Overview

Valued at ~$1.45 billion in 2023, the electrophysiology diagnostic catheters market is

projected to reach ~$2.46 billion by 2028, increasing at a CAGR of 11.2% over

the 2023-2028 forecast period. This Market Snapshot is part of LSI’s Market Intelligence platform, your

one-stop-shop for global medtech market sizing and analysis, procedure volume data, startup company- and

deal-tracking, curated insights, and more.

Diagnostic EP catheters are used in conjunction with sophisticated computers to generate electrocardiogram (ECG)

tracings and electrical measurements with precision from within the chambers of the heart. These devices assess

the heart’s electrical activity and are primarily used in the diagnosis of arrhythmias. When paired with

ablation catheters, EP diagnostic catheters may also be used to treat areas of aberrant electrical activity,

particularly in rhythmic disorders such as atrial fibrillation (AFib) and ventricular tachycardia.

Products included within the scope of this analysis include:

Diagnostic EP catheters

This Market Snapshot is intended to provide a high-level overview of the global market for electrophysiology

diagnostic catheters market, with key insights into:

Unit volumes from 2023 to 2028

Market forecasts from 2023 to 2028

Market insights

Competitive landscape analysis of major competitors

Insights into key market events for strategic and startups

Electrophysiology Diagnostic Catheters Market Snapshot Summary

| Snapshot Aspect | Data and Details |

| Base Year for Estimate | 2023 |

| Forecast Period | 2023 - 2028 |

| Market Size in 2023 | $1.45 billion |

| CAGR | 11.2% |

| Projected Market Size in 2028 | $2.46 billion |

Electrophysiology Diagnostic Catheters Market Insights

The electrophysiology diagnostic catheters market is experiencing strong growth, driven by the increasing

utilization of cardiac

ablation procedures for treating heart rhythm disorders such as AFib and supraventricular tachycardia.

While the prevalence of heart rhythm disorders is difficult to determine, conservative estimates suggest they

affect approximately 2% of the general population, with 40 to 60 million people living with AFib alone.

Electrophysiology diagnostic catheters are integral to both the diagnosis and treatment of these conditions,

used in conjunction with ablation procedures, as well as during pacemaker, implantable cardioverter

defibrillator (ICD), and cardiac resynchronization therapy (CRT) device implantations.

A key market driver is the shift towards higher-priced EP mapping and steerable catheters, which offer enhanced

capabilities and greater precision. These advanced devices—which can cost up to seven times more per unit than

conventional fixed-curve catheters—are becoming more widely adopted, contributing to increased market value.

Additionally, the introduction and growing adoption of pulsed-field ablation (PFA) technology is expected to

further drive procedure volumes as PFA is being integrated into ablation procedures. This, in turn, will lead to

an increased demand for diagnostic mapping catheters. As the market continues to expand, the demand for more

specialized, high-performance diagnostic catheters will drive further growth in the electrophysiology diagnostic

catheters market.

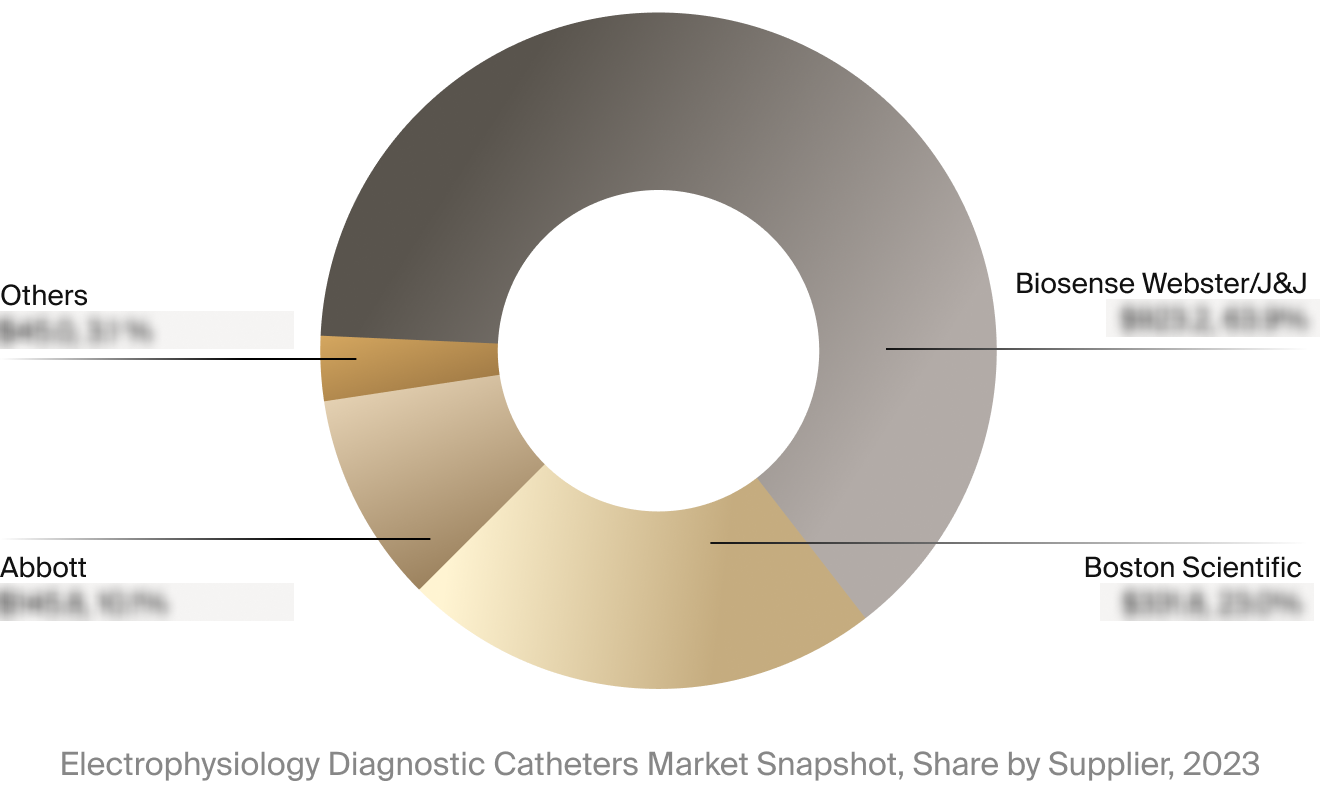

Competitive Landscape

The full Market Snapshot includes a robust analysis of the competitive landscape for the electrophysiology

diagnostic catheters market. This includes estimated market revenue and market share for key players, such as

Abbott, Biosense Webster/J&J, and Boston Scientific.

Select Market Events

| Company | Date | Type | Event |

|

Biosense Webster

|

7/2023 | Commercial Milestone | Biosense Webster announced the company began commercialization of its OPTRELL Mapping Catheter. |

|

Boston Scientific

|

4/2024 | Clinical Milestone | Boston Scientific began its NAVIGATE-PF study, which combines its FARAWAVE Nav PFA catheter with its FARAVIEW Software Module, enabling PFA therapy and mapping in the same device. |

Key Companies Covered

Abbott

Access Point Technologies

Baylis Medical Technologies

BD

BIOTRONIK

Biosense Webster/J&J

Boston Scientific

Innovative Health

Kardium

MedFact Engineering

Medtronic

MicroPort Scientific

Synaptic Medical