Every week, LSI’s Market Intelligence team dives into a different topic shaping the future of medical technology. From disruptive startups to fast-growing device segments, we connect the dots between clinical demand, market dynamics, and innovation pipelines. Here’s what the LSI Market Intelligence team tracked this past month across electrophysiology (EP), transcatheter mitral valve replacement (TMVR), and the U.S. and APAC medtech markets.

Rewiring the Rhythm: Breakthroughs in Electrophysiology

Heart rhythm disorder management is entering a new era. Once dominated by basic monitoring tools like the surface ECG, EP now encompasses a robust ecosystem of AI-powered diagnostics, leadless pacemakers, non-invasive ablation technologies, and real-time navigation software.

Today, over 1.5 million pacemaker implantation procedures and 1.4 million cardiac ablation procedures are performed annually. Demand is growing, driven by technological refinement, an aging global population, and rising awareness of arrhythmias like atrial fibrillation (AFib).

Disruptive Players Redefining EP

AccurKardia

- CEO: Juan Jimenez

- Stage: Seed

- Raise to date: $3.2M

- Innovation: AI-driven ECG analytics for 13 heart rhythm disorders

- Potential Impact: Reduces time to diagnosis and supports both remote and ambulatory patient monitoring

CAIRDAC

- CEO: Edouard Fonck

- Stage: Series A

- Raise to date: ~$18.5M

- Innovation: A leadless, self-sustainable pacemaker powered by the heart’s own kinetic energy

- Potential Impact: Improves the device’s efficiency and durability

CardiaCare

- CEO: Amir Soltanianzadeh

- Stage: Series A

- Raise to date: $4.5M

- Innovation: Non-invasive neuromodulation wearable targeting the median-vagus axis

- Potential Impact: Offers a personalized therapy for reducing AFib burden and symptoms in a market of more than 60 million patients. (Also see LSI Alumni Innovator Spotlight: CardiaCare CEO Amir Soltanianzadeh, The Lens, February 2025.)

EBAMed

- CEO: Marina Izzo

- Stage: Series A

- Raise to date: ~$22.0M

- Innovation: Non-invasive arrhythmia ablation using synchronized ultrasound and proton beam therapy

- Potential Impact: Eliminates catheterization, potentially broadening access to arrhythmia care

Volta Medical

- CEO: Théophile Mohr Durdez

- Stage: Series B

- Raise to date: ~$69.0M

- Innovation: AI-powered mapping software compatible with most EP systems

- Potential Impact: Improves precision during ablation procedures

According to LSI Market Intelligence, the global mapping and ablation consoles and catheters market is already worth $6.5 billion and growing at a 9.3% CAGR, outpacing most of medtech. The convergence of non-invasive technology, intelligent software, and growing clinical need is fueling a wave of innovation across the EP space.

Opening the Valve: TMVR Moves to the Main Stage

The TMVR market has reached an inflection point. With CE Mark approval for Edwards Lifesciences’ SAPIEN M3, a transfemoral replacement system for moderate-to-severe or severe mitral regurgitation, the field is finally seeing a commercially viable, minimally invasive TMVR solution.

This is more than a product milestone. It represents a turning point for the entire structural heart landscape.

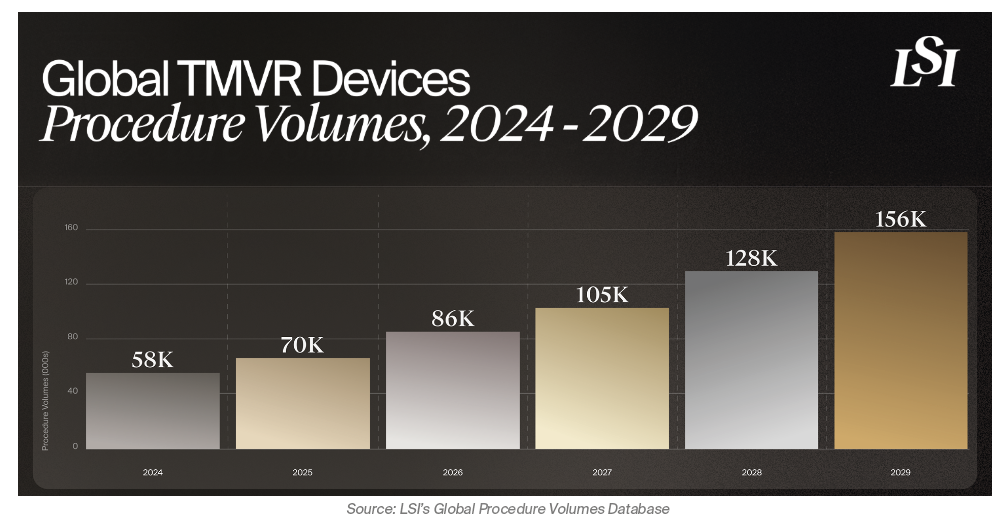

TMVR by the Numbers

- Global Procedure Volumes: From 58,000 in 2024 to 128,000 by 2028 (22% CAGR)

- Market Value: From $1.65B in 2024 to $5.47B by 2029 (27.0% CAGR)

- Clinical Demand: Over 24 million people globally suffer from mitral valve disease; a majority remain untreated or ineligible for surgery.

If the trajectory of aortic valve replacement (TAVR) is any indication—growing from high-risk to broad indications in under a decade—the TMVR market may see even faster expansion.

Companies to Watch

Edwards Lifesciences is forecasting $2 billion in sales from its transcatheter mitral and tricuspid therapies segment by 2030. Meanwhile, Abbott retains a dominant 75% share of the mitral repair and replacement market. However, with over three dozen companies developing TMVR solutions according to LSI’s Compass, competitive dynamics are intensifying.

Capstan Medical

- CEO: Maggie Nixon

- Stage: Series C

- Latest Raise: $110M

- Solution: Catheter-based surgical robot to deliver heart valve implants for the repair and replacement of diseased heart valves

Tioga Cardiovascular

- CEO: Mike Dineen

- Stage: Later stage

- Currently Raising: $40M

- Solution: Transcatheter valve replacement experience that is procedurally simpler and less invasive than the current mitral or tricuspid approaches

InnovHeart

- CEO: David Wilson

- Stage: Series C

- Currently Raising: $17.6M

- Solution: Saturn trans-septal TMVR System addressing many challenges, such as left ventricular outflow tract (LVOT) obstruction and annular size and shape, identified by other companies in early feasibility studies focused on addressing MR

Sutra Medical

- CEO: Wei Sun

- Stage: Series A

- Currently Raising: $8M

- Solution: Minimally invasive solution for treating MR, featuring a posterior leaflet replacement designed to coapt with the native anterior mitral leaflet, effectively eliminating MR while maintaining a minimal footprint in the heart

Surgical Surge: What’s Powering U.S. Procedure Growth

In the world’s largest medtech market, accounting for more than 45% of global medtech revenue, the numbers reveal a different narrative than the headlines—one of quiet strength and consistent growth. While macroeconomic pressure and policy changes dominate media coverage, surgical procedure volumes in the U.S. continue to trend upward.

U.S. Procedure Volume Trends

- 2024 Actuals: Revised up from 92.3M to 95.7M

- 2025 Forecast: 97.8M procedures

- 100M Milestone: Expected as early as 2026

High-Growth Procedure Categories

The top three procedure categories by volume in the U.S. are:

- Aesthetic, Dermatological, and Plastic Surgery

- General Surgery

- Urological Procedures

A closer look at high-growth individual procedures from 2024–2029 highlights the broader strength of the U.S. market:

- Extracranial Radiotherapy (excl. lung/spine): 17.3%

- Shoulder Replacement: 11.5%

- Aortic Valve Repair: 10.4%

- Ischemic Stroke Mechanical Thrombectomy: 10.0%

- Nephrectomy: 6.0%

Key Drivers of Procedure Growth

This acceleration is being driven by shifts in clinical demand and structural changes across care delivery, particularly the rise of Ambulatory Surgical Centers (ASCs). ASCs enable faster, lower-cost care and are accelerating demand for devices that are compact, interoperable, and cost-effective. (Also see Market Dive: Orthopedic Surgery, The Lens, December 2024.)

Strategic Implications

- AI integration is helping clinicians stratify patients more accurately, reducing unnecessary interventions.

- The U.S. remains a first-choice market for medtech innovation, given faster commercialization timelines, ASC-friendly design, and payor alignment.

- In contrast, Europe’s MDR environment and fragmented reimbursement landscape continue to delay the adoption of novel technologies.

As Intuitive CEO Gary Guthart reminded the audience during his keynote at LSI USA ’25, “What I know is that next year people will need surgery, and I know the year after that people will need surgery, and I know that five years from now they’ll need surgery … that means that we’ll get through the turbulence.” The need is constant—and the data supports the demand. (Read more about Guthart’s insightful perspective in our April 2025 cover story, “The Rich and Bold Future of Intuitive: Inside Gary Guthart’s Vision for Robotics and Healthcare.”)

APAC in Focus

For many companies, particularly those based in the U.S., the Asia-Pacific (APAC) region is now the second-most important commercialization priority after the domestic market. With over 4.5 billion people, rapidly expanding healthcare systems, and increasing regulatory clarity in key nations, APAC is no longer a future opportunity—it’s a current imperative.

Regional Market Metrics

- Medtech Revenue (2024): $143.6B

- Global Share: 22.9%

- CAGR (2024–2029): 8.4% vs. global medtech market of 6.6%

- Surgical Procedure Volumes (2024): 212.6M

- Procedure CAGR (2024–2029): 4.8%

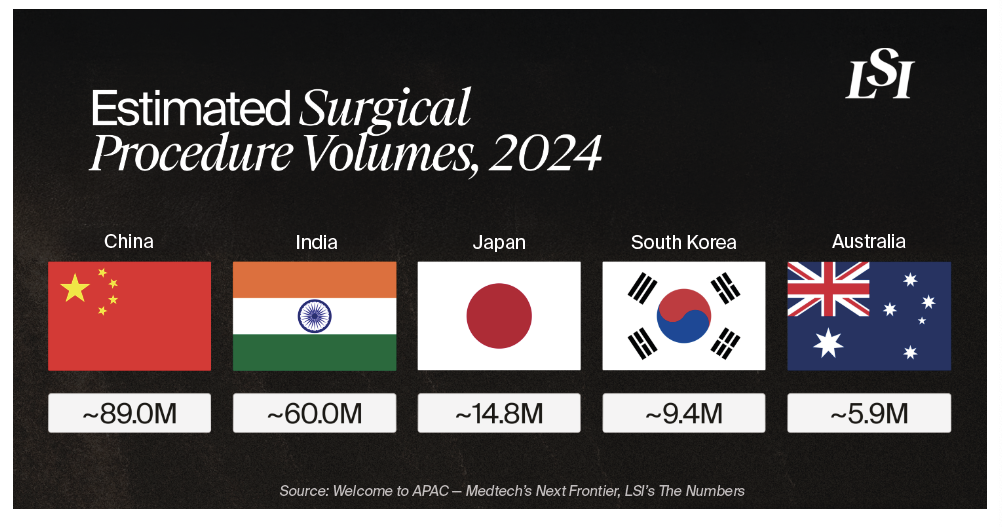

Country-by-Country Breakdown

China

- Population: ~1.4B

- Estimated Procedure Volumes (2024): ~89.0M

- Market Characteristics: APAC’s largest medtech market, driven by government-backed innovation, rapid healthcare infrastructure development, and a growing middle class. Domestic giants like Mindray and MicroPort are gaining international traction.

- Market Access Difficulty: Challenging. Stringent localization requirements, complex regulatory hurdles, and a strong preference for domestic suppliers can limit opportunities for Western firms.

Japan

- Population: ~125M

- Estimated Procedure Volumes (2024): ~14.8M

- Market Characteristics: A highly developed market with global influence in diagnostic imaging. Companies like Olympus and Terumo maintain leadership positions.

- Market Access Difficulty: Moderate. Japan’s PMDA regulatory process is strict but transparent, offering a reliable path to entry for companies that meet its standards.

India

- Population: ~1.4B

- Estimated Procedure Volumes (2024): ~60.0M

- Market Characteristics: A high-growth market with increasing healthcare investment. Historically reliant on imports, India is now building domestic medtech capacity through its “Make in India” initiative.

- Market Access Difficulty: Moderate to challenging. Pricing controls, complex approval processes, and domestic manufacturing preferences present hurdles for Western firms.

South Korea

- Population: ~52M

- Estimated Procedure Volumes (2024): ~9.4M

- Market Characteristics: An emerging powerhouse in digital health, biotech, and advanced diagnostics, with major players like Samsung expanding into medtech.

- Market Access Difficulty: Moderate. The country has a well-structured regulatory system, the Ministry of Food and Drug Safety (MFDS), but pricing pressures and cost sensitivity can impact market entry and growth.

Australia

- Population: ~26M

- Estimated Procedure Volumes (2024): ~5.9M

- Market Characteristics: A high-income, innovation-driven market with robust demand for cutting-edge medical technologies.

- Market Access Difficulty: Easier relative to China and India. Australia’s Therapeutic Goods Administration (TGA) is globally respected and closely aligned with the FDA and the EU MDR, simplifying cross-market strategies.

Southeast Asia (ASEAN)

- Population: ~675M

- Market Characteristics: Includes a range of markets at different stages of healthcare development. Countries like Thailand, Malaysia, and Indonesia are seeing rapid adoption of both local and imported medtech solutions.

- Market Access Difficulty: Highly variable. Singapore offers one of the most streamlined and innovation-friendly environments, while others, such as Indonesia, present more complex regulatory and importation challenges.

Western companies exploring APAC must understand that market access strategies are not one-size-fits-all. From localized manufacturing to public-private R&D collaborations, success in the region depends on tailoring technology and commercialization to local needs.

17011 Beach Blvd, Suite 500 Huntington Beach, CA 92647

714-847-3540© 2026 Life Science Intelligence, Inc., All Rights Reserved. | Privacy Policy