The global rise of end-stage kidney disease (ESKD) highlights a longstanding truth: while dialysis is life-saving, it remains a costly, labor-intensive, and outdated solution. In an era marked by aging populations and chronic disease, the urgency to modernize how we manage kidney failure is only growing.

The dialysis market—historically dominated by large-scale outpatient clinics and decades-old technologies—is under pressure. The global patient population is growing faster than treatment capacity, and even modest improvements in access or efficiency could have profound impacts. While new technologies show promise, the path forward demands systemic change.

In this edition of The Numbers, we examine where the dialysis market is headed—by the numbers, by the players, and by the innovations that could shape the next generation of kidney care.

Special thanks to contributing author Tim Fitzpatrick, founder of Signals Group, a research and media firm spotlighting innovation in kidney health.

Hemodialysis, Peritoneal Dialysis, and a Market Defined by Consumables

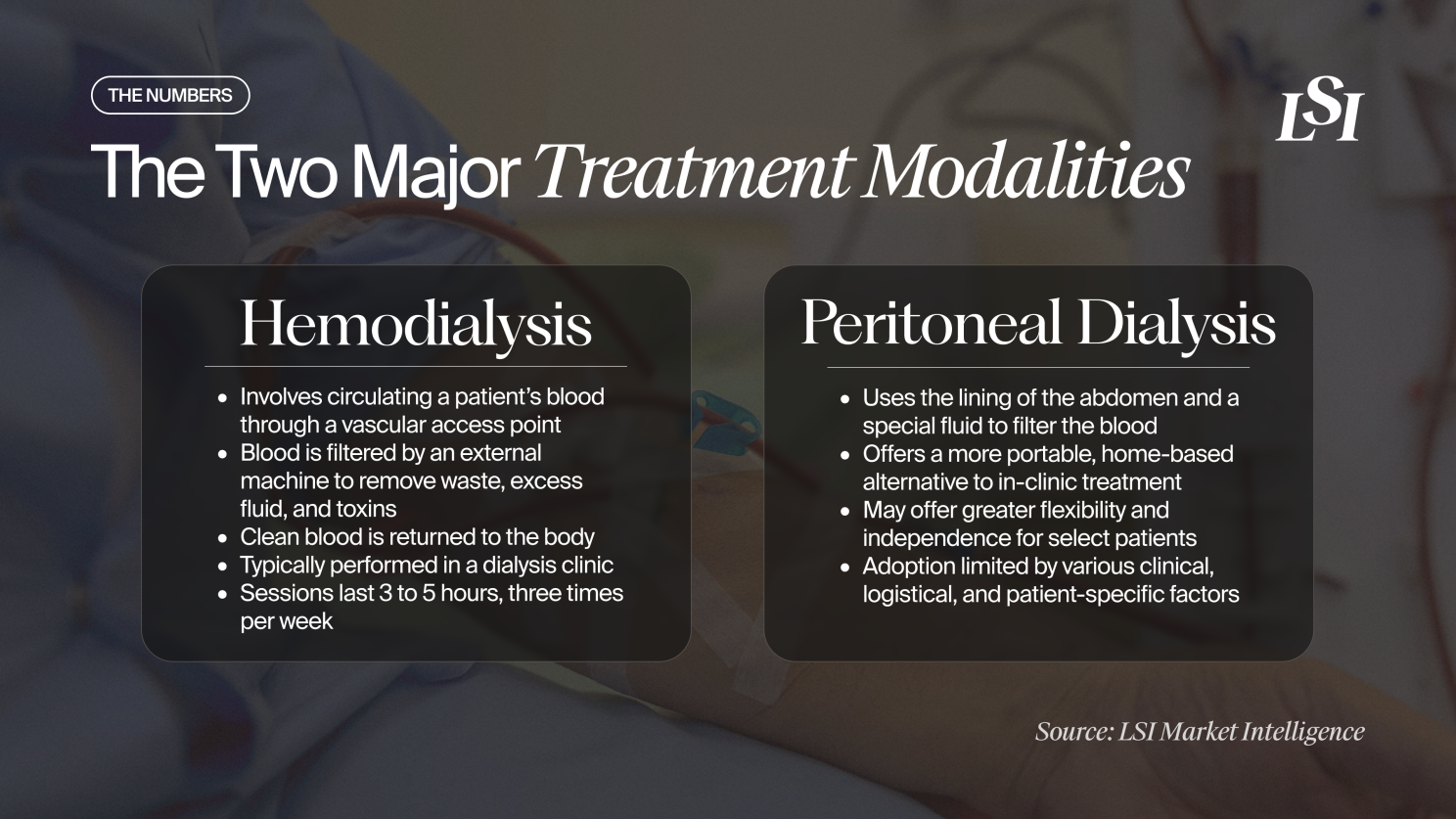

Dialysis treatment typically takes one of two forms: hemodialysis (HD) or peritoneal dialysis (PD). HD, the more common option, involves filtering the patient’s blood through an external machine via a vascular access point. These sessions generally last several hours and are performed multiple times weekly, often in clinical settings.

PD, by contrast, allows for treatment at home by using the abdominal lining to filter waste through a special solution. Although PD offers greater flexibility, it remains underutilized due to clinical and logistical limitations.

Around 87% of global dialysis product revenues stem from HD-related equipment and consumables, reflecting the widespread use of this modality.

Major industry players—including Fresenius Medical Care, DaVita, Baxter, and NIPRO—operate vast treatment networks and manufacture the machines, catheters, and dialyzers essential to dialysis delivery. This high concentration of market power presents barriers for emerging companies looking to disrupt the status quo.

Market Snapshot: A Growing Patient Base and Steady Expansion

According to Compass, LSI’s proprietary discovery platform for medtech market intelligence, the global dialysis products market was valued at $14.0 billion in 2024 and is expected to reach $17.05 billion by 2029, growing at a 4.0% CAGR.

A primary growth driver is the escalating number of people requiring ongoing dialysis, driven by the rising burden of diabetes and hypertension. An estimated 500 million dialysis treatments are performed globally each year, with 85 to 90 million taking place in the United States alone.

Notably, about 86% of product revenue in this market comes from consumables, like dialyzers, tubing, and vascular access products that are essential for each treatment session. As global patient populations grow by 3% to 5% annually, the demand for these consumables climbs in parallel.

Yet even with this growth, access remains far below global need. Experts estimate that the world requires three to four times the current dialysis capacity to meet demand. This gap underscores the urgency for scalable solutions that can extend reach without overwhelming already-strained health systems.

Shifting Landscapes and Emerging Entrants in the Dialysis Market

Today’s dialysis market is largely concentrated, with Fresenius holding approximately 35% of the global share. While newcomers face regulatory and structural barriers, niche innovations are beginning to surface in parallel with the legacy care model rather than in opposition to it.

Peripheral technologies—like vascular access devices, sensor-based fluid monitoring, and remote management platforms—are generating momentum. These tools are particularly relevant for home dialysis and acute care applications, which could help relieve staffing shortages and enhance patient autonomy.

Meanwhile, startups such as Diality, Quanta, Xeltis, Roivios, CloudCath, and Relavo are rethinking how dialysis is delivered altogether. Whether through miniaturized systems, automation, or more user-friendly hardware, these companies are reframing kidney care around convenience, safety, and independence.

Compass continues to track these innovations, helping executives identify opportunities across private company activity, funding trends, and early-stage technologies before they go mainstream.

What’s Next for Kidney Care Innovation?

Unlike previous decades, where efforts focused primarily on improving the dialysis machine itself, the current wave of innovation is centered on reimagining care delivery. Can treatment move closer to the home? Can new technologies address gaps in managing fluid overload or acute kidney injury in other clinical domains, such as cardiology?

Real transformation will require systemic alignment—including new reimbursement structures, broader provider training, and patient-first care models that expand choice from the moment of diagnosis.

Though barriers remain, the alignment of market growth, clinical need, and cost-saving potential makes now a pivotal time to rethink how we treat ESKD.

Rebuilding the Dialysis Market for a New Era

The dialysis market is overdue for change. For too long, treatment has relied on labor-intensive models with limited adaptability—particularly in low-resource settings. While the total market continues to grow steadily, that growth masks significant disparities in access, innovation, and care quality.

Regulatory frameworks like the U.S. dialysis bundle have historically disincentivized change, and while programs like TPNIES aim to reverse that, their short implementation windows limit true impact. In the meantime, underfunded clinics and an overstretched workforce struggle to meet rising demand.

The way forward is clear: innovation must be centered not only on technology but on dignity, accessibility, and long-term outcomes. As more patients rely on dialysis for longer durations, the healthcare system must evolve to meet them where they are—with better tools, better infrastructure, and better models of care.

Contributing Author

This edition of The Numbers was written in collaboration with Tim Fitzpatrick, founder of Signals, a media and research firm dedicated to innovations in kidney health. His newsletter reaches over 15,000 nephrology professionals across more than 50 countries each month. Tim previously co-founded IKONA, a company that developed immersive educational tools for dialysis patients and care teams across 250+ clinics in the United States.

Schedule an exploratory call

Request Info17011 Beach Blvd, Suite 500 Huntington Beach, CA 92647

714-847-3540© 2026 Life Science Intelligence, Inc., All Rights Reserved. | Privacy Policy