Boston Scientific has officially added Nalu Medical to its growing neuromodulation portfolio, marking its third acquisition of 2025. The $533 million deal reflects Boston Scientific’s strategy of targeting commercial-stage companies in high-growth therapy areas and highlights the rising importance of peripheral nerve stimulation (PNS) in chronic pain management.

The acquisition includes an upfront cash payment of roughly $533 million for the remaining equity not already owned by Boston Scientific, which first invested in Nalu back in 2017. The transaction cements Nalu as one of the year’s standout medtech exits and extends Boston Scientific’s leadership in neurostimulation technologies.

Understanding the Market Behind the Deal

According to projections from LSI’s analyst team, the global implantable neuromodulation devices market is valued at about $6.1 billion, dominated by three key segments:

Three Major Implantable Neuromodulation Categories |

|

|

Category |

Indication |

|

Spinal cord stimulation (SCS) |

Chronic pain management |

|

Deep brain stimulation (DBS) |

neurological and movement disorders |

|

Sacral nerve stimulation (SNS) |

Incontinence |

Together, these categories account for roughly 90% of implantable neuromodulation revenue worldwide.

However, both SCS and DBS are mature markets, growing at less than 5% annually, slower than the overall medtech industry’s 6.6% CAGR. In contrast, sacral and peripheral nerve stimulation are expanding rapidly as device design improves and reimbursement pathways strengthen.

Earlier this year, Boston Scientific acquired Axonics, a recognized leader in sacral nerve stimulation. Now, by bringing Nalu Medical into its ecosystem, the company is tapping into the PNS segment, which is expected to grow at a CAGR of 18.9% in the U.S. over the next five years.

Though still emerging, the U.S. PNS market already represents an estimated $250 million opportunity, according to LSI analysts.

Why Nalu Medical Stood Out

At the center of this deal is the Nalu Neurostimulation System, an FDA-cleared platform designed to support both SCS and PNS therapies. The system uses a micro-implantable pulse generator (IPG) powered externally, eliminating the need for bulky internal batteries and reducing the need for replacement surgeries.

This design not only addresses the pain points associated with traditional implantable neurostimulation therapies but also enables physicians to offer patients a smaller, more flexible therapy option. Nalu’s commercial traction reflects that advantage.

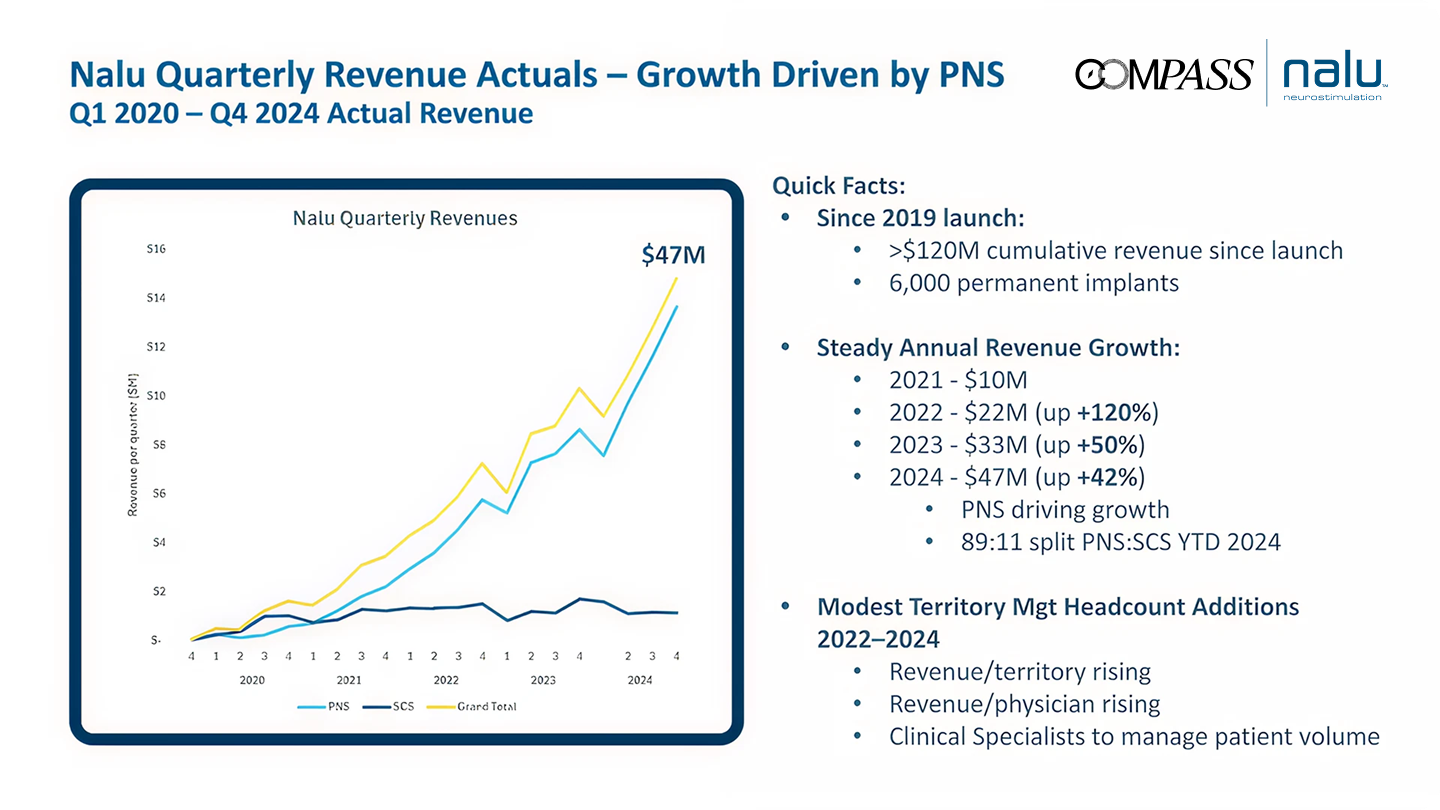

According to insights from LSI’s Compass, Nalu reported the following steady revenue growth:

- 2021: $10 million revenue

- 2022: $22 million (+120%)

- 2023: $33 million (+50%)

- 2024: $47 million (+42%)

That performance is driven primarily by PNS, which represented about 89% of Nalu’s total revenue in 2024. CEO Thomas A. West, speaking at LSI USA ’25, emphasized expanding payer coverage, a clear path to cash-flow breakeven by 2027–2028, and strong clinical data showing meaningful reductions in pain and medical costs.

Clinical outcomes from company data include:

- 87% of patients reported more than 50% pain relief

- 36% achieved greater than 80% relief

- 22% reduction in total pharmacy costs

- 31% discontinued opioid use

- 50% reduction in total medical costs one year post-implant

These results, along with the company’s capital efficiency and consistent growth, positioned Nalu as an attractive acquisition for Boston Scientific.

Competitive Dynamics and Portfolio Synergy

The acquisition also reinforces Boston Scientific’s competitive stance against Medtronic and Abbott, both long-standing leaders in the neuromodulation space. Boston Scientific’s neuromodulation revenue climbed from $917 million in 2022 to $1.1 billion in 2024, momentum that the Nalu integration is expected to strengthen further.

As the industry watches how this integration unfolds, one thing is clear: Nalu’s trajectory illustrates how targeted innovation in underserved therapeutic segments can lead to transformative exits and how strategic players are using focused acquisitions to fuel long-term growth.

Schedule an exploratory call

Request Info17011 Beach Blvd, Suite 500 Huntington Beach, CA 92647

714-847-3540© 2026 Life Science Intelligence, Inc., All Rights Reserved. | Privacy Policy