Overview

Valued at ~$247.2 million in 2023, the coronary angiography catheters and guidewires market is

projected to reach ~$268.7 million by 2028, increasing at a CAGR of 1.7% over

the 2023-2028 forecast period. This Market Snapshot is part of LSI’s Market Intelligence platform, your

one-stop-shop for global medtech market sizing and analysis, procedure volume data, startup company- and

deal-tracking, curated insights, and more.

Catheters and guidewires are essential devices used in coronary angiography, a minimally invasive procedure that

involves injecting a contrast agent into the coronary arteries to visualize blood flow and identify blockages or

narrowing of vessels. Catheters are thin, flexible tubes, while guidewires are thin, flexible wires. Together,

these devices are used to advance the catheter to a diseased vessel, where the contrast agent is delivered for

imaging with X-rays (i.e., fluoroscopy). These devices play a crucial role in many procedures, including

percutaneous coronary intervention (PCI) and coronary artery bypass grafting (CABG), to guide medical

instruments to the site of a blockage or diseased artery requiring treatment.

Products included within the scope of this analysis include:

Coronary angiography catheters

Coronary angiography guidewires

This Market Snapshot is intended to provide a high-level overview of the global market for coronary angiography

catheters and guidewires, with key insights into:

Unit volumes from 2023 to 2028

Market forecasts from 2023 to 2028

Market insights

Competitive landscape analysis of major competitors

Insights into key market events for strategic and startups

Coronary Angiography Catheters and Guidewires Market Snapshot Summary

| Snapshot Aspect | Data and Details |

| Base Year for Estimate | 2023 |

| Forecast Period | 2023 - 2028 |

| Market Size in 2023 | $247.2 million |

| CAGR | 1.7% |

| Projected Market Size in 2028 | $268.7 million |

Coronary Angiography Catheters and Guidewires Market Insights

The coronary angiography catheters and guidewires market is projected to grow at a modest CAGR of 1.7% during

the forecast period. While the utilization of stand-alone coronary angiography is declining due to the

increasing adoption of non-invasive imaging techniques such as contrast-enhanced CT angiography, recent studies

suggest that CT angiography offers comparable accuracy to invasive angiography, with the added benefit of a

significantly lower radiation dose. This shift in preference is impacting market dynamics, but price increases

are expected to offset the decline in unit volume, driven by the broader trend of rising prices across the

medical device market.

Although the overall unit volume is projected to decline at a slower rate than in previous years, the dollar

volume market is still expected to see a gradual increase, primarily due to price inflation. There is also

growing interest in developing radiation-free alternatives to traditional angiography, which is expected to

shape the market’s future as more cost-effective, non-invasive solutions gain traction.

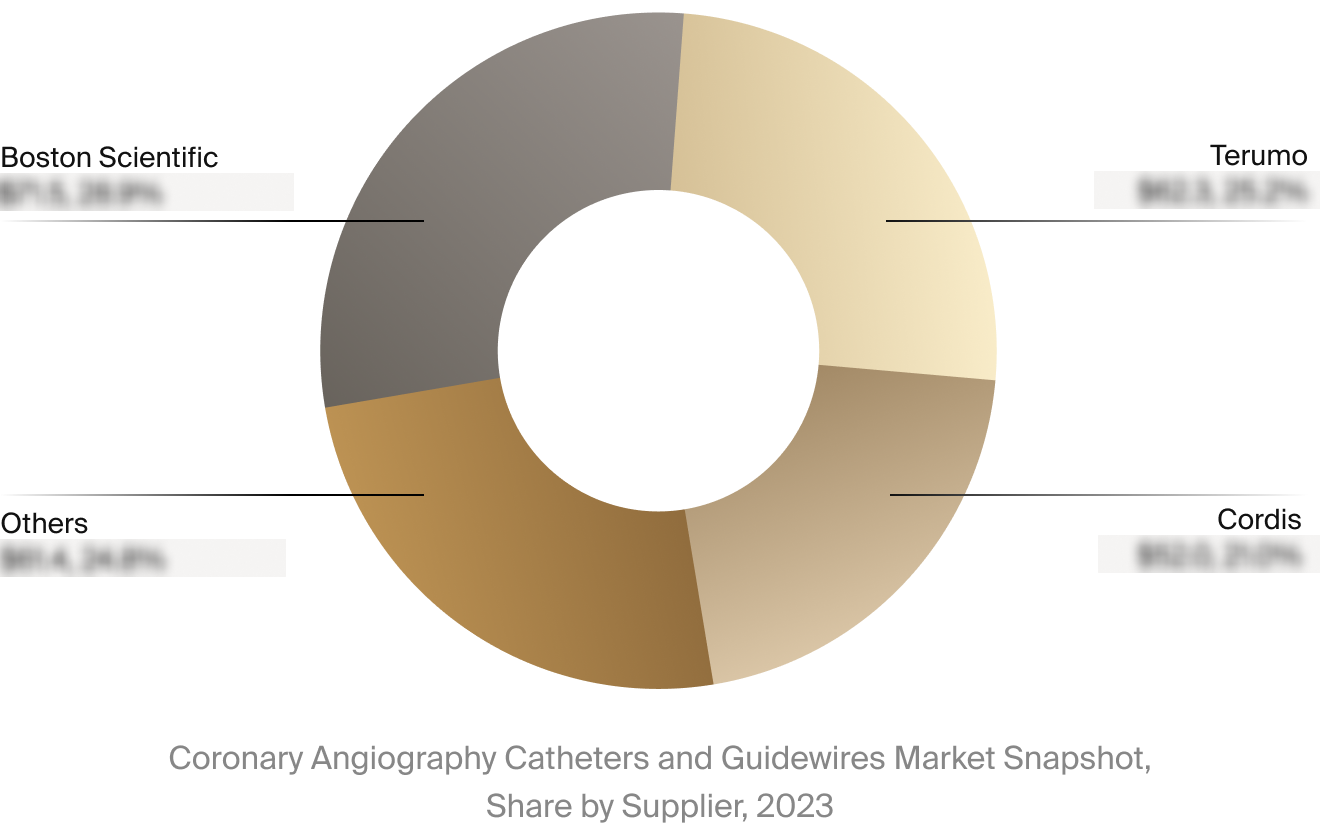

Competitive Landscape

The full Market Snapshot includes a robust analysis of the competitive landscape for the coronary angiography

catheters and guidewires market. This includes estimated market revenue and market share for key players, such

as Boston Scientific, Terumo, and Cordis.

Select Market Events

| Company | Date | Type | Event |

|

Boston Scientific

|

5/2024 | Product Recall | Boston Scientific recalled more than 1 million angiographic catheters due to issues with the advancement of the guidewire through the device. |

|

Vantis Vascular

|

12/2024 | Fundraising | Vantis Vascular announced that the company closed a $10 million Series B-1 round. |

Key Companies Covered

Abbott

AngioDynamics

B. Braun

Boston Scientific

Cook Medical

Cordis

Medtronic

Merit Medical

MicroPort Scientific

Philips

Teleflex

Vantis Vascular