The landscape of the in vitro diagnostics market has undergone significant transformations, driven by mergers and acquisitions, strategic realignments, and technological advancements. One of the most noteworthy developments is the merger between Waters Corporation and BD (Becton, Dickinson and Company), valued at $17.5 billion, marking a pivotal moment in the ongoing evolution of the diagnostics sector. This deal reflects the broader medtech industry’s shift toward specialized focus and strategic consolidation.

Understanding Waters’ Strategic Move and BD’s Shift

Waters Corporation, well-established in analytical instrumentation, is expanding its footprint in the clinical diagnostics market with this high-profile acquisition of BD’s Life Sciences business. BD’s Life Sciences unit, which generated $3.4 billion in revenue in 2024, includes prominent sectors like flow cytometry, single-cell biology, and microbiology diagnostics. BD’s decision to divest this unit is part of its strategy to refocus its operations on high-growth, high-margin medtech segments such as interventional care and medication management.

For Waters, this acquisition not only expands its product offering but also strengthens its position against medtech giants like Thermo Fisher Scientific and Danaher Corporation in core IVD markets. By acquiring BD’s assets, Waters gains immediate access to the flow cytometry market, valued at $7 billion, and a growing microbiology diagnostics sector, valued at around $4 billion. Waters’ enhanced portfolio will give it the competitive edge needed to challenge longstanding leaders and capture a larger share of the IVD market, which is projected to grow to over $100 billion by 2027, according to LSI’s Market Intelligence team.

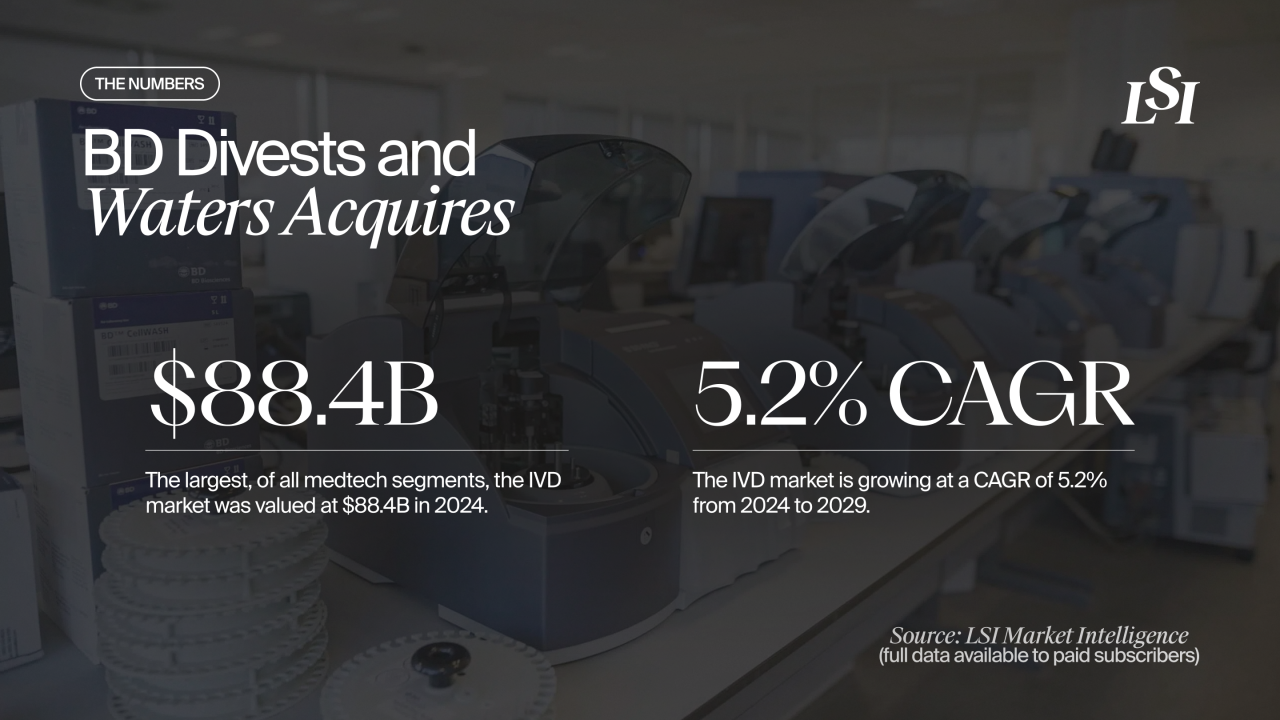

The Numbers Behind the In Vitro Diagnostics Market Growth

The in vitro diagnostics market continues to grow at an impressive rate. According to LSI’s Compass platform, the global IVD market was valued at $88.4 billion in 2024, making it the largest medtech segment by revenue. With a forecasted compound annual growth rate (CAGR) of 5.2% from 2024 to 2029, the IVD sector is poised to surpass $100 billion by 2027. Flow cytometry, microbiology, and single-cell biology are among the high-growth subsegments within the IVD market, driving much of the expansion.

In terms of competitive dynamics, BD has long been a leader in the flow cytometry market, but the shift of these assets to Waters has reshaped the landscape. Waters now positions itself as a formidable competitor in these high-demand sectors, with the deal enhancing its ability to cross-sell complementary instruments across the clinical diagnostics space.

The Competitive Landscape of the IVD Market

Thermo Fisher Scientific remains a dominant force in the in vitro diagnostics market, with 2024 revenues of approximately $42 billion. Known for its broad IVD portfolio, Thermo Fisher’s strengths lie in mass spectrometry, PCR, and sequencing technologies. Its M&A strategy is highly active, focusing on both bolt-on acquisitions and larger platform deals. Recent acquisitions include 3M’s Solventum purification and filtration business and Olink Proteomics’ next-gen proteomics solutions.

Danaher Corporation, with 2024 revenues of around $28 billion, is another key player in the IVD space. It’s known for its strong presence in flow cytometry and lab automation, with brands such as Beckman Coulter Diagnostics and Cepheid. Danaher’s M&A strategy focuses on precision, spinning off non-core operations while acquiring high-value, precision diagnostics assets. Recent acquisitions include Abcam’s antibodies, reagents, biomarkers, and assays, as well as Pall Corporation’s merger into Cytiva’s bioprocess business.

Waters, with 2024 post-deal revenues of $6 billion, is a new contender in this space. The company’s strengths lie in mass spectrometry, chromatography, and now, flow cytometry and microbiology, thanks to its recent acquisition of BD’s Life Sciences assets. While Waters may not surpass these industry giants immediately, it’s now operating in the same league, gaining access to key market segments that will enhance its competitiveness.

Future Outlook for the IVD Market

Looking ahead, the in vitro diagnostics market is expected to continue its expansion, with major trends emerging across multiple sectors. The integration of artificial intelligence (AI) into diagnostic instruments, particularly in oncology and immunology, is expected to drive significant improvements in diagnostic accuracy and speed. Additionally, the increasing demand for decentralized testing solutions, spurred by the COVID-19 pandemic, is accelerating the adoption of point-of-care testing across various healthcare settings.

With innovations in multi-omic integration, AI-enhanced diagnostics, and more compact, affordable diagnostic machines, the IVD sector is likely to see new entrants and growing competition. Waters’ acquisition of BD’s Life Sciences division positions the company to benefit from these trends, providing the necessary tools and technologies to address the growing demand for efficient and accurate diagnostics.

The Future of Medtech Mergers and Acquisitions

The BD-Waters deal is part of a broader trend in the medtech industry where companies are strategically divesting non-core units and acquiring high-growth businesses. This approach enables companies to streamline their operations, sharpen their focus, and enhance competitiveness in rapidly expanding markets, such as diagnostics. As we have seen with other medtech leaders, including Stryker, Medtronic, and Edwards Lifesciences, companies are increasingly concentrating on core areas where they can achieve the greatest impact and drive profitability.

Schedule an exploratory call

Request Info17011 Beach Blvd, Suite 500 Huntington Beach, CA 92647

714-847-3540© 2026 Life Science Intelligence, Inc., All Rights Reserved. | Privacy Policy