Atrial septal occlusion devices are used to close abnormal holes between the upper chambers of the heart and remain a core intervention in congenital cardiology. Driven by a stable rate of atrial septal defects (ASDs) per birth and evolving closure device technology, the ASD occluder market is experiencing steady growth.

A Market Shaped by Congenital Trends and Technology Adoption

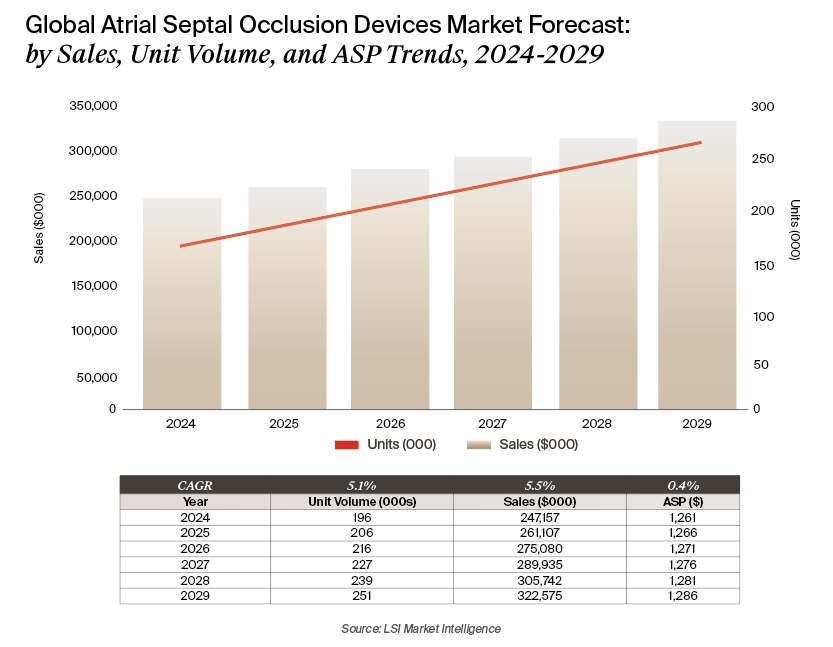

The global ASD closure device market, excluding patent foramen ovale (PFO) indications, is projected to grow at a compound annual growth rate (CAGR) of 5.5% from 2024 through 2029. This reflects an increase from the 4.6% forecast in the prior year. Global unit volumes and procedures are expected to rise at a 5.1% CAGR over the same period, also up from last year’s 4.0% estimate. The upward revision is due in part to the introduction of new devices and broadening procedural eligibility.

ASDs occur in approximately six to 10 per 10,000 live births, a rate that has remained consistent over time. While global birth rates are declining slightly, the rate of population growth continues to drive the overall addressable patient base. Advances in device technology and procedural imaging are expanding the population eligible for minimally invasive closure procedures. Transcatheter ASD closure has become the preferred standard of care for many patients, replacing more invasive surgical options with shorter recovery times and reduced risk.

FDA approvals in recent years have played a significant role in shaping market dynamics. Both Abbott’s Amplatzer and W.L. Gore’s Cardioform occluders are approved for PFO and ASD closure, while Occlutech’s device recently entered the U.S. market with a differentiated design. These approvals are catalyzing market expansion by offering clinicians more options tailored to patient anatomy.

Regulatory Milestones and Commercial Momentum

Occlutech’s December 2023 FDA approval marked a major turning point in the ASD occluder landscape. The company’s soft, self-centering occluder has been widely adopted internationally, with commercial U.S. procedures beginning in August 2024 at several leading cardiac centers.

Occlutech’s ASD occluder is designed to adapt to a wide range of anatomies, with a flexible delivery system and strong closure performance. Early procedural data in the U.S. suggests low complication rates and excellent technical success. A full commercial rollout is planned for September 2025 at the Pediatric and Congenital Interventional Cardiovascular Society (PICS) Annual Symposium.

New Frontiers in Bioresorbable Occlusion

atHeart Medical is taking ASD occlusion one step further with a metal-free, bioresorbable design. Its reSept ASD Occluder uses two fabric disks connected by synthetic filaments that dissolve over time. The potential benefits include a more leveled and potentially re-crossable septum.

The ongoing ASCENT ASD study spans more than 20 hospitals across North America and Europe. The company has already implanted its device in over 100 patients and reports successful procedures with favorable safety profiles. In December 2024, the study expanded to a fifth hospital in France, Centre Hospitalier Universitaire de Lille, where clinicians reported straightforward implantations and positive early outcomes.

Long-Term Data from Established Players

W.L. Gore remains a key player in the ASD occlusion devices market and recently published three-year outcomes from the ASSURED study in JACC: Cardiovascular Interventions. The data demonstrated 100% closure success at 36 months among the evaluated patients, with a low rate of reported 30-day device/procedure-related serious adverse events, as well as a low rate of device events and clinically significant new arrhythmia through 36 months. At three years, the composite clinical success, defined by technical success, safety, and closure efficacy, was achieved in 84% of the 418 patients.

With over 55 million medical devices implanted over more than 45 years, Gore’s credibility and focus on evidence-based expansion continue to drive adoption. The company is also expanding the diameter range of its Cardioform family, enabling closure for a wider range of ASDs.

Competitive Dynamics and Market Share Trends

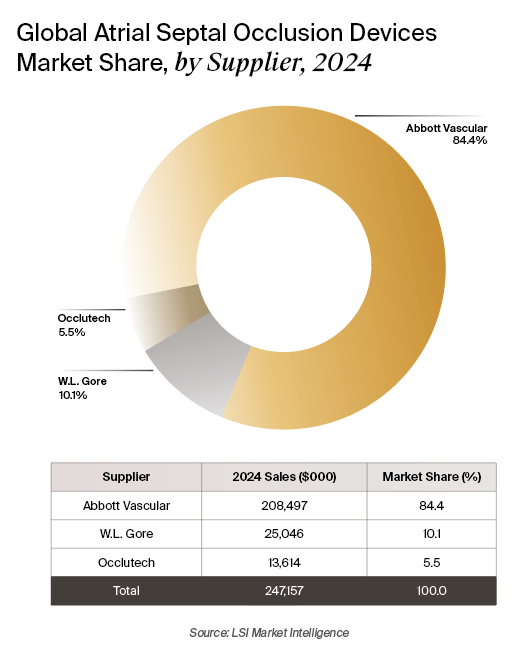

The ASD occluder market remains relatively concentrated, with Abbott Vascular accounting for nearly 85% of global sales. Occlutech’s U.S. launch and atHeart Medical’s novel approach introduce much-needed competition into a space historically dominated by Abbott and Gore. The market remains distinct from the larger PFO closure category, though devices like the Gore Cardioform and Abbott Amplatzer are approved for both indications.

Emerging companies are increasingly focused on solving long-term limitations of traditional metal-framed occluders, such as erosion risk, device rigidity, and challenges with future transseptal access. This innovation cycle is beginning to reshape physician preferences and procurement decisions, particularly in advanced cardiac centers.

Looking Ahead

With a growing pipeline of differentiated devices, a steady volume of congenital heart defect diagnoses, and expanding access to minimally invasive therapies, the outlook for the atrial septal occlusion device market remains positive. Innovations such as bioresorbable occluders and long-term data supporting existing platforms are opening new doors for patients and clinicians alike. The recent rise in global procedure volumes and accelerated device approvals suggest that this historically stable segment is poised for a dynamic future.

As companies prepare for upcoming commercial milestones and continued clinical trials, the market for ASD occlusion is expected to remain a competitive and strategically important space in the broader structural heart device landscape.

17011 Beach Blvd, Suite 500 Huntington Beach, CA 92647

714-847-3540© 2026 Life Science Intelligence, Inc., All Rights Reserved. | Privacy Policy