carvolix differentiates itself by starting with a product that is already cleared for use.

TAVIPILOT is an AI-driven guidance system for transcatheter aortic valve replacement. Carvolix plans to retain direct commercialization rights in Europe while pursuing commercial partners in the United States, the Middle East, and Asia. The initial tranche of financing is intended to support this rollout. These funds will also be used to advance clinical and marketing efforts for Artus, Epygon, and Artedrone’s stroke robotics platform. The company has also stated that partnership activity around Artus could help extend its cash runway.

Carvolix will remain a public company and expects to continue raising capital through equity financing.

Looking Ahead

There is a lot embedded in this announcement, even without fully exploring the stroke robotics component. Combining implants, AI-driven guidance, and robotics within cardiovascular care introduces both opportunity and complexity.

Surgical robots operating in the cardiovascular system face high technical and regulatory hurdles, and broad clinical adoption remains years away. Still, early interest from medtech stakeholders suggests this remains an area of sustained focus.

Want more insights like this? Subscribe to LSI’s weekly newsletter, The Numbers.

Schedule an exploratory call

Request Info17011 Beach Blvd, Suite 500 Huntington Beach, CA 92647

714-847-3540© 2026 Life Science Intelligence, Inc., All Rights Reserved. | Privacy Policy