CathWorks is redefining what a medtech partnership can be through a deliberate, globally minded build-to-buy model aimed at transforming how coronary artery disease is diagnosed and treated. Anchored by its “skin-in-the-game” partnership with Medtronic and its innovative wire-free and drug-free FFRangio System, the company has used markets across the United States, Europe, and Japan as real-world validation engines. The result is a model that combines scientific proof, speedy innovation, scalability, and partnership discipline that could impact how startups position themselves for acquisition.

When Ramin Mousavi, President and CEO of CathWorks, steps onto an LSI stage, he likes to mention that CathWorks was the very first company to present at the very first LSI Emerging Medtech Summit, in 2020. It’s an aside delivered with a smile, and is not so much nostalgic but rather a celebratory reflection backed up by 12+ years of startup peaks and valleys, and a game-changing build-to-buy deal with device industry giant Medtronic.

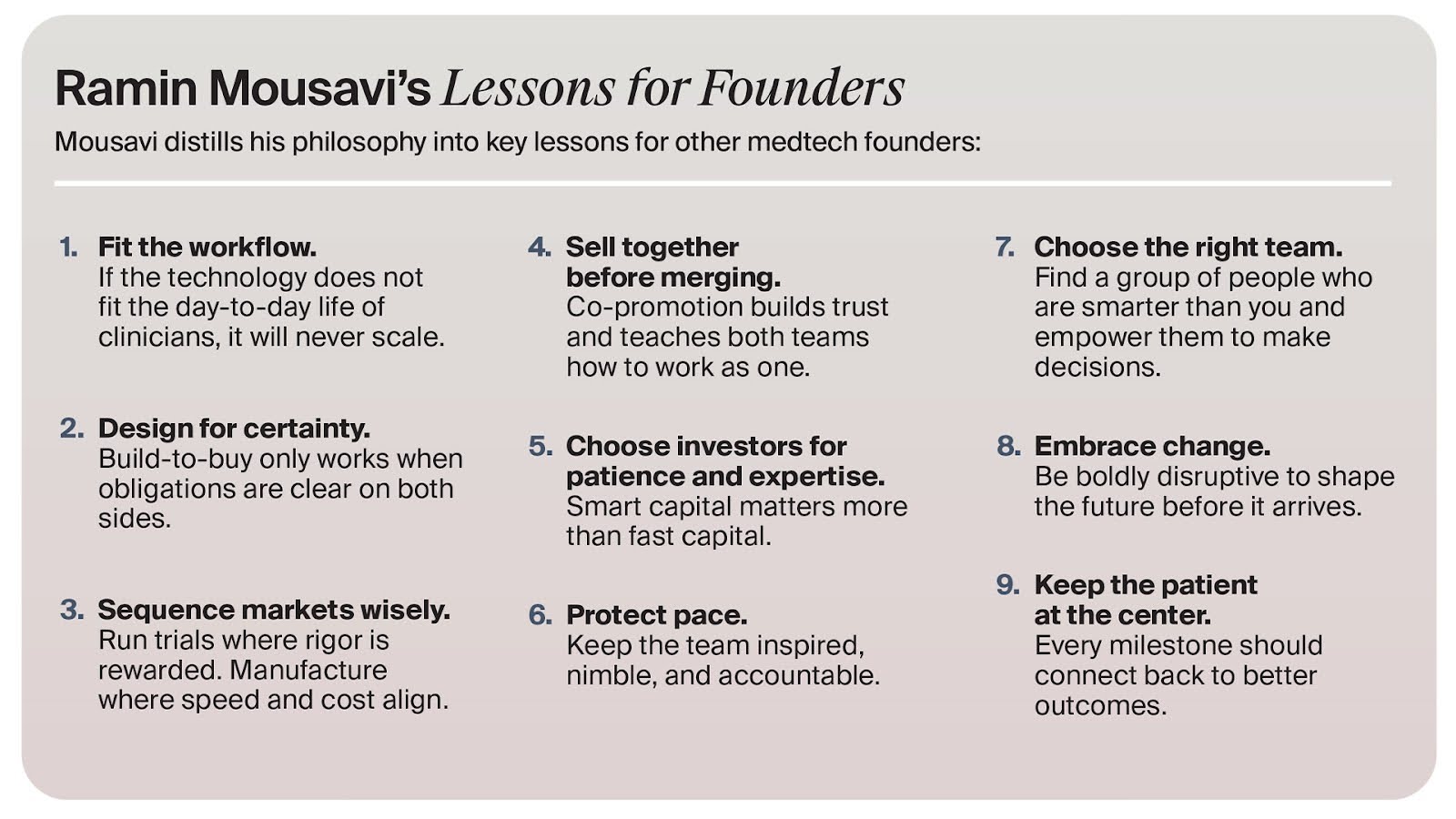

For Mousavi, success in medtech is not about flash or speed. It’s about playing the long game, building deliberately, and earning outcomes through persistence and precision. He has built his career around that philosophy.

After earning dual degrees in computer and electrical engineering at the University of California, Irvine (UCI), he completed an MBA at UCI’s Paul Merage School of Business and a Healthcare Executive Leadership certificate from Harvard Business School. (In September, Mousavi’s alma mater recognized him with the 2025 Lauds & Laurels Distinguished Alumnus Award, UCI’s highest alumni honor.) His early years in the device, tech, and aerospace industries at Edwards Lifesciences, Baxter International, Panasonic Avionics, and Rockwell Collins (now Collins Aerospace) gave him a unique blend of skills, including technical depth, operational discipline, and commercial awareness.

At Baxter, he led the patient monitoring and digital health portfolio through a series of acquisitions. At Edwards for nearly a decade, he honed his understanding of cardiovascular markets. Now at CathWorks, which he joined in 2019, Mousavi has fused his start-up and large strategic leadership experience within the medical device, aerospace, and tech industries to create a company that sits squarely at the intersection of innovation and scalability.

From Prototype to Patient-Focused Product

CathWorks began more than a decade ago in Israel, with a vision to transform how physicians assess coronary artery disease. Its signature product, the FFRangio System, uses routine angiograms, artificial intelligence (AI) and computational science to calculate an accurate multi-vessel fractional flow reserve (FFR) without the need for invasive pressure wires, drugs, or a guide catheter, and with an approximate 20% reduction in radiation compared to wire-based physiology. This ability to gather real-time FFRangio values at every point on the coronary tree optimizes clinical decision-making, and it has demonstrated excellent real-world outcomes in line with data from large FFR studies.

Early on, the concept attracted attention. Clinicians loved the idea of getting physiology data instantly from standard angiograms. But when the first version launched commercially, it stumbled. Cases took nearly 20 minutes, and physicians found the workflow cumbersome.

When the pandemic hit, Mousavi and his team took the pause as an opportunity to rebuild. They studied advances in computer vision outside the medical world, recruited a technical leader from Samsung’s imaging division, and integrated artificial intelligence into the workflow. By automating the manual image-selection and image-tracing step, they reduced case time from 20 minutes to about two.

“No matter how cool your technology is, if it doesn’t fit the procedural workflow, you have a task, not a product,” he says.

The underlying science never changed. The team kept the validated algorithm intact but removed the friction. When the updated platform re-launched in 2021, adoption accelerated quickly.

“We kept the algorithm. We automated the pain. That’s when adoption finally happened,” says Mousavi.

The FFRangio System soon proved its power in the field. Across five clinical studies, the technology achieved a sensitivity of 91% and specificity of 94% compared to gold standard wire-based FFR. It delivered what physicians had long wanted: comprehensive physiology-guided decision support inside their existing workflow.

Most importantly, the technology is impacting patient lives. In a busy cath lab, a patient with stable angina and multivessel disease presents a familiar dilemma. Clinicians can make decisions based on angiographic appearance alone or take the time to use invasive pressure wires to measure physiology. Both paths carry risk and delay.

FFRangio changes that. In a matter of minutes, the physician can see exactly where ischemia exists and decide which lesions truly need intervention. They can now also plan interventions with clinical tools added since 2021. The result is faster care, fewer unnecessary stents, and lower risk. In high-volume centers, those minutes translate into lives touched and costs reduced.

“Engineering taught me systems. Business taught me people. But patients, that’s where it all comes together,” says Mousavi. “Have a vision that’s truly patient-driven, or choose an easier job.”

Build-to-Buy with a Twist

Medtronic’s relationship with CathWorks began in 2018, with a minority investment when the company raised $30 million in their Series C. That same year, the company received FDA clearance for FFRangio. In 2021, CathWorks raised another $30 million across the next financing rounds, gained national reimbursement in Japan, and built a strong clinical and commercial record.

By 2021, CathWorks had proven its model and faced a choice. It could sell outright or find a partner willing to share in the journey. Mousavi chose the latter.

In July 2022, CathWorks and Medtronic announced a deal that has since become a reference point for strategic partnerships. Medtronic invested $75 million upfront and secured an option to acquire CathWorks for as much as $585 million plus undisclosed milestones. The two companies also agreed to co-promote FFRangio in the U.S., Europe, and Japan.

What makes the deal unusual is its symmetry. If Medtronic decides not to exercise its option by 2027, CathWorks has the option to compel acquisition under undisclosed predefined conditions. Mousavi describes it as an engagement towards a marriage.

“If we were going to enter this, everyone needed real skin in the game. Otherwise, just sell and be done,” he says.

The term “build-to-buy” is a popular buzzword of late in medtech circles, but Mousavi defines it precisely. For him, it is about alignment and clarity, not financial engineering.

“There are three things you’re trying to de-risk in build-to-buy: technology, capital, and market execution. This model de-risks all three by pulling on the strength of both organizations,” he says.

In Mousavi’s view, the key is balance. If the structure offers only optionality without commitment, the startup risks capping its upside while keeping all the downside. Certainty must be written into the agreement. CathWorks’ arrangement with Medtronic does exactly that.

The Medtronic deal gave CathWorks stability at a time when most startups were struggling to raise capital. It also allowed the company to keep its independence, maintain its innovation cadence, and gain access to Medtronic’s impressive global commercial infrastructure.

But that doesn’t mean everything gets easy. “Getting the deal done is hard,” Mousavi says. “Executing after the deal is even harder. You’re an agile speedboat next to a large steady ship.”

The model has panned out. With funding secured and commercial support in place, CathWorks moved forward confidently, expanding its presence and stocking its clinical evidence coffers across continents while continuing to refine its technology at the rapid startup pace.

“In three years, when many companies struggled to raise, we had capital, alignment, and execution,” says Mousavi.

The build-to-buy deal gave CathWorks what it needed most, and it also offered Medtronic a clear path into the emerging space of digital cardiology. Together, they created a structure that rewarded progress and shared risk.

For Mousavi, the decision to take the build-to-buy path was rooted in experience and trust. Years inside large companies had taught him how partnerships work when they are built on trust, transparency, and shared intent. “If the incentives are aligned and you trust your partner,” he says, “everyone rows in the same direction.”

The APAC and EU Chessboard

Just as CathWorks took a carefully calculated approach to its Medtronic deal, it is doing the same with its clinical and regulatory plan.

Japan became the company’s second market after the U.S. The choice was strategic: Japan’s cardiology community places a high value on functional physiology assessment, with adoption rates approaching 90% compared to about 25% in the U.S., according to Mousavi.

That environment made it the perfect place to prove the technology. CathWorks launched its first randomized controlled trial in Japan and later conducted the 2,000-patient, randomized, controlled, global ALL-RISE trial that included one-third of patients from Japanese sites. Those studies became the foundation of its evidence base.

“Japan gave us early, clear signals, faster than the U.S. in some respects. That changed our map,” Mousavi says.

The company is building on that success by expanding into China, Singapore, Korea, and Taiwan. These markets are often out of reach for U.S. medtech startups, but Medtronic’s regional presence provided a vital bridge. Local distribution networks, reimbursement knowledge, and regulatory experience gave CathWorks access it would not have had alone.

“You can partner with consultants, but nothing substitutes for a group that has lived through it,” notes Mousavi.

Onstage at LSI Asia ‘25, Mousavi described Asia-Pacific not as a single market but as a chessboard of competencies. Japan represents precision and high-value regulatory rigor. China offers speed and scale. Singapore is a design hub with manufacturing advantages and R&D tax incentives. Australia supports early clinical feasibility through government funding. India provides massive volume and data diversity, though at much lower price points. This regional sequencing has helped CathWorks balance regulatory risk, cost structure, and market access in a way few startups manage to do.

“Match each country’s core competency to your phase. That’s where acceleration happens,” he advises.

CathWorks then set its sights on Europe. It achieved full MDR approval and launched in six countries: Switzerland, the United Kingdom, France, Italy, Spain, and Belgium, with more European countries being launched in the upcoming months. The expansion created a diverse base of clinical data and payor experience that will strengthen the company’s future negotiations and reimbursement pathways.

“Global co-promotion let us go where the adoption signals were strongest, not just where we could afford to hire,” explains Mousavi.

In the U.S., adoption is also growing. Lenox Hill Hospital and the Northwell Health team in New York recently performed their 1,000th FFRangio case. The milestone demonstrates both the scalability of the technology and its fit in high-volume cath labs.

Japan’s reimbursement was a turning point for CathWorks, demonstrating that a value-based healthcare system could reward a noninvasive technology. Co-promotion with Medtronic in Europe and the U.S. has given the company exposure to hundreds of hospitals and a steady stream of real-world data that informs continuous improvement.

Looking Ahead

As CathWorks expands adoption in the U.S., deepens its footprint in Europe, and continues to grow across Asia, the Medtronic option feels less like a question and more like an inevitable milestone. The engagement model does not guarantee a wedding, but it guarantees a plan. That plan has carried the company through capital scarcity and into the heart of a conversation about what the future of medtech partnerships should look like.

As the company advances toward a potential acquisition, the milestones that matter most are not vanity numbers but tangible proof points. They include pivotal clinical results that influence guidelines, reimbursement expansion, and documented scalability beyond the home market.

CathWorks has lived more than one lifetime already. It has faced setbacks, rebuilt itself, and found a way to thrive through a mix of humility, vision, and persistence. Its story is proof that innovation is not a moment; it is a discipline.

And for Ramin Mousavi, that discipline continues to guide every move, from Irvine to Tokyo to Tel Aviv and beyond. In his world, building to be bought is not about exits alone. It is about building something worth buying.

He is also focused on finding value in and contributing value to the global medtech ecosystem through his partnership with LSI and the “New Era” signature series panel discussions he led at three consecutive LSI summits around the world in 2025, and that he’s bringing back in 2026.

“What Scott and his team have accomplished at LSI is the very example of vision, creativity, and commitment in value creation that every board member and CEO thrives for every day,” says Mousavi. “I know this because we were the first to buy into it, that they turned this vision into a world-class, must-attend, value-creating ecosystem, where entrepreneurs, investors, strategics, and the supporting service partners all have a lot to gain. But even more important, you get to build life-long and life-changing relationships. We are partners for as long as they will have us, because we are a beneficiary of this amazing ecosystem.”

Stay tuned, as Mousavi also has a game-changing, stealth-mode project under wraps that he’ll be announcing at LSI USA ‘26 in Dana Point (March 16-20).

Ramin Mousavi

President & Chief Executive Officer

CathWorks

Ramin Mousavi brings extensive executive leadership and operational expertise across various domains, including general management, marketing, strategy, product development, and commercialization within diverse market segments. With a notable tenure most recently leading the patient monitoring and digital health portfolio at Baxter International, Mousavi has also held key leadership roles at Edwards Lifesciences, Panasonic, and Rockwell Collins.

At CathWorks, Mousavi served as Vice President of Global Marketing and Strategy, as well as Chief Marketing Officer from 2019 to 2020. He holds dual B.S. degrees in Computer and Electrical Engineering from the University of California, Irvine (UCI), complemented by an M.B.A. from the Paul Merage School of Business at UCI. Additionally, he has furthered his expertise with a Healthcare Executive Leadership certificate for Business Innovation in Global Healthcare from Harvard Business School.

This September, the UCI Paul Merage School of Business namedMousavi as the recipient of this year’s Lauds & Laurels Distinguished Alumnus Award. The Lauds & Laurels is the UCI Alumni Association’s (UCIAA) highest honor at UCI, recognizing distinguished members of the UCI community for their service to the university, the community, or their profession.

For more insights like this, subscribe to The Lens medtech magazine today.

17011 Beach Blvd, Suite 500 Huntington Beach, CA 92647

714-847-3540© 2026 Life Science Intelligence, Inc., All Rights Reserved. | Privacy Policy