Overview

Valued at ~$144.2 million in 2023, the peripheral vascular guidewires market is projected to

reach ~$195.7 million by 2028, increasing at a CAGR of 6.3% over the 2023-2028

forecast period. This Market Snapshot is part of LSI’s Market Intelligence platform, your

one-stop-shop for global medtech market sizing and analysis, procedure volume data, startup company- and

deal-tracking, curated insights, and more.

Guidewires are an integral tool for endovascular procedures. They are used to guide catheters or stents through

the vasculature in peripheral vascular disease (PVD) treatment. Guidewires come in a variety of configurations,

with the core diameter being a key metric by which a guidewire is evaluated. Smaller diameter wires have

increased flexibility, while larger diameter wires offer increased device support.

Products included within the scope of this analysis include:

Guidewires employed in transcatheter PVD diagnosis and interventional procedures

This Market Snapshot is intended to provide a high-level overview of the global market for peripheral vascular

guidewires, with key insights into:

Unit volumes from 2023 to 2028

Market forecasts from 2023 to 2028

Market insights

Competitive landscape analysis of major competitors

Insights into key market events for strategic and startups

Peripheral Vascular Guidewires Market Snapshot Summary

| Snapshot Aspect | Data and Details |

| Base Year for Estimate | 2023 |

| Forecast Period | 2023 - 2028 |

| Market Size in 2023 | $144.2 million |

| CAGR | 6.3% |

| Projected Market Size in 2028 | $195.7 million |

Peripheral Vascular Guidewires Devices Market Insights

The peripheral vascular guidewires market is experiencing steady growth, largely due to the growing prevalence

of PVD, a condition closely linked to aging. As the global population aged 65 and older is projected to increase

by 2.9% annually from 2023 to 2028, the incidence of PVD and its more severe forms is expected to rise

accordingly. Endovascular therapies, which are considered the gold standard for treating PVD, are driving the

market, particularly as increased screening helps identify more patients in need of treatment.

While the demand for surgical intervention continues to grow, the market faces pricing pressures, with prices

expected to increase at a slower rate than the overall medical device market—projected at only 0.4% annually.

This is due to ongoing challenges in reimbursement rates. Despite these pressures, the market for peripheral

vascular guidewires is still poised for moderate growth, driven by the increasing need for surgical resources

and continued advancements in treatment options.

Competitive Landscape

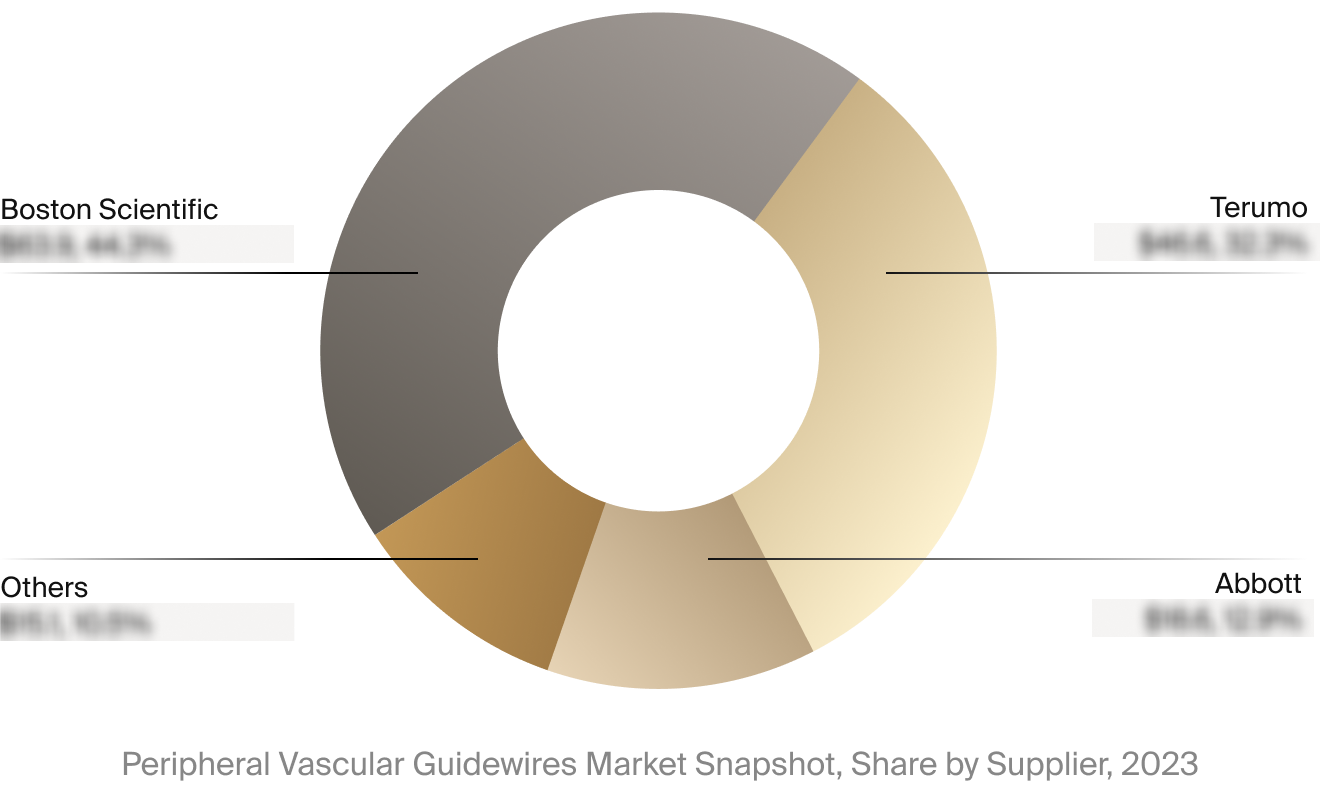

The full Market Snapshot includes a robust analysis of the competitive landscape for the peripheral vascular

guidewires market. This includes estimated market revenue and market share for key players, such as Boston

Scientific, Terumo, and Abbott.

Select Market Events

| Company | Date | Type | Event |

|

Johnson & Johnson

|

4/2024 | M&A | J&J announced that the company will acquire Shockwave Medical for $13.1 billion. |

|

Cordis

|

10/2023 | M&A | Cordis announced the completion of its acquisition of MedAlliance, a developer of drug-eluting balloon technologies. Cordis paid $200 million upfront with additional achievement and commercial milestone payments totaling $900 million. |

Key Companies Covered

Abbott

Artiria

Asahi Intecc Medical

Baylis Medtech

Boston Scientific

Cook

Cordis

Johnson & Johnson

Medtronic

Merit Medical

Sensome

Sentante

Shockwave Medical

Terumo

Translumina

Xenter