Overview

Valued at ~$3.07 billion in 2023, the cardiac ablation devices market is projected to reach

~$5.42 billion by 2028, increasing at a CAGR of 12.0% over the 2023-2028

forecast period. This Market Snapshot is part of LSI’s Market Intelligence platform, your

one-stop-shop for global medtech market sizing and analysis, procedure volume data, startup company- and

deal-tracking, curated insights, and more.

Atrial fibrillation (AFib), atrial flutter, and atrial tachycardia are rapid heartbeat symptoms that can be

treated by ablation technology. Catheter ablation has emerged as an effective approach to treat AFib. Ablation

is a complex procedure requiring sophisticated diagnostic equipment to map the heart’s electrical activity to

identify areas of the heart causing irregular electrical activity. Radiofrequency (RF), cryoablation, and

pulsed-field ablation (PFA) are types of energy used to create lesions within the heart to disrupt electrical

activity that causes an irregular heart.

Products included within the scope of this analysis include:

Cardiac ablation catheters

This Market Snapshot is intended to provide a high-level overview of the global market for cardiac ablation

devices, with key insights into:

Unit volumes from 2023 to 2028

Market forecasts from 2023 to 2028

Market insights

Competitive landscape analysis of major competitors

Insights into key market events for strategic and startups

Cardiac Ablation Devices Market Snapshot Summary

| Snapshot Aspect | Data and Details |

| Base Year for Estimate | 2023 |

| Forecast Period | 2023 - 2028 |

| Market Size in 2023 | $3.07 billion |

| CAGR | 12.0% |

| Projected Market Size in 2028 | $5.42 billion |

Cardiac Ablation Devices Market Insights

The cardiac ablation devices market is experiencing strong growth, driven by advancements in screening,

diagnosis, and treatment technology for atrial fibrillation (AFib), alongside increased awareness of the

condition. With an estimated 40 to 60 million people living with AFib worldwide, the number of cardiac ablation

procedures is expected to continue rising, particularly as improved detection methods, such as ambulatory

monitoring devices, gain wider use. Technological advancements—including the introduction of force-sensing

catheters and PFA technology—are further fueling market expansion by offering more precise treatments and better

long-term outcomes, such as reduced recurrence of AFib.

The market is expected to continue growing at a strong pace, outpacing the overall medical device market, driven

by the increasing shift from lifelong drug treatments to ablation therapies. As more patients are diagnosed with

AFib and new, more effective ablation technologies are introduced, the demand for cardiac ablation devices will

remain robust, positioning the market for sustained growth in the coming years.

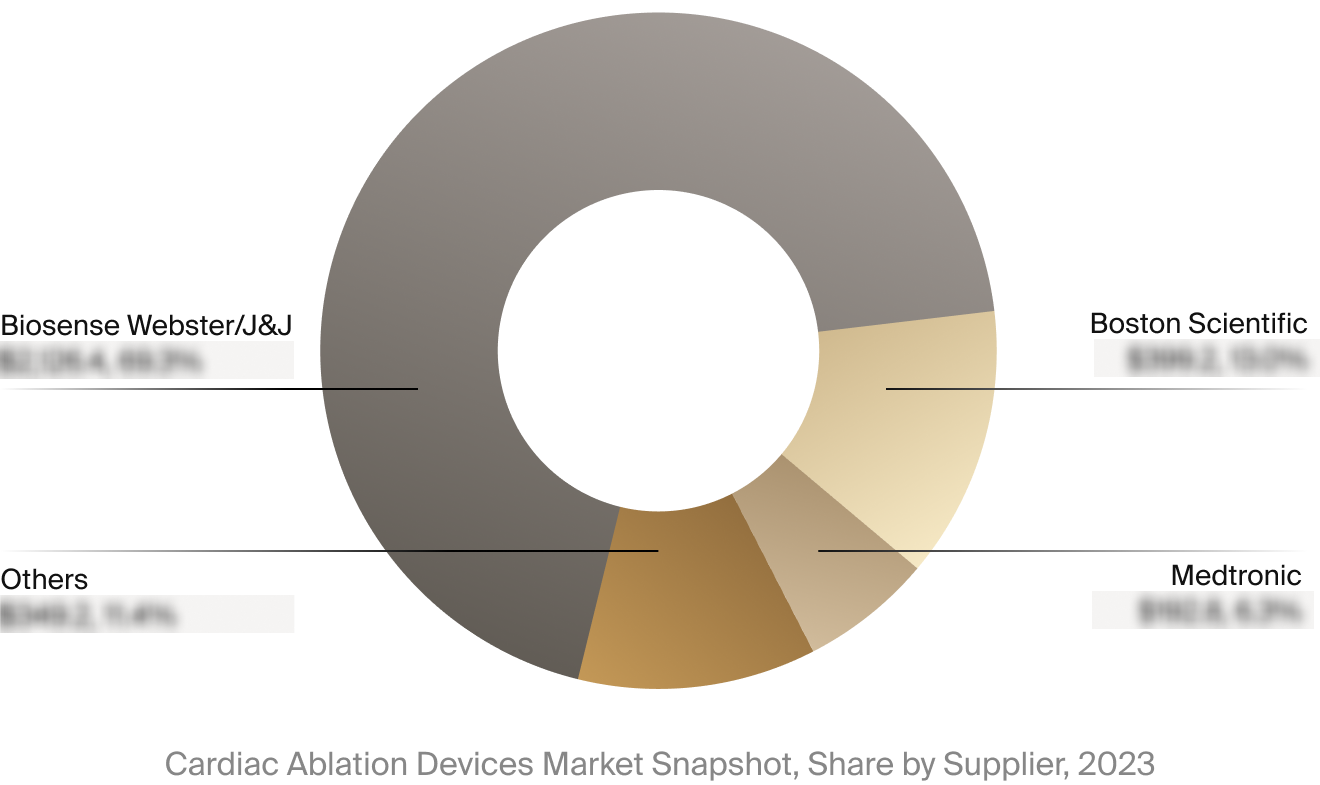

Competitive Landscape

The full Market Snapshot includes a robust analysis of the competitive landscape for the cardiac ablation

devices market. This includes estimated market revenue and market share for key players, such as Biosense

Webster/Johnson & Johnson, Boston Scientific, and Medtronic.

Select Market Events

| Company | Date | Type | Event |

|

Biosense Webster

|

3/2024 | Regulatory Filing | Biosense Webster announced that the company has applied for FDA Premarket Approval of the VARIPULSE Platform. The company received the CE Mark for VARIPULSE in February 2024. |

|

Boston Scientific

|

1/2024 | Regulatory Approval | Boston Scientific received FDA approval for the FARAPULSE PFA System. |

Key Companies Covered

Abbott

Affera

AliveCor

AtriCure

Biosense Webster

Boston Scientific

CardioFocus

Field Medica

Galvanize Therapeutics

Johnson & Johnson

Medtronic

Stereotaxis