Overview

Valued at ~$1.69 billion in 2023, the peripheral vascular and biliary stents market is

projected to reach ~$2.24 billion by 2028, increasing at a CAGR of 5.9% over

the 2023-2028 forecast period. This Market Snapshot is part of LSI’s Market Intelligence platform, your

one-stop-shop for global medtech market sizing and analysis, procedure volume data, startup company- and

deal-tracking, curated insights, and more.

Peripheral vascular and biliary stents are medical devices designed to maintain the patency of anatomical

vessels or ducts. A peripheral vascular stent is typically inserted during a percutaneous

transluminal angioplasty (PTA) or other revascularization procedures to treat stenosed blood vessels and

restore proper blood flow. In contrast, a biliary stent is a thin, tube-like device placed to support a narrowed

section of the bile duct, preventing the reformation of a stricture or providing palliative relief for

malignancies in the biliary tract. Biliary stents are commonly placed using endoscopic retrograde

cholangiopancreatography (ERCP) or percutaneous transhepatic cholangiography (PTC).

Products included within the scope of this analysis include:

Biliary stents

Iliac artery stents

Peripheral vascular stents

This Market Snapshot is intended to provide a high-level overview of the global market for peripheral vascular

and biliary stents, with key insights into:

Unit volumes from 2023 to 2028

Market forecasts from 2023 to 2028

Market insights

Competitive landscape analysis of major competitors

Insights into key market events for strategic and startups

Peripheral Vascular and Biliary Stents Market Snapshot Summary

| Snapshot Aspect | Data and Details |

| Base Year for Estimate | 2023 |

| Forecast Period | 2023 - 2028 |

| Market Size in 2023 | $1.69 billion |

| CAGR | 5.9% |

| Projected Market Size in 2028 | $2.24 billion |

Peripheral Vascular and Biliary Stents Market Insights

The peripheral vascular and biliary stents market is experiencing steady growth, driven by the rising prevalence

of peripheral vascular disease and the increasing use of advanced stent technologies. While stents, including

drug-eluting types, have seen some decline due to the rise of drug-coated balloons, the market is expected to

grow with the introduction of bioresorbable stents. These innovative devices are anticipated to offer improved

clinical outcomes for patients with severe peripheral artery disease.

Bioresorbable stents, such as Abbott’s Esprit, provide short-term support to diseased vessels, enhancing vessel

patency and reducing the risk of complications like stent fractures. As these technologies continue to develop,

they are expected to drive growth in both unit and dollar volume for the stents market, particularly in the

latter years of the forecast period.

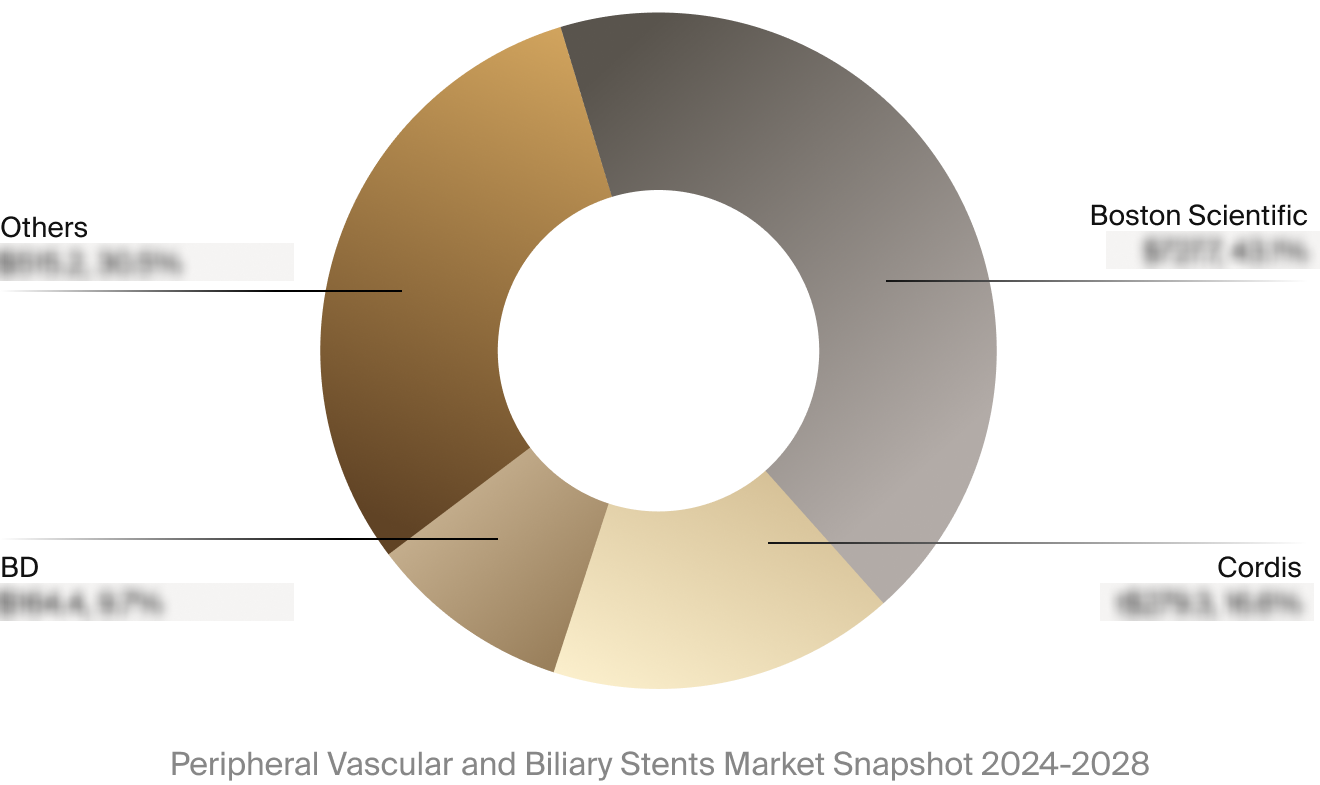

Competitive Landscape

The full Market Snapshot includes a robust analysis of the competitive landscape for the peripheral vascular and

biliary stents market. This includes estimated market revenue and market share for key players, such as Boston

Scientific, BD, and Cordis.

Select Market Events

| Company | Date | Type | Event |

|

Abbott

|

4/2024 | Regulatory Approval | Abbott received U.S. FDA clearance for its Esprit BTK Everolimus Eluting Resorbable Scaffold System in arteries below the knee. |

|

Cordis

|

11/2023 | Clinical Study | Cordis announced the end of patient enrollment in its RADIANCY premarket clinical study in pursuance of CE mark approval for its SMART Radianz vascular stent system. |

Key Companies Covered

Abbott

BIOTRONIK

Boston Medical

Boston Scientific

Bryan Medical

Cordis

Hood Labs

Maquet

Merit Medical

MicroPort Scientific

Olympus

W.L. Gore