Overview

Valued at ~$1.56 billion in 2023, the aortic stent grafts market is projected to reach

~$1.69 billion by 2028, increasing at a CAGR of 1.5% over the 2023-2028

forecast period. This Market Snapshot is part of LSI’s Market Intelligence platform, your

one-stop-shop for global medtech market sizing and analysis, procedure volume data, startup company- and

deal-tracking, curated insights, and more.

Aortic aneurysms occur when a weakening in the wall of the aorta gradually expands, potentially leading to

rupture or dissection. These aneurysms can develop anywhere along the aorta and are classified as either

thoracic aortic aneurysms (TAA) in the chest or abdominal aortic aneurysms (AAA) in the abdomen, with AAA being

the more common type. Treatment for aortic aneurysms is typically prophylactic, as the risk of mortality

increases significantly once an aneurysm ruptures. The primary repair method involves implanting a mesh graft to

prevent rupture, which can be done either through a surgical (i.e., open) or transcatheter (endovascular)

approach.

Products included within the scope of this analysis include:

Stent grafts for the surgical and transcatheter repair of AAA and TAA

This Market Snapshot is intended to provide a high-level overview of the global market for aortic stent grafts,

with key insights into:

Unit volumes from 2023 to 2028

Market forecasts from 2023 to 2028

Market insights

Competitive landscape analysis of major competitors

Insights into key market events for strategic and startups

Aortic Stent Grafts Market Snapshot Summary

| Snapshot Aspect | Data and Details |

| Base Year for Estimate | 2023 |

| Forecast Period | 2023 - 2028 |

| Market Size in 2023 | $1.56 billion |

| CAGR | 1.5% |

| Projected Market Size in 2028 | $1.69 billion |

Aortic Stent Grafts Market Insights

The aortic stent grafts market is projected to grow at a modest 1.5% CAGR over the forecast period. While

inflationary pressures are supporting market growth, the average selling price of aortic stent grafts is

expected to decline during this same period due to increasing competitive pricing, which could limit overall

market expansion. The decline in procedure volumes for aortic aneurysm repair, including both endovascular and

open repair, that occurred between 2017 and 2020 stabilized in 2021. The market entered a growth phase in 2022,

with growth expected to continue through 2028, primarily driven by an increase in the global 55+ population,

which is expected to grow by 2.6% annually.

Technological advancements in device design, such as improved methods for repairing endoleaks and smaller device

profiles, have helped mitigate the impact of declining procedure volumes. Transcatheter techniques now account

for 93-94% of total procedures in the United States, reflecting their increasing dominance. However, the market

may face long-term challenges from emerging treatments that utilize targeted drug delivery technologies,

potentially reducing the need for traditional surgical interventions.

Competitive Landscape

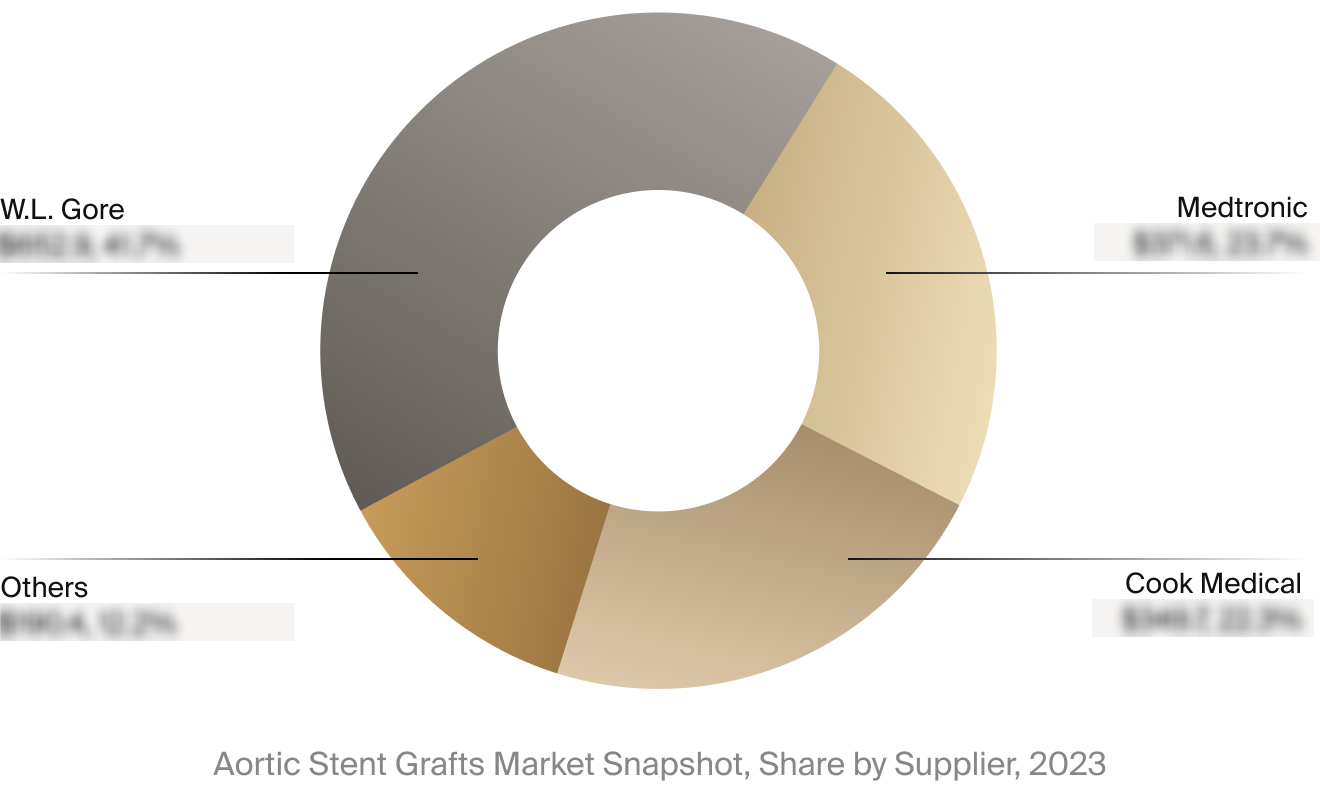

The full Market Snapshot includes a robust analysis of the competitive landscape for the aortic stent grafts

market. This includes estimated market revenue and market share for key players, such as W. L. Gore, Medtronic,

and Cook Medical.

Select Market Events

| Company | Date | Type | Event |

|

W. L. Gore

|

1/2024 | Regulatory Approval | W. L. Gore announced that the company received U.S. FDA approval for its GORE EXCLUDER Thoracoabdominal Branch Endoprosthesis (TAMBE) device for the treatment of aneurysmal disease involving the visceral aorta. |

|

Cook Medical

|

1/2024 | Clinical Milestone | Cook Medical announced the first clinical patient implant of its ZENITH FENESTRATED+ Endovascular Graft (ZFEN+) in the United States. |

Key Companies Covered

Cook Medical

Cordis

Endospan

Lombard Medical

Medtronic

MicroPort Scientific

Terumo

W.L. Gore