Investment activity remains a crucial indicator of the health and vitality of the medtech sector. As the industry continues to evolve, tracking capital inflows provides valuable insights into market confidence, emerging trends, and the pace of innovation.

In this article, we take a look at the latest medtech investment data from Q2 2025, highlighting key trends, growth drivers, and notable market shifts in medtech. From cardiovascular devices to diagnostic innovations, here’s how the industry is advancing and what to expect in the second half of 2025.

Investment Highlights: Q2 2025 Medtech Market

While the global headlines might have been dominated by healthcare challenges, regulatory issues, and geopolitical tensions, Q2 2025 saw a strong performance in medtech investment.

Total Deals and Capital Raised

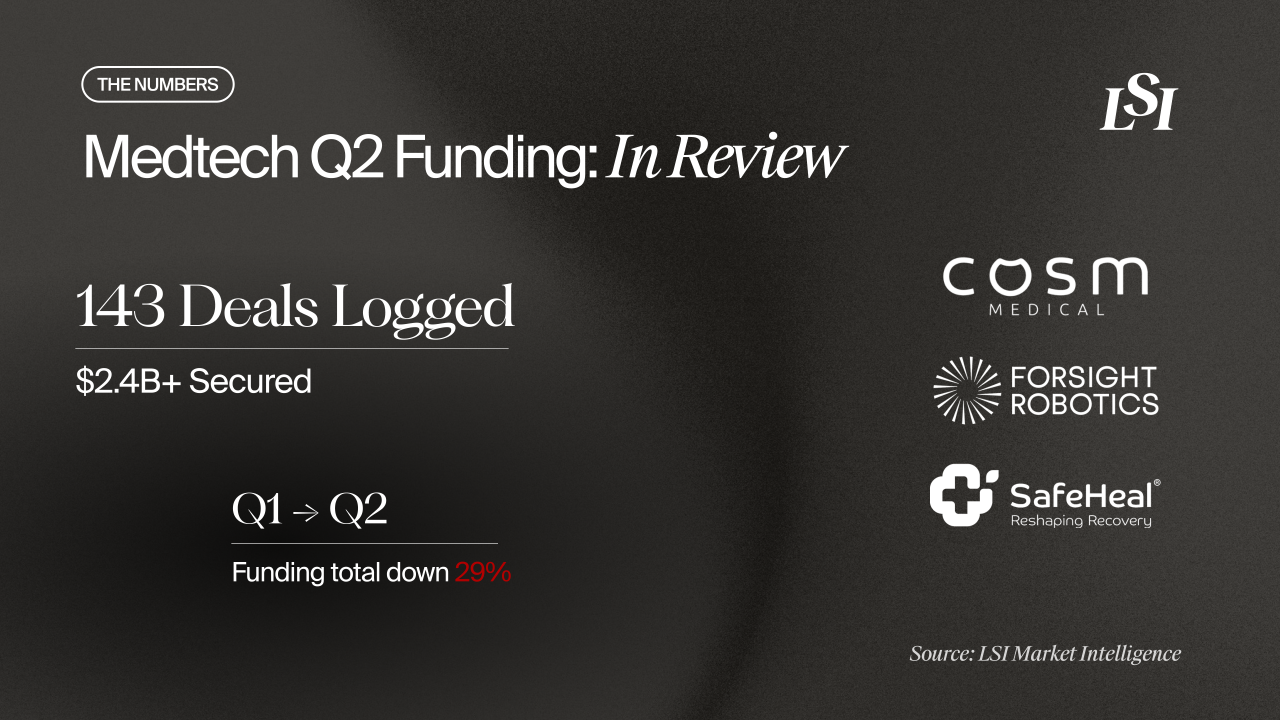

In Q2, 143 medtech deals were closed, up from 138 in Q1. However, the total amount of capital raised dropped by approximately 29%, from Q1 to Q2, primarily due to fewer mega-deals. Of the 143 deals in Q2, $2.4 billion was raised. The decrease in capital raised can largely be attributed to the absence of several large rounds seen in Q1.

Key Investment Trends in Q2

Cardiovascular Devices: A Prime Focus

Cardiovascular devices, particularly those targeting arrhythmias and heart failure, saw significant investments in Q2. With major unmet needs in these areas, several companies are catching the eye of investors. Notable deals included Core Medical’s $100 million, EBR Systems’ $36.1 million, Atraverse Medical’s $29.4 million, and Corvia Medical’s $55 million raises. These investments underscore the growing market demand for innovative treatments addressing large patient populations suffering from heart conditions.

Diagnostics: A Key Growth Area

Diagnostics, from imaging to testing, dominated in both deal volume and funding. In Q2, diagnostic companies received a large share of investments, with prominent transactions including Illumina’s $425 million acquisition of SomaLogic and ResMed’s acquisition of VirtuOx, Inc. Diagnostics is becoming a cornerstone in healthcare systems globally, with chronic disease management and early diagnosis receiving increasing attention. Capital flowing into this space highlights the industry’s focus on improving disease detection and management at earlier stages to better control healthcare costs.

Robotics and Minimally Invasive Surgery

Surgical robotics is another area driving investment activity in 2025. For example, ForSight Robotics raised $125 million for its ophthalmic surgical robot. The deal stands out for expanding surgical robotics into specialized fields, such as ophthalmology, showcasing the precision and efficiency that robotic systems bring to the operating room.

Similarly, Cosm Medical raised seed funding for its innovative pelvic floor disorder treatments. This personalized approach to treatment is generating strong investor interest, as it offers a solution that addresses inefficiencies in conventional care.

Noteworthy Deals: Small but Significant

Although large-scale deals often dominate the headlines, there are smaller, strategic rounds that deserve attention. For instance, SafeHeal raised $35 million to support its innovative technology, which provides a temporary bypass sheath in the colon following colorectal surgeries, reducing the need for ostomies.

Cosm Medical’s seed round for pelvic floor disorder treatments, as well as ForSight Robotics’ funding for ophthalmic surgery, shows how specialized solutions continue to attract significant investor interest. These deals highlight the potential for smaller companies with disruptive technologies to make a substantial impact in niche medical fields.

The Outlook for the Second Half of 2025

Looking ahead, medtech investment is expected to remain strong. The deal volume in Q2 was consistent, with about 50 deals closed each month, showing that the market is still active despite uncertainties. As we progress through 2025, expect to see continued interest in areas like cardiovascular health, diagnostics, and robotics.

Although Q2 saw a slight decrease in the total amount of capital raised, investor sentiment remains positive, particularly in sectors focused on long-term disease management, surgical innovations, and early diagnostics. The pipeline for these technologies is robust, and many of the key players in the medtech space are investing heavily to maintain their competitive edge.

Medtech Investment Trends in 2025

As medtech companies continue to navigate a shifting landscape, investment in innovation remains critical for growth. Whether it’s cardiovascular devices, diagnostics, robotics, or personalized healthcare solutions, the market for medtech in 2025 is flourishing despite external challenges.

Looking forward to the second half of the year, medtech continues to offer exciting opportunities for both investors and companies. Those companies that can align their innovations with the evolving healthcare landscape, focusing on patient needs, cost-effective solutions, and clinical outcomes, will remain at the forefront of the industry.

To stay updated on the latest trends in medtech investment and access exclusive data, subscribe to LSI’s Compass platform, which offers comprehensive insights into emerging technologies, deal flow, and investment activity.

Schedule an exploratory call

Request Info17011 Beach Blvd, Suite 500 Huntington Beach, CA 92647

714-847-3540© 2026 Life Science Intelligence, Inc., All Rights Reserved. | Privacy Policy