Olympus Corporation and Revival Healthcare Capital made headlines this week by formalizing a build-to-buy agreement. Under the terms, Olympus gains exclusive rights to acquire Swan EndoSurgical, a company it co-incubated with Revival to develop a next-generation robotic platform for endoluminal surgery.

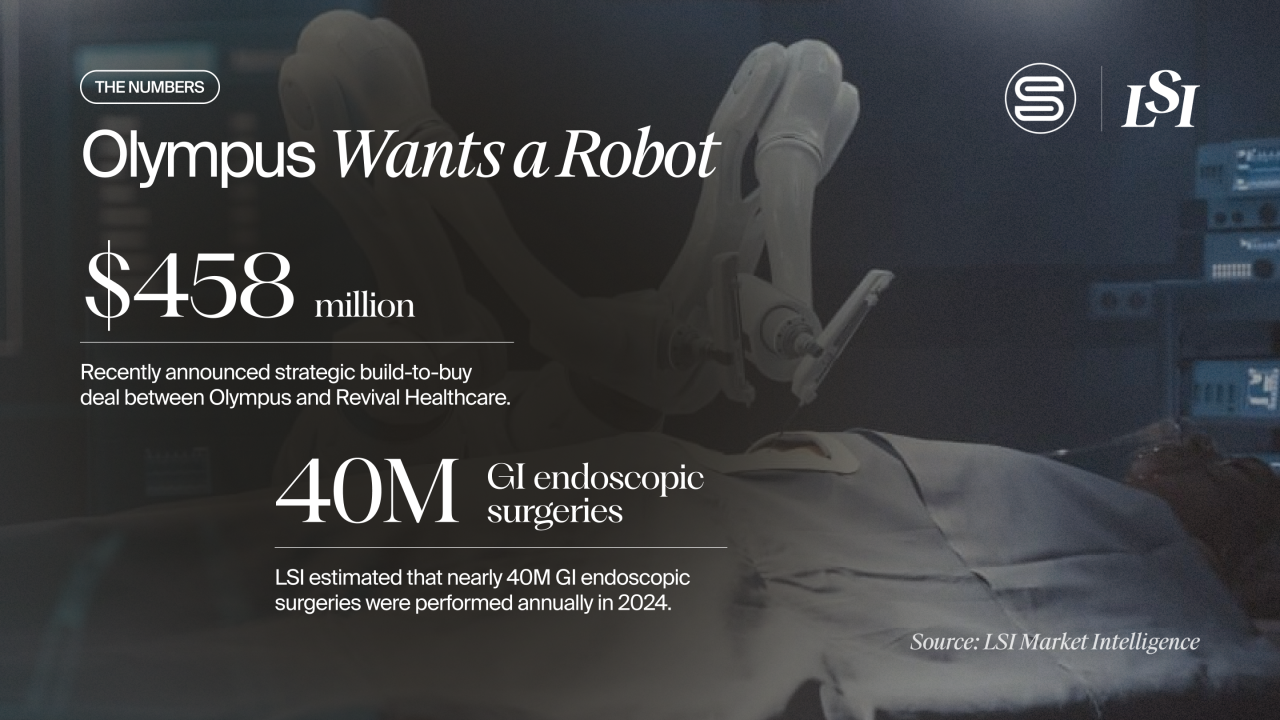

The potential price tag? Up to $458 million, starting with a $65 million initial investment from Olympus. The deal positions Olympus to expand into high-value gastrointestinal (GI) interventions while reducing the risk typically associated with acquiring early-stage technologies.

Why Build-to-Buy Deals Are Gaining Momentum

Build-to-buy partnerships, also known as structured deals or option-to-acquire models, have been part of medtech for years, but they are now emerging as a preferred approach for capital-efficient innovation. In these arrangements, a strategic partner invests in a startup early, offering not just financial backing but also clinical, regulatory, and commercial expertise. The strategic retains the right, though not the obligation, to acquire the startup at a later date.

This approach offers benefits to all parties. For strategics, it enables them to evaluate technologies up close before committing to a full acquisition, mitigating both financial and integration risks. Startups gain stability, clear exit visibility, and access to expertise they might not otherwise have, all while maintaining operational autonomy. Investors see a de-risked path to liquidity with a buyer already in place.

When structured effectively, the build-to-buy model aligns incentives. Startups advance toward commercialization, strategics secure a vetted innovation pipeline, and investors can plan exits with greater certainty.

Notable Precedents in Medtech

While Olympus’ move with Swan EndoSurgical is the latest example, several previous deals illustrate the model’s versatility.

|

Year |

Companies |

Details |

|

2014 |

Medtronic & Twelve |

Medtronic partnered with transcatheter mitral valve replacement startup Twelve through a structured acquisition agreement. After proof-of-concept and early clinical success, Medtronic acquired the company in 2015 for roughly $458 million plus milestone payments. |

|

2015 |

Abbott & Cephea Valve Technologies |

Abbott invested in this Foundry spinout with an option to acquire, which it exercised in 2019 following positive early clinical results for its transcatheter mitral valve. |

|

2020 |

Olympus & Veran Medical Technologies |

Olympus partnered early with Veran Medical, a lung navigation company, before completing a $340 million acquisition after validating the technology’s market fit. |

|

2024 |

Ajax Health/Boston Scientific & Cortex |

Ajax Health formed Cortex to focus on interventional heart failure, with Boston Scientific securing rights to acquire once key development milestones are achieved. The structure mirrored other Boston Scientific–incubator collaborations. |

The Market Context: GI Endoscopic Procedures

According to LSI’s Global Surgical Procedure Volumes Database, around 40 million GI endoscopic procedures were performed globally in 2024. Volumes are expected to grow at a compound annual rate of 2.9% over the next five years.

The United States currently represents almost half of all global procedures but has the slowest growth rate. Asia leads growth, while Europe maintains steady increases.

Most procedures today are diagnostic, and robotics are not cost-effective for basic diagnostics at scale. The growth opportunity lies in advanced therapeutic interventions for complex or undertreated conditions, such as:

- GI cancers: Approximately 5.3 million new cases annually, projected to increase by 45–50% by 2040

- GI defects: Rare but complex, affecting roughly one in every 5,000 to 10,000 live births

- Inflammatory bowel disease (IBD): Impacting 20–40 million people worldwide, with increasing demand for interventions to address complications

Olympus’ goal is not merely to maintain its dominant position in endoscopic imaging and instruments. Instead, it aims to expand the overall number of advanced endosurgical procedures by enabling more complex interventions to be performed endoscopically rather than through open or laparoscopic surgery.

Competitive Pressures Driving the Move

The decision also has a defensive dimension. Competitors like Johnson & Johnson and Medtronic are actively developing endoluminal robotic platforms, and Intuitive Surgical’s success in laparoscopic consumables has increased the urgency for Olympus to strengthen its own robotics portfolio. Investing in Swan EndoSurgical through a build-to-buy structure gives Olympus a faster and more controlled pathway to market.

Insights from Rick Anderson at Revival

At LSI USA ’24, Revival Healthcare Capital Chairman Rick Anderson discussed the rationale behind this kind of partnership in a fireside chat with former Johnson & Johnson CEO and Chairman Alex Gorsky.

Anderson emphasized the importance of moving beyond the traditional medtech “build and exit” playbook, where startups chase potential acquirers for years before a sale. Instead, he advocates for early alignment between strategics and innovators, with clear objectives and sufficient capital to see transformational technologies through to market readiness.

Key points from Anderson’s perspective included:

- Challenging Conventional Funding Models: Large-scale innovation often requires $300–400 million to reach global commercialization, and the build-to-buy model can pool strategic capabilities with startup agility to get there efficiently.

- Defining the Exit Early: Knowing the likely acquirer and timeline from the start eliminates the need for constant fundraising and allows management to stay focused on product development.

- Reducing Friction for Strategics: Building the product within processes that align with the eventual acquirer’s quality system removes integration barriers post-acquisition.

Strategic Upside for Olympus

Although Swan EndoSurgical’s platform is still years from market, early collaboration among Olympus, Revival, and Swan provides a foundation for rapid execution once commercialization begins. The technology’s initial indications represent only the beginning, with potential applications in other high-value procedures such as duodenal mucosal resurfacing (DMR), an emerging treatment that could benefit from robotic endoscopic precision.

Given the size of the GI market, the rising complexity of cases treatable through minimally invasive techniques, and the competitive forces in play, Olympus’ build-to-buy deal could prove to be a defining moment in its robotics strategy.

Schedule an exploratory call

Request Info17011 Beach Blvd, Suite 500 Huntington Beach, CA 92647

714-847-3540© 2026 Life Science Intelligence, Inc., All Rights Reserved. | Privacy Policy