Overview

Valued at ~$1.03 billion in 2023, the vertebroplasty and kyphoplasty devices market is

projected to reach ~$1.33 billion by 2028, increasing at a CAGR of 5.2% over

the 2023-2028 forecast period. This Market Snapshot is part of LSI’s Market Intelligence platform, your

one-stop-shop for global medtech market sizing and analysis, procedure volume data, startup company- and

deal-tracking, curated insights, and more.

Vertebroplasty and kyphoplasty are two widely used minimally invasive procedures for vertebral

augmentation. Vertebroplasty and kyphoplasty cement and delivery devices are used to treat vertebral

compression fractures (VCFs) of the spine, typically caused by osteoporosis or spinal tumors. Vertebroplasty

involves the percutaneous injection of bone cement directly into a fractured vertebra to stabilize the spine.

Kyphoplasty involves percutaneously inserting a balloon into a fractured vertebra, inflating it to create a

cavity, and filling the cavity with bone cement after balloon removal.

Products included within the scope of this analysis include:

Vertebroplasty and kyphoplasty cement and delivery devices

This Market Snapshot is intended to provide a high-level overview of the global market for vertebroplasty and

kyphoplasty devices, with key insights into:

Unit volumes from 2023 to 2028

Market forecasts from 2023 to 2028

Market insights

Competitive landscape analysis of major competitors

Insights into key market events for strategic and startups

Vertebroplasty and Kyphoplasty Devices Market Snapshot Summary

| Snapshot Aspect | Data and Details |

| Base Year for Estimate | 2023 |

| Forecast Period | 2023 - 2028 |

| Market Size in 2023 | $1.03 billion |

| CAGR | 5.2% |

| Projected Market Size in 2028 | $1.33 billion |

Vertebroplasty and Kyphoplasty Devices Market Insights

The vertebroplasty and kyphoplasty devices market is primarily driven by the rapid growth of the global elderly

population, which faces an increased risk of developing osteoporosis, the leading cause of vertebral compression

fractures. As the aging population expands, the demand for vertebral augmentation procedures continues to rise.

In the United States, the number of vertebroplasty and kyphoplasty procedures performed annually has declined

significantly over the past 15 years due to results from outcome studies showing questionable efficacy.

Worldwide, the number of vertebroplasty procedures continues to increase, but the rate of increase has declined

in some countries as clinical experience shows questionable efficacy. In addition to efficacy concerns, the high

unit cost of kyphoplasty devices remains a significant barrier to broader market adoption. Additionally,

government healthcare cost-containment efforts are expected to constrain prices further, adding pressure on the

market to deliver cost-effective solutions.

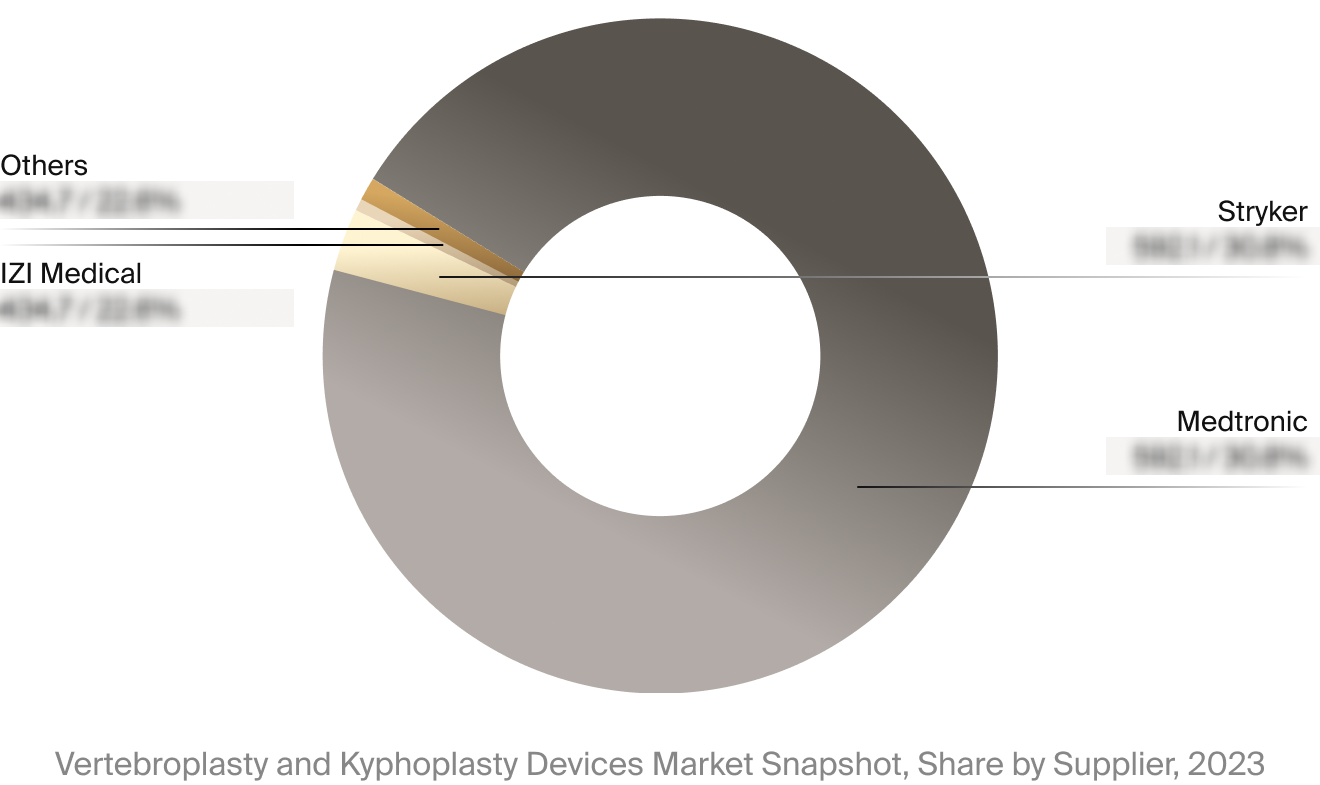

Competitive Landscape

The full Market Snapshot includes a robust analysis of the competitive landscape for the vertebroplasty and

kyphoplasty devices market. This includes estimated market revenue and market share for key players, such as

Medtronic, Stryker, and IZI Medical.

Select Market Events

| Company | Date | Event Type | Event |

|

Medtronic

|

6/2024 | Strategic Partnership | Medtronic announced its partnership with Merit Medical to supply Medtronic’s Kyphon XPANDERⓇ Inflation Syringes in the United States. |

Key Companies Covered

IZI Medical

Medtronic

Tecres

Merit Medical

Stryker