Overview

Valued at ~$360.0 million in 2023, the benign prostatic hyperplasia (BPH) implants market is

projected to reach ~$532.2 million by 2028, increasing at a CAGR of 8.1% over

the 2023-2028 forecast period. This Market Snapshot is part of LSI’s Market Intelligence platform, your

one-stop-shop for global medtech market sizing and analysis, procedure volume data, startup company- and

deal-tracking, curated insights, and more.

BPH implants are an alternative therapy for the relief of symptoms associated with BPH in men, such as

incomplete voiding, urinary frequency, urgency, weak urinary stream, difficulty urinating, and sleep disruption.

BPH Implants are delivered via minimally invasive techniques through the urethra to mechanically expand and

retain the prostate tissue surrounding the urethra and reduce obstruction.

Products included within the scope of this analysis include:

Temporary and permanent implants placed via the urethra

This Market Snapshot is intended to provide a high-level overview of the global market for BPH implants, with

key insights into:

Unit volumes from 2023 to 2028

Market forecasts from 2023 to 2028

Market insights

Competitive landscape analysis of major competitors

Insights into key market events for strategic and startups

Benign Prostatic Hyperplasia Implants Market Snapshot Summary

| Snapshot Aspect | Data and Details |

| Base Year for Estimate | 2023 |

| Forecast Period | 2023 - 2028 |

| Market Size in 2023 | $360.0 million |

| CAGR | 8.1% |

| Projected Market Size in 2028 | $532.2 million |

Benign Prostatic Hyperplasia Implants Market Insights

The BPH implants market is poised for strong growth, driven by the increasing number of men worldwide suffering

from an enlarged prostate, with over 500 million affected. However, only a small percentage (about 0.2%) of

these men undergo surgical treatments for BPH each year, highlighting a significant opportunity for minimally

invasive procedures. Competitors in the interventional urology

market estimate that the Total Addressable Market (TAM) for BPH implants exceeds $1.5 billion.

While BPH implants face competition from alternative therapies such as holmium laser ablation (HoLEP),

transurethral prostatectomy (TURP), and water vaporization (e.g., Rezūm), they remain a popular choice due to

their simplicity and the reversibility of the procedure. Market growth in the latter part of the forecast period

is expected to be fueled by the entry of new suppliers alongside established players like Neotract/Teleflex,

Medi-Tate/Olympus, and Butterfly Medical, making the BPH implant market increasingly competitive and dynamic.

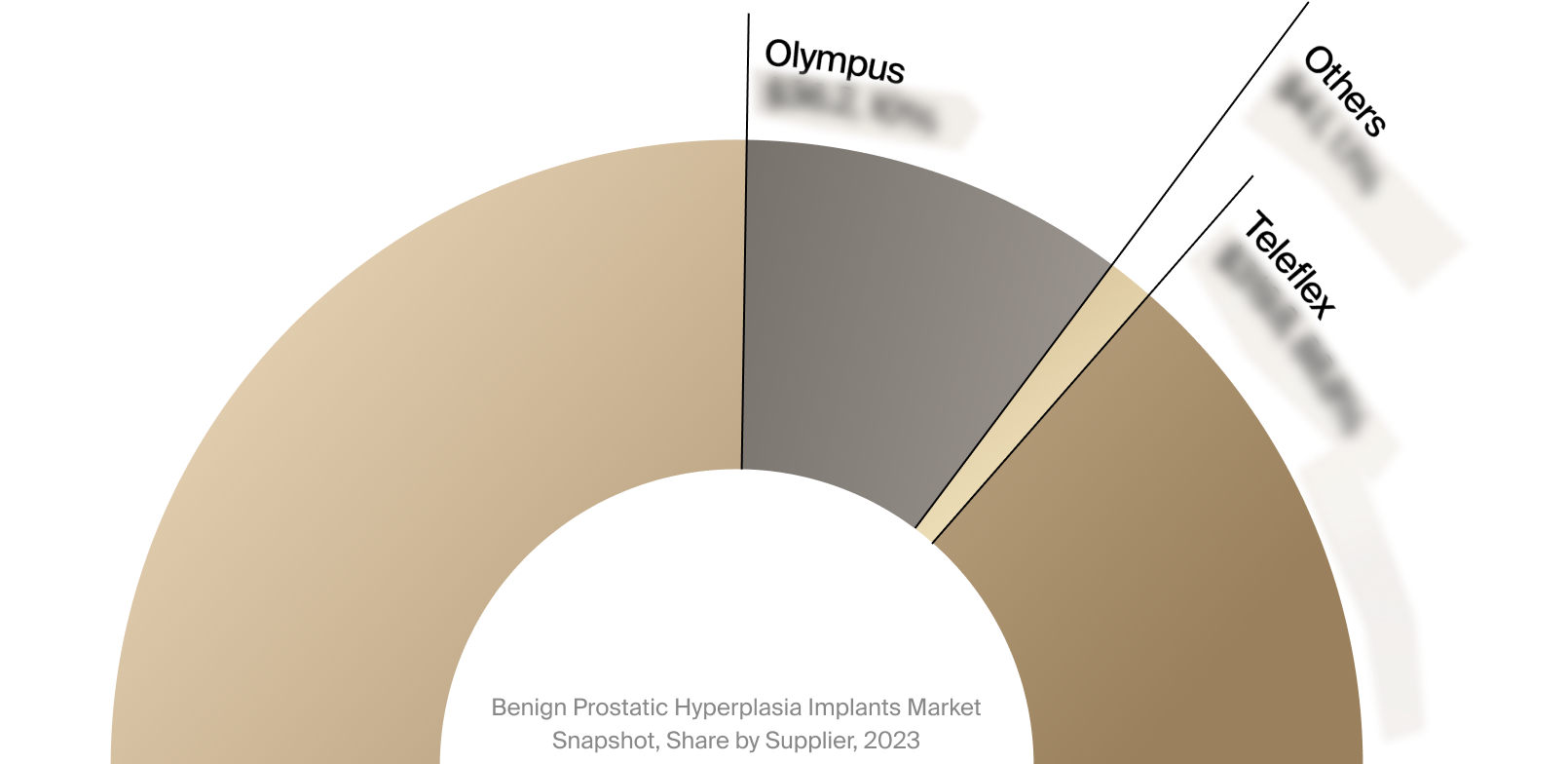

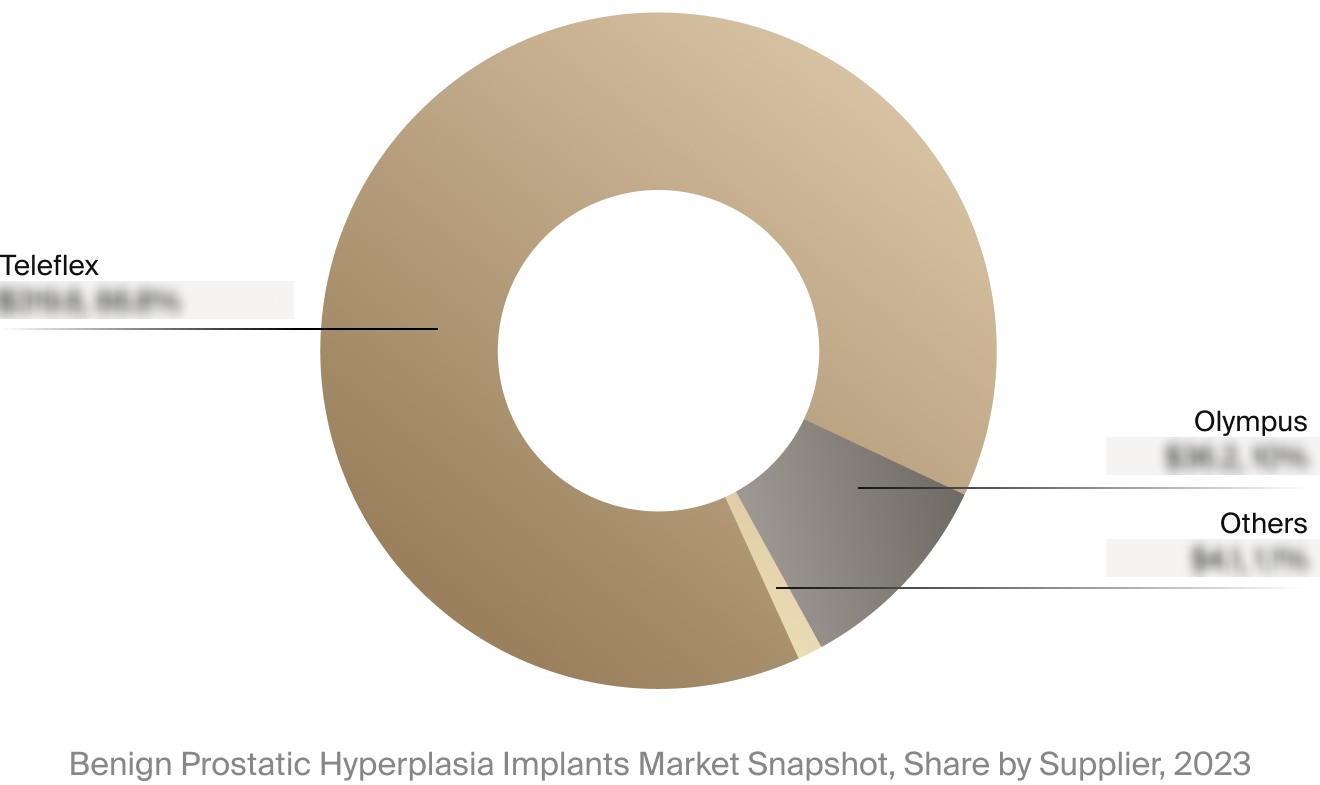

Competitive Landscape

The full Market Snapshot includes a robust analysis of the competitive landscape for the benign prostatic

hyperplasia implants market. This includes estimated market revenue and market share for key players, such as

Teleflex and Olympus.

Select Market Events

| Company | Date | Type | Event |

|

Olympus

|

3/2024 | Commercial Milestone | Olympus announced that the iTind BPH treatment device is now available on 13 GPO contracts in the United States. |

|

Teleflex

|

4/2024 | Commercial Launch | Teleflex announced the upcoming market release for its next-generation Urolift 2 implant, an FDA-cleared platform for treating BPH in all prostate types. |

Key Companies Covered

Butterfly Medical

Endotherapeutics

Olympus

ProArc Medical

ProVerum

Teleflex

Zenflow