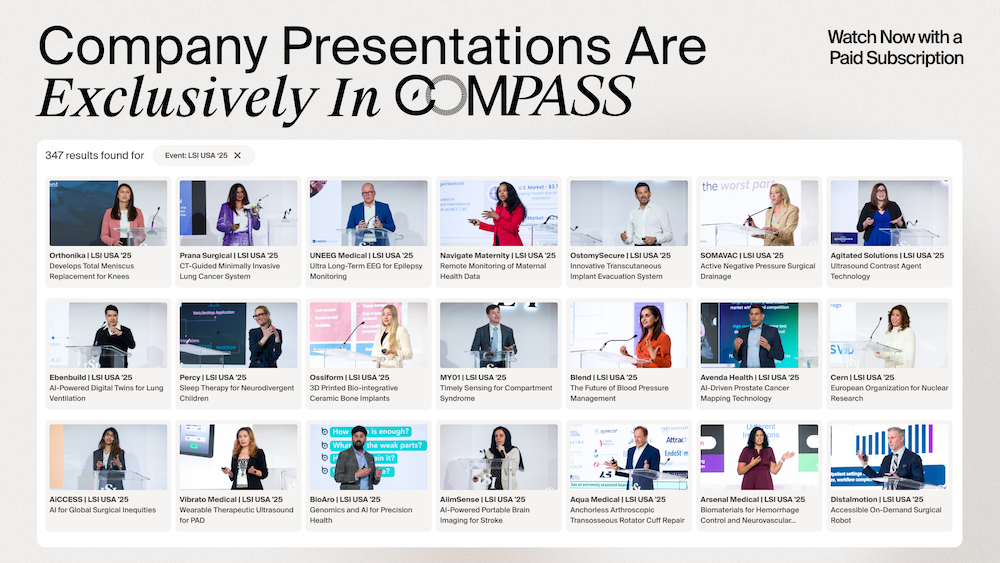

- Video Library

- Lali Sekhon, SpinePoint - Interbody Devices for Spine Surgery | LSI USA '24

Lali Sekhon, SpinePoint - Interbody Devices for Spine Surgery | LSI USA '24

shaping the future of

Medtech at LSI USA ‘26

Waldorf Astoria, Monarch Beach

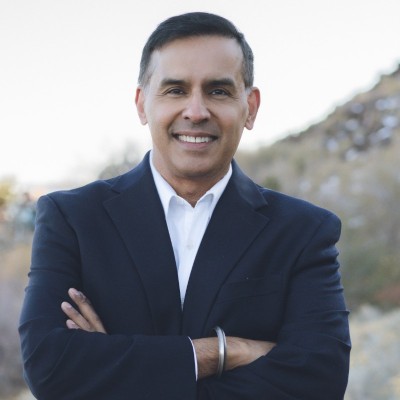

Lali Sekhon

My biggest attribute is I get things done. I am ethical, driven, decent, honest and fair. I understand strategy, the big picture. I have modeled my life around hard work, results, altruism and empathy. Make the impossible possible. Dream it and live it. I am passionate about justice and equality and achieving your best. I look after my team. Get results and be as good as you can be. With an MD, a PhD and an MBA, I have a breadth of skills. I try not to post infomercials.

Specialities: Spine Surgery, Neurosurgery, Education, Teaching, Spinal Implants, Intellectual Property, Leadership, Management

Lali Sekhon

My biggest attribute is I get things done. I am ethical, driven, decent, honest and fair. I understand strategy, the big picture. I have modeled my life around hard work, results, altruism and empathy. Make the impossible possible. Dream it and live it. I am passionate about justice and equality and achieving your best. I look after my team. Get results and be as good as you can be. With an MD, a PhD and an MBA, I have a breadth of skills. I try not to post infomercials.

Specialities: Spine Surgery, Neurosurgery, Education, Teaching, Spinal Implants, Intellectual Property, Leadership, Management

17011 Beach Blvd, Suite 500 Huntington Beach, CA 92647

714-847-3540© 2026 Life Science Intelligence, Inc., All Rights Reserved. | Privacy Policy