The transcatheter aortic valve replacement (TAVR) market is undergoing significant evolution. As the demand for less invasive heart valve procedures continues to rise, the competitive landscape is rapidly shifting. Medtech giants like Medtronic and Edwards Lifesciences remain dominant, but innovation continues to play a crucial role in reshaping the future of the TAVR market.

This article dives into the current state of the TAVR market, key industry players, and the forces driving growth, as well as recent industry moves such as Boston Scientific’s decision to exit the TAVR space.

The TAVR Landscape in 2025

Since its U.S. approval in 2011, TAVR has transformed the treatment of severe aortic stenosis. Particularly beneficial for high-risk patients who are not candidates for open-heart surgery, TAVR has quickly become the standard procedure for aortic valve replacement in many countries.

The procedure’s appeal lies in its less invasive nature, shorter recovery time, and, in many cases, comparable or even superior outcomes to traditional valve replacement surgeries. TAVR has been a breakthrough for elderly patients, especially those with comorbidities. Yet, as the market matures, TAVR developers are facing the challenge of sustaining growth.

With most of the high-risk patient population already treated, companies are now looking to expand into more complex areas, including younger, asymptomatic patients or those with bicuspid valves. The TAVR market continues to be a focus for innovation, but the stakes are higher than ever. In order to remain competitive, companies must push the limits of valve design and delivery, ensuring that new products meet the growing demands of a global population.

The Numbers Behind the TAVR Market’s Growth

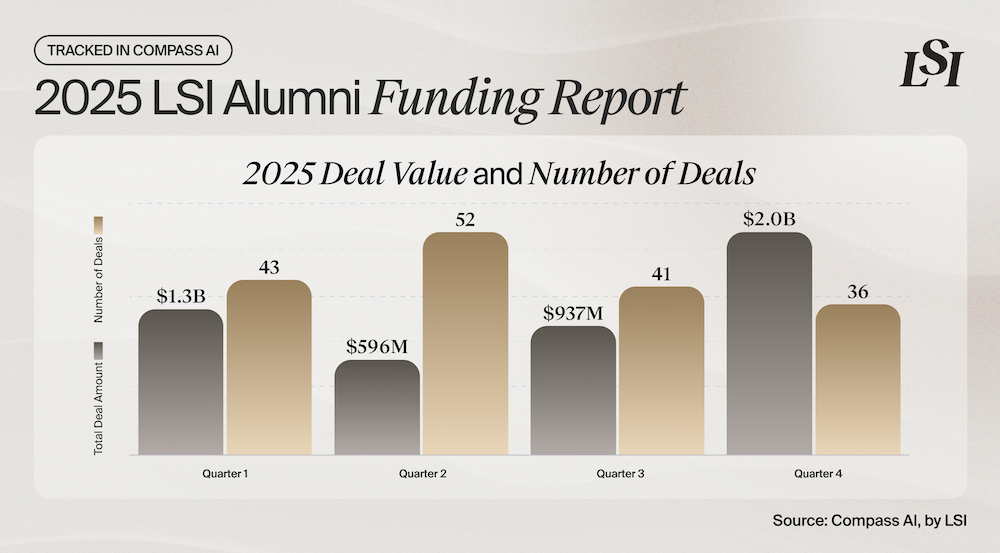

The global TAVR market reached an estimated value of $6.2 billion in 2024. This represents a 5.1% year-over-year increase, signaling continued market expansion. Over the five-year forecast, the TAVR market is expected to grow at a compounded annual growth rate (CAGR) of 9.9%, reaching nearly $10 billion by 2029. This growth significantly outpaces the overall medtech market, reflecting the growing demand for TAVR procedures as well as the development of innovative technologies and devices.

According to LSI’s Global Procedure Volumes Database, approximately 200,000 TAVR procedures will be performed worldwide this year, with more than half of those procedures taking place in the United States. The volume of procedures is increasing steadily, and as new patient populations are targeted, we expect the growth trajectory to continue.

The Competitive Landscape: Edwards Lifesciences vs. Medtronic

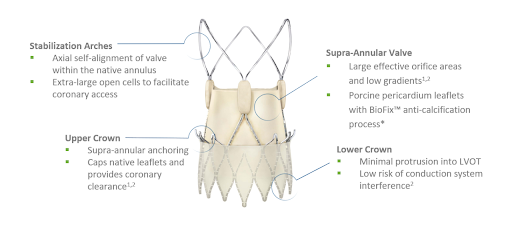

The TAVR market remains highly competitive, with Edwards Lifesciences and Medtronic holding the lion’s share of market sales. Edwards’ Sapien platform and Medtronic’s Evolut platform are widely considered the industry leaders, both in terms of clinical performance, patient outcomes, and innovation.

- Edwards Lifesciences has maintained its dominant position in the TAVR market. The company’s Sapien platform remains a strong leader, benefiting from ongoing improvements in valve design and delivery systems. Edwards is continually innovating, with a focus on refining its technology to meet the needs of a wider range of patients.

- Medtronic, another key player, continues to perform well in the TAVR market with its Evolut platform. Medtronic’s strength lies in its vast global footprint and ability to expand TAVR to more diverse patient populations, including those with low or intermediate-risk conditions.

While Boston Scientific attempted to make its mark in the TAVR space with the ACURATE neo2 valve, the company announced earlier this year that it would be exiting the market entirely. The decision follows a series of technical and regulatory challenges that ultimately led to disappointing trial results and a more cautious outlook. Boston Scientific’s exit serves as a reminder of the high barriers to entry and the intense competition within the TAVR market, where dominant players have a significant advantage.

Innovation in the TAVR Market: New Entrants and New Technologies

Despite Boston Scientific’s decision to exit the TAVR market, innovation is far from slowing down. Several emerging companies are developing next-generation TAVR systems or alternative treatment options designed to expand the patient population and improve long-term outcomes. Some of the players to watch include:

- Anteris Technologies: Anteris is working on the DurAVR™ valve, a biomimetic 3D aortic valve designed to improve durability and hemodynamics, especially for younger, more active patients. This innovative approach could redefine how TAVR technology is used, particularly for patients with specific needs.

- Cardiawave: Instead of focusing on valve replacement, Cardiawave is pioneering a non-invasive approach using ultrasound therapy to treat calcific aortic stenosis. Their technology restores leaflet mobility, offering a potential option for patients who aren’t eligible for TAVR or surgery.

- Cuspa: Cuspa is developing a novel artificial cusp designed to repair valve insufficiency, offering a minimally invasive solution for aortic insufficiency that targets a niche patient population with limited options.

- Pi-Cardia: The company’s Leaflex™ device is a mechanical scoring system designed to restore valve leaflet function without replacement. This technology is ideal for patients who might otherwise remain untreated due to surgical or anatomical limitations.

These emerging players are pushing the boundaries of what’s possible in TAVR, exploring both incremental and radical innovations that could change the treatment landscape for aortic valve disease.

The Road Ahead

While the TAVR market remains dominated by two giants, Edwards Lifesciences and Medtronic, the future is not without uncertainty. As the market matures, the focus will shift from rapid adoption to differentiation. TAVR is expected to continue growing, particularly with new patient groups being targeted. The challenge for developers will be to innovate in ways that stand out from the established platforms.

Key factors expected to shape the future of the TAVR market include:

- Expansion into new patient populations: The focus is shifting to younger, lower-risk patients who are often asymptomatic. Targeting this group will require significant adjustments to valve technology, delivery mechanisms, and patient monitoring.

- Technology convergence: Advancements in imaging systems, AI-driven decision support tools, and real-time monitoring will likely be integrated into TAVR platforms, improving procedural outcomes and long-term results.

Want a deeper dive into the TAVR market? Subscribe to Compass to gain access to total market sizing, worldwide sales, and share by supplier data.

Schedule an exploratory call

Request Info17011 Beach Blvd, Suite 500 Huntington Beach, CA 92647

714-847-3540© 2026 Life Science Intelligence, Inc., All Rights Reserved. | Privacy Policy