Overview

Valued at ~$1.45 billion in 2023, the percutaneous revascularization devices market is

projected to reach ~$4.19 billion by 2028, increasing at a CAGR of 23.6% over

the 2023-2028 forecast period. This Market Snapshot is part of LSI’s Market Intelligence platform, your

one-stop-shop for global medtech market sizing and analysis, procedure volume data, startup company- and

deal-tracking, curated insights, and more.

Percutaneous revascularization devices are catheter-based tools used to treat atherosclerosis, a condition where

arteries narrow and restrict blood flow. These devices work by modifying plaque within the vessel, which helps

widen the artery and improve blood circulation. These devices are one of many solutions available to prepare and

revascularize occluded vessels. This analysis focuses on catheter-based revascularization devices, excluding angioplasty

balloons,

another commonly used treatment option.

Products included within the scope of this analysis include:

Directional atherectomy

Laser atherectomy

Orbital atherectomy

Laser atherectomy

Intravascular lithotripsy (IVL)

This Market Snapshot is intended to provide a high-level overview of the global market for percutaneous

revascularization devices, with key insights into:

Unit volumes from 2023 to 2028

Market forecasts from 2023 to 2028

Market insights

Competitive landscape analysis of major competitors

Insights into key market events for strategic and startups

Percutaneous Revascularization Devices Market Snapshot Summary

| Snapshot Aspect | Data and Details |

| Base Year for Estimate | 2023 |

| Forecast Period | 2023 - 2028 |

| Market Size in 2023 | $1.45 billion |

| CAGR | 23.6% |

| Projected Market Size in 2028 | $4.19 billion |

Percutaneous Revascularization Devices Market Insights

The percutaneous revascularization devices market has experienced substantial growth, driven by innovations like

IVL, which has become an essential technique for managing calcified lesions. The adoption of IVL—particularly

the Shockwave Medical IVL device—has significantly reshaped the market, with Shockwave becoming the largest

supplier in the atherectomy/plaque modification device market by revenue in 2022. This market has expanded to

$1.45 billion in 2023, a nearly three-fold increase since Shockwave’s entry in 2016.

The shift from traditional atherectomy devices to IVL has significantly changed the market’s pricing dynamics,

as IVL catheters, such as the Shockwave device, are priced significantly higher—up to four times more than

conventional atherectomy catheters. This shift reflects the growing clinical acceptance of IVL for plaque

modification, positioning it as a dominant solution in the revascularization devices market.

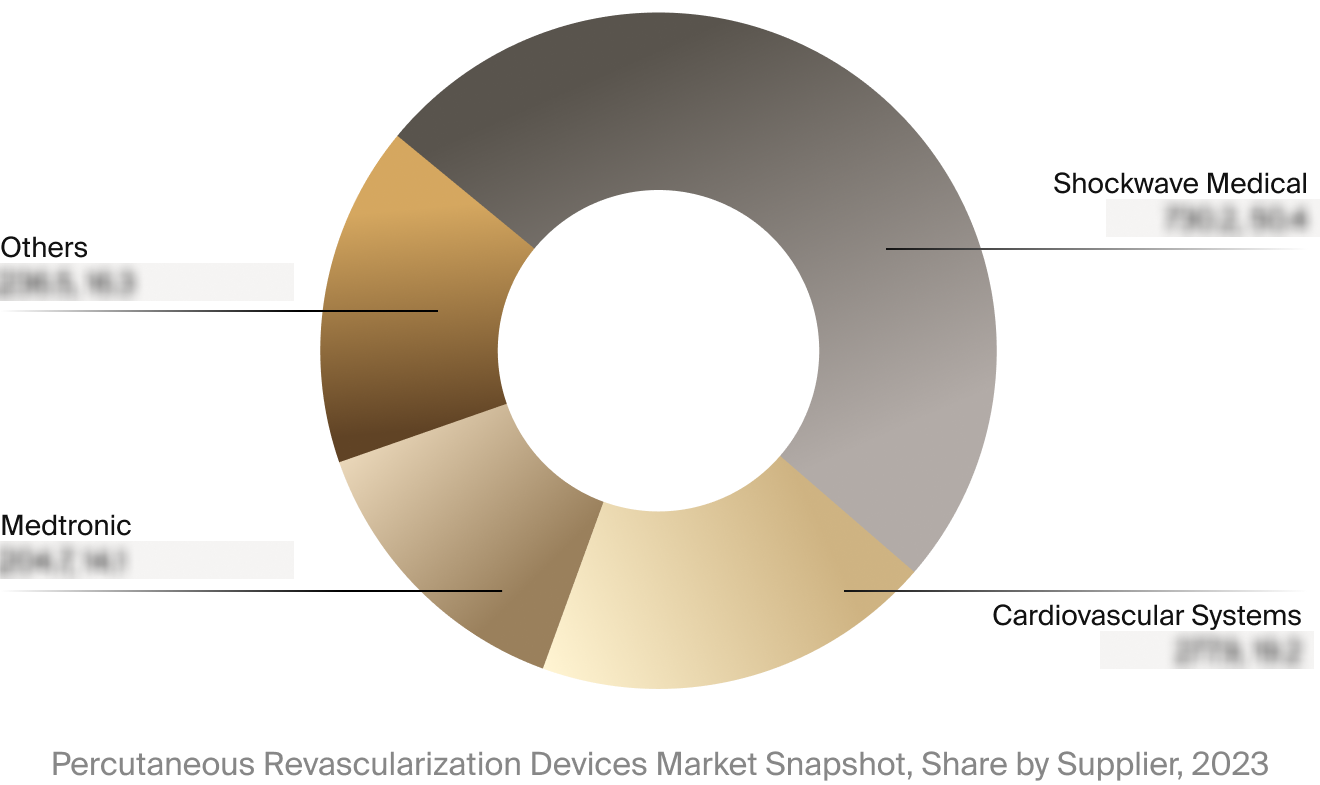

Competitive Landscape

The full Market Snapshot includes a robust analysis of the competitive landscape for the percutaneous

revascularization devices market. This includes estimated market revenue and market share for key players, such

as Shockwave Medical, Cardiovascular Systems, and Medtronic.

Select Market Events

| Company | Date | Type | Event |

|

Johnson & Johnson

|

5/2024 | M&A | J&J completed its acquisition of Shockwave Medical, the current market leader for atherectomy devices. |

Key Companies Covered

Amplitude Vascular Systems

Boston Scientific

Cardiovascular Systems

FastWave Medical

Johnson & Johnson

Rex Medical

Shockwave Medical

Sonosemi Medical

Vantis Vascular