The global diabetes devices market in 2025 is witnessing significant changes as new technologies and strategic shifts drive growth and transformation. A key example is Medtronic’s decision to divest its $2.5 billion diabetes business, which includes a wide range of devices such as continuous glucose monitors (CGMs) and insulin pumps. This strategic move has sparked considerable industry discussion, raising questions about the future of diabetes care and how companies are positioning themselves for continued success. Here, we’ll explore the key developments in the diabetes devices market, the role of major players, and what Medtronic’s decision means for the broader industry.

Overview of The Diabetes Devices Market

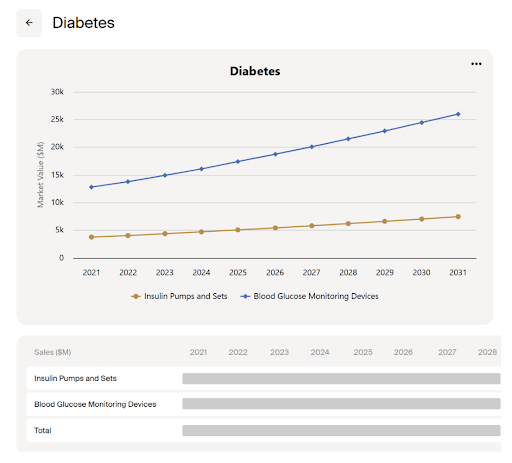

Diabetes management is a rapidly evolving space, with continuous glucose monitoring (CGM) and insulin pumps at the forefront. According to LSI’s Compass, the global market for diabetes monitoring and management devices was valued at $20.8 billion in 2024. Over the next five years, the market is projected to grow at a compound annual growth rate (CAGR) of 7.6%, driven by increasing diabetes prevalence and advancements in device technology.

Globally, diabetes affects approximately 830 million people, and as the global population ages, this number is expected to rise. The diabetes devices market includes a range of products aimed at improving patient care, from diagnostic devices like CGMs to therapeutic solutions like insulin pumps. These technologies not only help manage blood glucose levels but also enhance patients’ quality of life by making diabetes care more convenient and effective.

Medtronic’s Strategic Shift in the Diabetes Devices Market

Medtronic, one of the leading players in the diabetes devices market, recently made a significant move by deciding to spin off its diabetes business. The company’s diabetes division includes its insulin pumps, CGMs, and other diabetes-related products, and it accounted for approximately 8.0% of Medtronic’s total revenue in 2024. Despite recent growth in this segment, Medtronic plans to divest its diabetes business, creating a standalone company, “NewCo,” in order to streamline operations and focus on its core medical device offerings.

This move by Medtronic has triggered mixed reactions. Some analysts see it as a way for Medtronic to sharpen its focus on its primary healthcare divisions, while others view it as an attempt to address increasing competition in the diabetes care market, particularly from newer players that are challenging traditional models.

Key Drivers of Growth in the Diabetes Devices Market

Several factors are fueling growth in the diabetes devices market:

- Rising Prevalence of Diabetes: As mentioned, the number of people with diabetes continues to grow. The International Diabetes Federation reports that the prevalence of diabetes has increased from 8.5% in 2014 to an estimated 11.1% in 2025. This sharp rise is particularly noticeable in emerging markets, where urbanization and lifestyle changes are driving the increase.

- Technological Advancements: Innovations in diabetes management, such as CGM systems and insulin pumps, are making it easier for patients to manage their condition. The introduction of closed-loop systems, often referred to as artificial pancreas systems, is a game changer in diabetes care. These systems automate insulin delivery based on real-time glucose data, allowing patients to achieve better control of their blood sugar levels.

- Greater Accessibility: The growing availability of home-based diabetes testing and management tools is making it easier for patients to track and manage their condition from home. This shift to at-home care is helping to reduce the burden on healthcare systems and provides patients with more flexibility in managing their diabetes.

- Growing Market for Wearables and Digital Solutions: Digital health tools, including wearable health monitoring devices and apps, are playing an increasingly important role in diabetes management. Companies like Dexcom and Abbott are at the forefront of CGM technology, and the integration of diabetes care with other health monitoring systems is enhancing the ability of patients to manage their condition more effectively.

Medtronic’s Role in the Diabetes Devices Market

Medtronic’s decision to divest its diabetes business is not entirely unexpected. The company has been facing increasing competition from companies like Tandem Diabetes Care, Insulet, and Abbott, which have made significant strides in the insulin pump and CGM markets. Medtronic’s MiniMed series, one of the first insulin pumps to integrate with CGMs, has long been a market leader. However, the rise of new technologies, especially in the CGM space, has led to greater competition, prompting Medtronic to reassess its position.

The company’s spin-off strategy for the diabetes business aims to give the new entity more autonomy to focus on innovations that meet the unique needs of the diabetes care market while allowing Medtronic to concentrate on its core strengths in other medical device sectors. Medtronic’s decision to divest also underscores the growing consumerization of healthcare as patient-centric devices and direct-to-consumer sales models become more prevalent.

Competitive Landscape in the Diabetes Devices Market

The diabetes devices market remains dominated by a few key players, including:

- Medtronic: Despite the divestiture of its diabetes business, Medtronic remains a leader in the insulin pump space, with its MiniMed systems playing a critical role in diabetes management.

- Abbott Laboratories: Abbott is one of the biggest competitors in the CGM market, with its FreeStyle Libre system gaining widespread adoption. The company has been a significant disruptor in the space, offering a more affordable, easy-to-use CGM system.

- Tandem Diabetes Care and Insulet Corporation: These companies have emerged as strong competitors, particularly in the insulin pump market. Tandem’s t:slim insulin pump and Insulet’s Omnipod system have attracted considerable market share, offering unique features such as smartphone integration and tubeless designs.

- Pharmaceutical Companies: Companies like Novo Nordisk and Eli Lilly are also making waves in the diabetes space by advancing new diabetes medications and weight-loss therapies. These companies’ moves into the diabetes management space add an extra layer of competition for device makers.

Companies to Watch in the Diabetes Devices Market

While Medtronic, Abbott, Tandem, and Insulet continue to dominate the market, several emerging companies are introducing disruptive solutions for diabetes treatment and diagnostics. These companies are taking innovative approaches to improve both the treatment and management of diabetes:

|

Company |

Total Amount Raised |

Technology |

|

CeQur |

$391.6M |

CeQur’s Simplicity is a wearable mealtime insulin patch using a small, flexible cannula to deliver rapid-acting insulin under the skin. |

|

Senseonics |

$226.0M |

The Eversense CGM provides discrete, real-time monitoring of glucose using a small sensor implanted under the skin that connects to an external transmitter. |

|

Beta Bionics |

$553.0M |

The iLet Bionic Pancreas is an automated insulin delivery system designed to manage insulin dosing without manual input. |

What’s Next for the Diabetes Devices Market?

As the diabetes devices market continues to grow, several trends are expected to shape its future:

- The Rise of Digital and AI-driven Solutions: With advancements in artificial intelligence, digital tools, and wearables, the future of diabetes care is moving toward more personalized and efficient solutions. AI-powered systems are enhancing the accuracy and effectiveness of diabetes management by providing real-time, data-driven insights.

- Integration of Diabetes Care with Other Health Monitoring Systems: Companies are increasingly integrating diabetes management solutions with other health data, such as sleep patterns, activity levels, and stress, to provide a more comprehensive view of patients’ overall health.

- More Innovation in Insulin Delivery Systems: The push for automated insulin delivery systems, such as artificial pancreas systems, is expected to continue, with more companies working to develop closed-loop insulin delivery technologies.

Schedule an exploratory call

Request Info17011 Beach Blvd, Suite 500 Huntington Beach, CA 92647

714-847-3540© 2026 Life Science Intelligence, Inc., All Rights Reserved. | Privacy Policy