Overview

Valued at ~$94.8 million in 2023, the oncology ablation catheters market is projected to reach

~$169.3 million by 2028, increasing at a CAGR of 12.3% over the 2023-2028

forecast period. This Market Snapshot is part of LSI’s Market Intelligence platform, your

one-stop-shop for global medtech market sizing and analysis, procedure volume data, startup company- and

deal-tracking, curated insights, and more.

Oncology ablation catheters are medical devices used to treat various types of cancer by selectively destroying

tumor tissue through energy delivery. Tumor ablation procedures commonly utilize radiofrequency (RF) energy,

which is transmitted from a generator via a needle-tipped electrode inserted percutaneously into the tumor

during an image-guided procedure. The tumor tissue absorbs the RF energy, causing localized heating that

destroys cancer cells. In addition to RF, other energy types such as cryogenic, ultrasonic, pulsed electric

field (PEF), and plasma are also used for tumor ablation. This analysis focuses on RF and microwave ablation

electrodes, excluding cryoablation

devices, which are covered in a separate report.

Products included within the scope of this analysis include:

RF and microwave ablation electrodes

This Market Snapshot is intended to provide a high-level overview of the global market for oncology ablation

catheters, with key insights into:

Unit volumes from 2023 to 2028

Market forecasts from 2023 to 2028

Market insights

Competitive landscape analysis of major competitors

Insights into key market events for strategic and startups

Oncology Ablation Catheters Market Snapshot Summary

| Snapshot Aspect | Data and Details |

| Base Year for Estimate | 2023 |

| Forecast Period | 2023 - 2028 |

| Market Size in 2023 | $94.8 million |

| CAGR | 12.3% |

| Projected Market Size in 2028 | $169.3 million |

Oncology Ablation Catheters Market Insights

The oncology ablation catheters market is experiencing robust growth, driven by the increasing adoption of

ablation technologies for treating both primary and metastatic tumors. As new technologies emerge and clinical

evidence supporting the efficacy of ablation as an alternative to surgery continues to grow, the demand for

treatments such as RF and microwave ablation, focused ultrasound, laser ablation, and irreversible

electroporation is rising. These technologies are increasingly used to treat solid tumors, with liver, kidney,

bone, prostate, lung, and certain types of brain cancer being the primary targets for ablation therapies.

The market is also driven by the increasing burden of cancer, with the incidence of liver, lung, kidney,

prostate, and brain cancers expected to rise steadily from 2022 to 2030. The worldwide incidence of these

cancers—combined with the growing preference for ablation procedures over traditional surgery—is fueling the

market’s expansion. Projected market growth for the 2023 to 2028 forecast period is significantly stronger than

the prior year’s analysis, reflecting a growing recognition of ablation therapies as an effective treatment

modality in oncology.

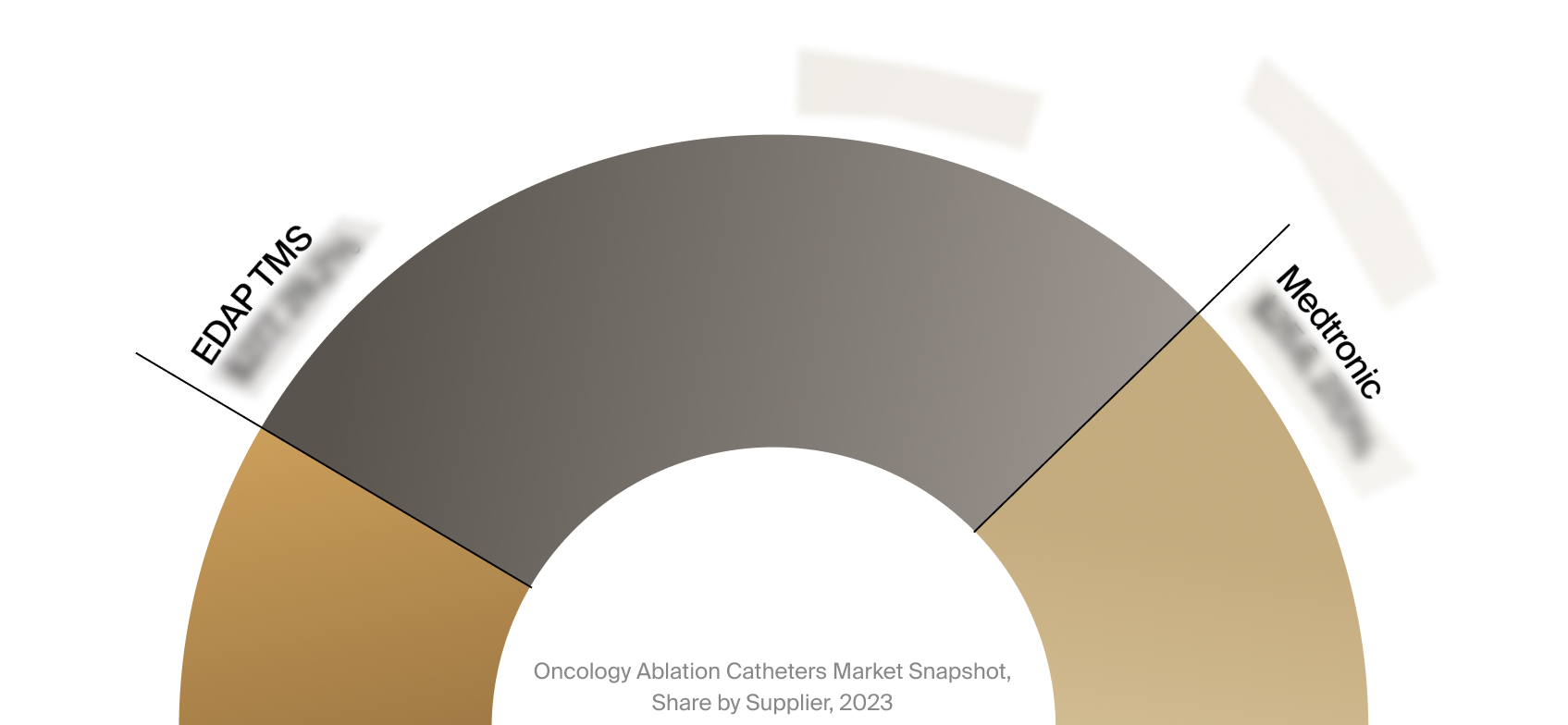

Competitive Landscape

The full Market Snapshot includes a robust analysis of the competitive landscape for the oncology ablation

catheters market. This includes estimated market revenue and market share for key players, such as Medtronic,

EDAP TMS, and AngioDynamics.

Select Market Events

| Company | Date | Type | Event |

|

EDAP TMS

|

7/2023 | Commercial Milestone | EDAP TMS announced that the company received reimbursement approval in Switzerland for its Focal One system for the treatment of prostate cancer. |

|

Medtronic

|

3/2024 | Regulatory Approval | Medtronic received U.S. FDA 510(k) clearance for its OsteoCool 2.0 bone tumor ablation system. |

Key Companies Covered

AngioDynamics

Baylis Medical Technologies

Canyon Medical

EDAP TMS

Galvanize Therapeutics

Innoblative

Medtronic

Mermaid Medical

Monteris

Sonoblate