As 2025 enters its final stretch, the latest data reveal a nuanced picture for medtech fundraising. The third quarter showed signs of a slowdown in deal volume but not in capital resilience. Amid macroeconomic uncertainty and investor caution, the medtech sector continued to outperform many other segments within healthcare and life sciences, maintaining steady momentum across financing activity.

LSI’s proprietary Compass platform, which tracks deal flow across the global medtech ecosystem, provides a clear snapshot of how capital flowed this quarter, and where it’s heading next.

A Look at the Numbers

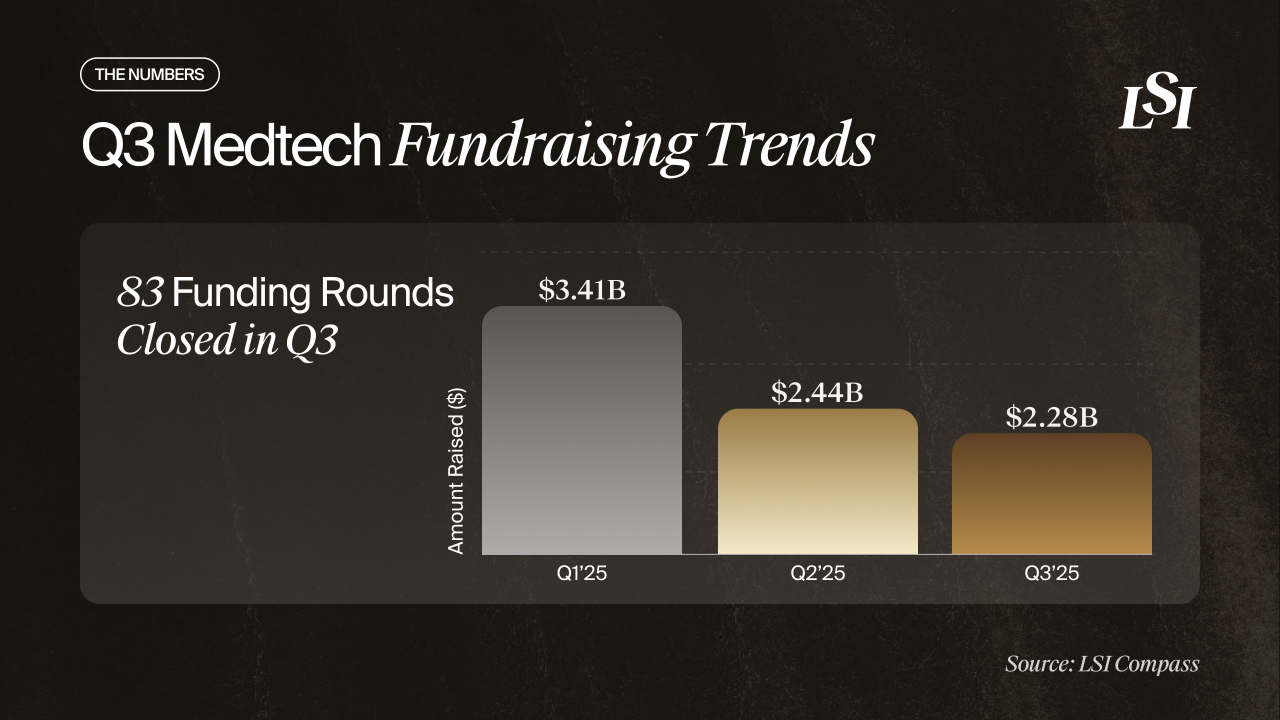

Total capital raised in Q3 reached approximately $2.28 billion, excluding M&A and IPO transactions. When those categories are included, total financing for the quarter climbs to $8.8 billion.

While the capital raised remains strong, deal activity dipped noticeably. The number of funding rounds (excluding M&A) fell 39.4% from Q2 to Q3, indicating investors may be shifting strategies.

Here’s how dealmaking compared across the first three quarters of 2025:

- Q1: $3.41 billion raised across 142 deals

- Q2: $2.44 billion across 137 deals

- Q3: $2.28 billion across just 83 deals

That decline in volume suggests investors concentrated capital into fewer, higher-conviction bets: a trend mirrored across other innovation sectors, particularly those influenced by the AI funding surge.

Why Deal Volume Dropped But Funding Held Steady

Several macro factors likely contributed to the reduction in overall deal count:

- Front-loaded investments earlier in the year

- Uncertainty surrounding interest rates and the U.S. government shutdown

- Portfolio managers reserving capital for follow-on investments in existing companies

Yet despite these pressures, total fundraising levels remained steady. The data reveal that later-stage medtech companies attracted the lion’s share of investment, while early-stage rounds declined sharply.

Capital Concentration and Market Behavior

The clearest signal from Q3 is investor selectivity. Rather than spreading risk across many early-stage ventures, funds are prioritizing companies with regulatory traction, solid clinical data, or proven commercial models.

From Q2 to Q3:

- Later-stage funding increased by 31%

- Early-stage (Seed and Series A) funding declined by 65%

- Average deal size grew by 30%, from $23.4 million to $30.4 million

Deal activity started strong in July before slowing significantly in August and September, reflecting broader market hesitancy. However, the size and structure of these rounds suggest that investors remain confident in high-quality assets nearing commercialization or revenue generation.

Key Themes in Q3 Medtech Fundraising

A deeper look at LSI’s Compass data highlights several trends shaping the landscape:

- Fewer Deals, Bigger Checks: Venture investors continue to deploy large sums into companies they perceive as low-risk or de-risked. These include firms with robust data packages, FDA approvals, or near-term market launches.

- Stability in M&A but Smaller Deal Sizes: M&A activity stayed relatively steady through Q3, but the average transaction value fell 54%. This likely reflects more disciplined valuations and an emphasis on smaller, bolt-on acquisitions rather than blockbuster deals.

- Sector Leadership in Cardiovascular and Robotics: Cardiovascular technologies and surgical robotics again dominated funding, highlighting continued investor confidence in these innovation clusters.

Category Highlights: Q3’s Standout Companies

Cardiovascular Innovations Lead the Way

Heart-focused companies once again topped the funding leaderboard:

Notable Rounds | Cardiovascular Devices |

|

|

Company |

Funding Amount |

|

Reprieve Cardiovascular |

$61,000,000 |

|

InspireMD |

$58,000,000 |

|

CroíValve |

$14,700,000 |

|

Berlin Heals |

$5,000,000 |

These companies reflect capital flowing into areas addressing heart failure, arrhythmias, and structural heart disease, indications that continue to drive medtech innovation and investor interest.

Robotics Maintains Its Momentum

Surgical robotics remained a focal point for capital, with both new entrants and maturing players raising funds to advance their platforms.

Notable Rounds | Surgical Robotics |

|

|

Company |

Funding Amount |

|

Ronovo Surgical |

$67,000,000 |

|

EndoQuest Robotics |

Undisclosed amount |

|

AiM Medical Robotics |

$8,100,000 |

Additional Noteworthy Fundraises

- Kardium raised $250 million for its mapping and ablation platform for atrial fibrillation, a space dominated by major strategics such as Biosense Webster, Boston Scientific, Medtronic, and Abbott.

- ViCentra closed an $85 million Series D to expand manufacturing and launch next-generation versions of its Kaleido insulin delivery system. The company is also preparing a bridge round to meet strong demand in Western Europe.

- Scanvio Medical raised $3.4 million in seed funding for its AI-guided ultrasound software for diagnosing endometriosis, which could dramatically reduce the need for invasive laparoscopy and accelerate diagnosis timelines for millions of women.

These companies represent a cross-section of what investors are valuing most: scalability, validated technology, and clear clinical differentiation.

What the Data Suggests for Q4 and Beyond

The third quarter of 2025 might have marked a cooling in deal activity, but not in confidence. The fundamentals remain strong, and early Q4 signals suggest continued investor appetite for growth-stage medtech assets.

Capital continues to favor companies with demonstrated performance and defensible market positions.

In aggregate, Q3 paints a picture of a healthy, evolving market, one that rewards quality and operational excellence over quantity.

17011 Beach Blvd, Suite 500 Huntington Beach, CA 92647

714-847-3540© 2026 Life Science Intelligence, Inc., All Rights Reserved. | Privacy Policy