As cardiac ablation procedures surge, the market for diagnostic electrophysiology (EP) catheters is experiencing accelerated growth. Driven by pulsed-field ablation (PFA) adoption, rising arrhythmia incidence, and an expanding product mix, this segment is evolving rapidly. Recent FDA approvals and strategic product launches from top competitors signal a new era of innovation in EP mapping and diagnostics.

Inside the Diagnostic EP Market

Diagnostic EP catheters serve as critical tools in the diagnosis and treatment of cardiac arrhythmias. These devices record electrograms from within the heart to assess electrical activity, guide treatment decisions, and support procedures such as cardiac ablation. Driven by the rapid increase in utilization of cardiac ablation procedures for heart rhythm disorders like atrial fibrillation (AFib) and supraventricular tachycardia, demand for diagnostic EP catheters is accelerating across global markets.

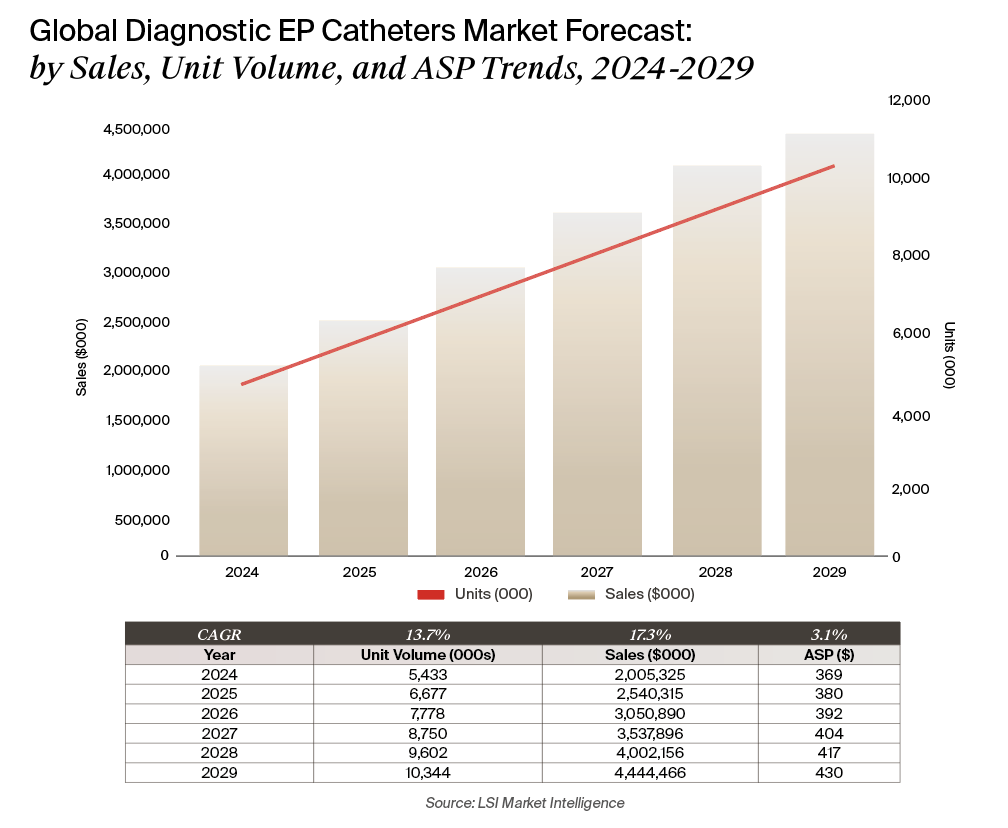

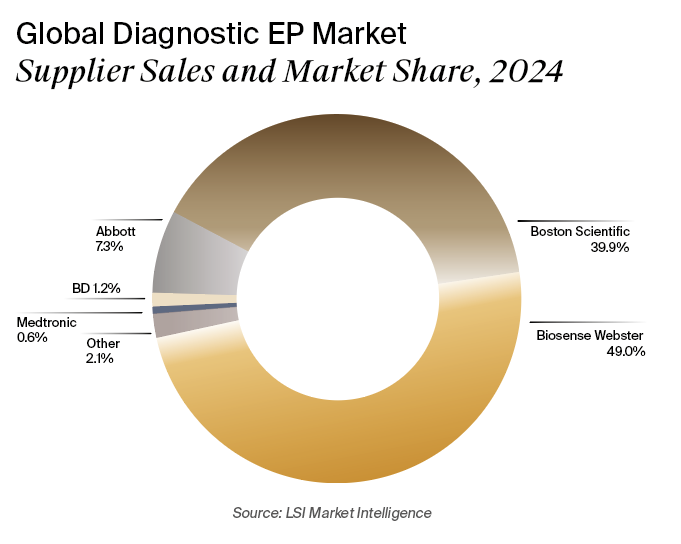

In 2024, diagnostic EP catheters reached $2.01 billion in worldwide sales, supported by 5.4 million unit sales. The market is projected to grow to more than $4.44 billion by 2029, representing a 17.3% compound annual growth rate (CAGR). Unit volume is forecast to grow at a 13.7% CAGR, while average selling prices (ASPs) are expected to climb modestly from $369 to $430 over the forecast period. Growth is outpacing prior forecasts, driven largely by the impact of PFA and a continued shift toward higher-cost, high-performance mapping catheters.

A Shift Toward Premium Mapping Technologies

Beyond procedural growth, one of the most significant contributors to market expansion is the shift in product mix toward advanced diagnostic technologies. While traditional fixed-curve catheters still serve as the baseline, steerable and high-density mapping catheters are gaining traction. These products can cost up to seven times more than conventional offerings, and their increasing use in complex procedures is lifting ASPs and total revenue.

In parallel, diagnostic EP catheters play an important role in procedures beyond ablation. Device implantations, including pacemakers, implantable cardioverter defibrillators (ICDs), and cardiac resynchronization therapy (CRT), routinely require intracardiac electrogram monitoring. As these therapies expand globally, so too does the need for real-time, high-fidelity diagnostic capabilities.

Visualization, Mapping, and PFA Integration Driving Innovation

2024 marked a turning point for the diagnostic EP catheters market, with major competitors racing to integrate their mapping systems with PFA platforms. Boston Scientific’s entry into the U.S. market with its FARAPULSE PFA System drove more than $1 billion in revenue and accelerated the shift toward single-shot ablation paired with diagnostic mapping. To support this transition, the company launched its FARAWAVE NAV Ablation Catheter and FARAVIEW Software, designed for seamless integration with the OPAL HDx Mapping System. The new tools combine therapy delivery and real-time visualization to streamline PFA workflows.

Abbott also advanced its diagnostic EP footprint with FDA clearance for the Advisor HD Grid X Mapping Catheter, Sensor Enabled. This system features an innovative electrode configuration that improves signal resolution regardless of catheter orientation, an important feature for accurately mapping complex arrhythmias. Paired with Abbott’s EnSite X mapping system and its upcoming Volt PFA System, the company’s diagnostic tools are designed to offer physicians more precise control and visualization during ablation.

Medtronic joined the fray with the FDA approval of its Affera Mapping and Ablation System and the Sphere-9 Catheter, which delivers dual-energy therapy while simultaneously enabling high-density mapping. By offering both radiofrequency (RF) and PFA capabilities in a single catheter, Medtronic aims to simplify workflow and provide physicians with greater flexibility to tailor treatment based on patient needs.

Notable Market Events

In May 2025, a California jury ruled that Johnson & Johnson subsidiary Biosense Webster, the current market leader, violated antitrust rules by withholding clinical support from hospitals using reprocessed catheters. The verdict resulted in $147 million in damages awarded to reprocessing company Innovative Health. A federal judge then tripled the damages to $442 million and granted Innovation Health’s motion for a permanent injunction.

Elsewhere in the industry, CoreMap received Investigational Device Exemption (IDE) approval from the FDA to extend its INvENI study into the U.S. The company’s EP mapping system uses a dense array of micro-scale electrodes and novel algorithms to identify AFib drivers, potentially enabling more tailored ablation strategies.

Another notable regulatory milestone came from Kardium, which received FDA premarket approval for its Globe Pulsed-Field System. The Globe platform uniquely combines single-shot PFA and high-density mapping in a single device, streamlining pulmonary vein isolation (PVI) while offering real-time visualization. The device’s clinical data, presented at the 2025 Heart Rhythm Society annual meeting, showed 78% freedom from atrial arrhythmia at one year in paroxysmal AFib patients with zero device-related primary safety events.

Looking Ahead

Together, these regulatory milestones and next-generation product launches highlight just how quickly the diagnostic EP catheter landscape is evolving. As mapping technologies grow more integrated with PFA and other ablation systems, the bar is rising for precision, performance, and clinical versatility.

With high-growth procedural trends, increasing reliance on sophisticated mapping systems, and the convergence of diagnostic and therapeutic platforms, the diagnostic EP catheter market is undergoing a transformative phase. As AFib and other arrhythmias continue to affect millions globally, diagnostic EP catheters will remain essential to advancing treatment and improving outcomes.

17011 Beach Blvd, Suite 500 Huntington Beach, CA 92647

714-847-3540© 2026 Life Science Intelligence, Inc., All Rights Reserved. | Privacy Policy