Key Takeaways:

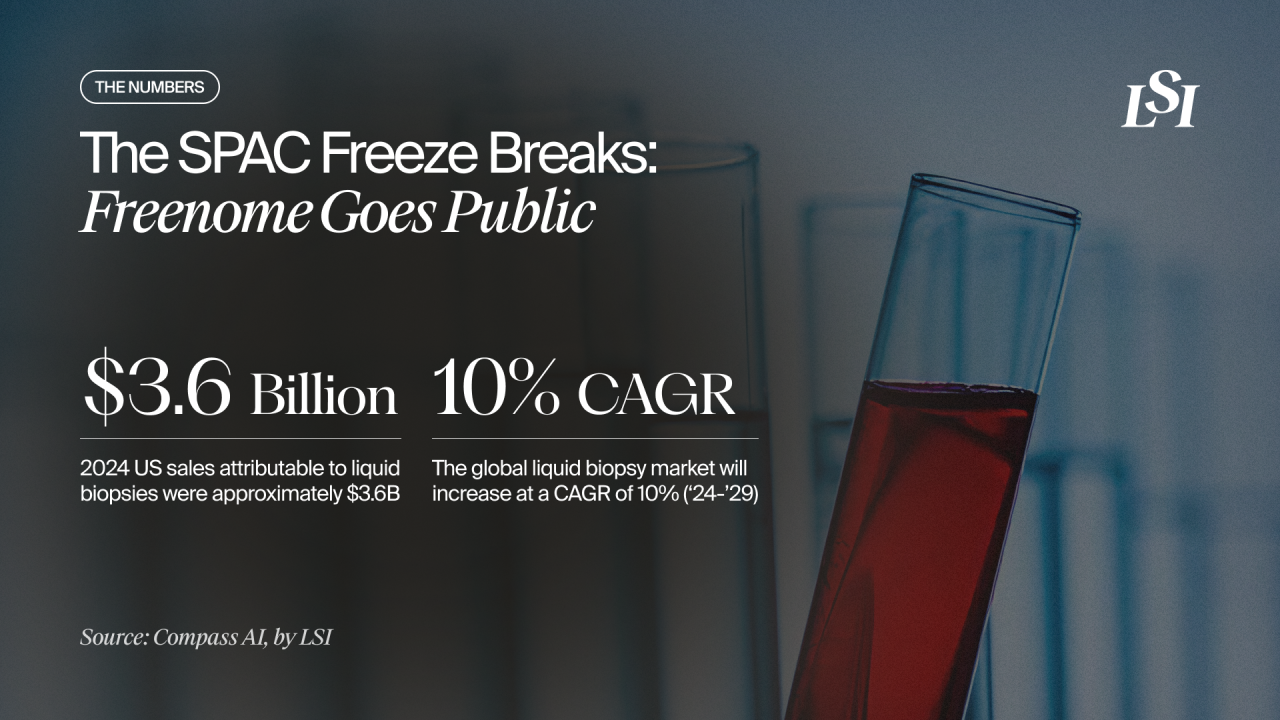

- Freenome plans to go public through a SPAC merger with Perceptive Capital Solutions Corp, one of the first medtech SPAC transactions in several years.

- In 2024, U.S. sales attributable to liquid biopsy technologies were estimated at approximately $3.6 billion.

- By 2029, the U.S. liquid biopsy market is projected to reach approximately $6.0 billion, representing an estimated CAGR of about 11.0 %.

- The global liquid biopsy market is projected to grow at a CAGR of approximately 10% from 2024 to 2029, outpacing the broader in vitro diagnostics market.

After several quiet years, SPAC activity is reappearing in medtech. Freenome, an early cancer detection company developing blood-based screening tests, has announced plans to go public through a merger with Perceptive Capital Solutions Corp (PCSC). The transaction stands out as one of the first medtech SPAC deals in years and arrives at a moment when the liquid biopsy market continues to draw strong investor and strategic interest.

The deal reflects the scale of opportunity associated with early cancer detection and liquid biopsy-based diagnostics. To understand why this transaction is gaining attention, it helps to look at both the structure of the deal and the underlying market dynamics.

A Return to SPACs in Medtech

SPACs surged across medtech in 2020 and 2021 as companies sought faster access to public markets. That momentum slowed significantly amid disappointing post-merger performance and increased regulatory scrutiny. Since then, few medtech companies have pursued this route.

Freenome’s announcement marks a notable departure from that trend. The proposed business combination is expected to generate approximately $330 million in gross proceeds, assuming no redemptions by PCSC’s public shareholders. Importantly, transactional risk is reduced due to the $240 million in PIPE financing led by Perceptive Advisors and RA Capital, with participation from ADAR1 Capital, Bain Capital Life Sciences, Farallon Capital Management, and other new and existing investors.

This capital builds on more than $1.3 billion Freenome has raised to date, placing it among the most-capitalized early cancer detection startups.

How Freenome Plans to Use the Capital

The proceeds from the transaction are expected to fund several strategic priorities. Freenome plans to continue developing its AI-enabled multiomics platform, expand commercial and data infrastructure, and advance a pipeline of blood-based cancer detection tests.

The company is focused on launching multiple tests beginning in 2026, including colorectal cancer and lung cancer indications, while continuing development of its personalized multi-cancer detection programs.

Strategic Partnerships Already in Place

Freenome enters the public markets with established commercial partnerships that support its near-term and long-term strategy.

In the U.S., Freenome has partnered with Exact Sciences, granting Exact U.S. commercialization and licensing rights to Freenome’s blood-based colorectal cancer screening test, SimpleScreen™ CRC, including future versions of the test. The agreement aligns with Exact’s existing leadership in colorectal cancer diagnostics.

Internationally, Freenome has entered into an exclusive agreement with Roche to develop and commercialize its tests outside the U.S. The partnership leverages Roche’s global diagnostics infrastructure and builds on Roche’s prior investment in the company. While the agreement does not include an acquisition, the diagnostics industry has a long history of strategic partnerships that precede larger transactions.

Why Freenome Has Drawn So Much Capital

Several factors explain why Freenome has attracted both capital and strategic partners.

First is the scale of the clinical need. Global cancer incidence continues to rise, driven largely by population growth and aging demographics. Earlier detection remains one of the most impactful ways to improve outcomes.

Second is technological differentiation. Clinical validation in diagnostics is time-consuming and expensive, creating high barriers to entry. Freenome’s approach combines multiomic blood signatures with machine learning, differentiating it from other major players.

Third is commercial alignment. Partnerships with Exact Sciences and Roche provide validation and access to established diagnostic infrastructure. Finally, Freenome has assembled an experienced management team capable of navigating clinical, regulatory, and commercial complexity.

The Liquid Biopsy Market by the Numbers

The fundamentals behind Freenome’s strategy closely mirror trends across the liquid biopsy market.

Over the five-year forecast period from 2024 to 2029, the global liquid biopsy market is projected to grow at a compound annual growth rate of approximately 10%. The U.S. accounts for roughly 45% of the global market value.

In 2024, U.S. sales attributable to liquid biopsy technologies were estimated at approximately $3.6 billion. That revenue spans four primary segments:

- Therapy selection, which identifies tumor mutations to guide targeted treatment decisions, represents the largest subsegment today. E.g., Guardant Health’s Guardant360Ⓡ

- Germline testing checks for inherited genetic variants linked with cancer risk. E.g., Invitae’s Common Hereditary Cancers Panel

- Minimal residual disease testing assesses circulating tumor DNA following treatment to identify residual disease or early recurrence. E.g., Natera’s Signatera™

- Multi-cancer early detection focuses on screening asymptomatic individuals for multiple cancer types from a single sample. Freenome’s lead programs target this segment, alongside products such as GRAIL’s GalleriⓇ.

By 2029, the U.S. liquid biopsy market is projected to reach approximately $6.0 billion, representing an estimated CAGR of about 11.0%. This growth rate is more than double that of the broader global in vitro diagnostics market, which is valued at approximately $90 billion.

Why This Matters Now

The combination of strong market growth, high technical barriers, and expanding clinical adoption has reopened exit opportunities for companies that successfully execute. Those exits may take the form of acquisitions or public offerings, and recent transactions across diagnostics provide reference points for investors.

Schedule an exploratory call

Request Info17011 Beach Blvd, Suite 500 Huntington Beach, CA 92647

714-847-3540© 2026 Life Science Intelligence, Inc., All Rights Reserved. | Privacy Policy