Overview

Valued at ~$1.59 billion in 2023, the neurovascular devices for ischemic stroke market is

projected to reach ~$2.04 billion by 2028, increasing at a CAGR of 5.1% over

the 2023-2028 forecast period. This Market Snapshot is part of LSI’s Market Intelligence platform, your

one-stop-shop for global medtech market sizing and analysis, procedure volume data, startup company- and

deal-tracking, curated insights, and more.

An ischemic stroke occurs when blood flow to the brain is blocked by a clot or thrombus, preventing the brain

from receiving oxygen and nutrients. Other causes of ischemic stroke include stenosis and embolism.

Transcatheter devices are increasingly being utilized to treat and prevent ischemic stroke. These devices

complement tissue plasminogen activator (tPA), the gold standard for treating ischemic stroke, and other

thrombolytic drugs such as tenecteplase, reteplase, and streptokinase.

Products included within the scope of this analysis include:

Neurovascular microcatheters, guidewires, guide catheters, and sheaths

Neurovascular stents

Thrombectomy devices

Stent retrievers

Aspiration devices

This Market Snapshot is intended to provide a high-level overview of the global market for neurovascular devices

for ischemic stroke, with key insights into:

Unit volumes from 2023 to 2028

Market forecasts from 2023 to 2028

Market insights

Competitive landscape analysis of major competitors

Insights into key market events for strategic and startups

Neurovascular Devices for Ischemic Stroke Market Snapshot Summary

| Snapshot Aspect | Data and Details |

| Base Year for Estimate | 2023 |

| Forecast Period | 2023 - 2028 |

| Market Size in 2023 | $1.59 billion |

| CAGR | 5.1% |

| Projected Market Size in 2028 | $2.04 billion |

Neurovascular Devices for Ischemic Stroke Market Insights

The neurovascular devices market for ischemic stroke is growing rapidly, driven by the increasing incidence of

ischemic stroke, which accounts for approximately 62.3% of all strokes globally. Devices for treating or

preventing ischemic stroke—including carotid stents, neurovascular thrombectomy devices, and aspiration

devices—were introduced more recently than devices

for hemorrhagic stroke treatment and prevention, such as embolic coils.

Modalities such as carotid stenting are used both to treat patients who have suffered a stroke to prevent

recurrence and for stroke prevention by revascularization of stenotic cerebral vessels. Mechanical thrombectomy

devices are used to remove blood clots from cerebral vessels to restore blood flow. In addition to tPA

administration, mechanical thrombectomy is a recommended approach for the management of acute stroke,

particularly in large vessel occlusions that typically respond poorly to tPA.

Epidemiological factors are the primary driving force behind unit volume and market growth. For example, trends

in obesity, sedentary lifestyles, and smoking are increasing the at-risk population for ischemic stroke, fueling

the demand for neurovascular devices for ischemic stroke and contributing to overall market growth.

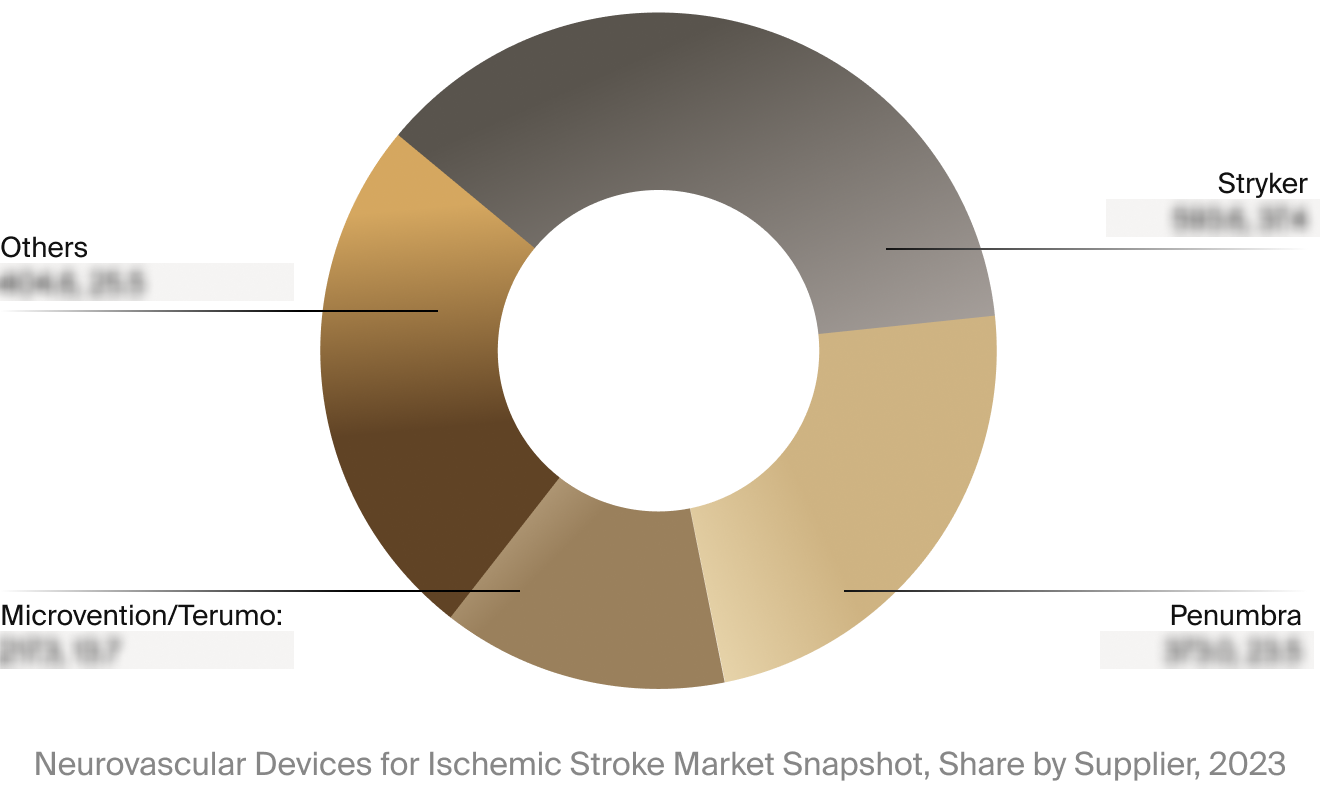

Competitive Landscape

The full Market Snapshot includes a robust analysis of the competitive landscape for the neurovascular devices

for ischemic stroke market. This includes estimated market revenue and market share for key players, such as

Stryker, Penumbra, and MicroVention/Terumo.

Select Market Events

| Company | Date | Type | Event |

|

MicroVention/Terumo

|

6/2032 | Product Launch | Microvention announced the U.S. commercial release of its ERIC Retrieval Device for treating ischemic stroke. |

|

Penumbra

|

6/2024 | Product Launch | Penumbra announced the European launch of its BMX81 and BMX96 for managing ischemic and hemorrhagic stroke. |

Key Companies Covered

Abbott

Cerenovus

Cordis

InNeuroCo

Johnson & Johnson

MicroPort Scientific

MicroVention

Penumbra

Rapid Medical

Stryker

Terumo