Overview

Valued at ~$24.16 billion in 2023, the gastrointestinal endoscopy devices market is projected

to reach ~$33.05 billion by 2028, increasing at a CAGR of 6.5% over the

2023-2028 forecast period. This Market Snapshot is part of LSI’s Market Intelligence platform, your

one-stop-shop for global medtech market sizing and analysis, procedure volume data, startup company- and

deal-tracking, curated insights, and more.

Endoscopy is a minimally invasive procedure that enables visualization, diagnosis, and surgical intervention

within the body. The procedures involve the introduction of a flexible, fiberoptic scope into the upper or lower

gastrointestinal (GI) tract. Endoscopy serves a crucial role in minimally invasive examination and treatment,

making it easier to diagnose and address medical issues with reduced postoperative complications.

Products included within the scope of this analysis include:

GI endoscopes for imaging

GI endoscopic instruments for intervention

This Market Snapshot is intended to provide a high-level overview of the global market for gastrointestinal

endoscopy devices, with key insights into:

Unit volumes from 2023 to 2028

Market forecasts from 2023 to 2028

Market insights

Competitive landscape analysis of major competitors

Insights into key market events for strategic and startups

Gastrointestinal Endoscopy Devices Market Snapshot Summary

| Snapshot Aspect | Data and Details |

| Base Year for Estimate | 2023 |

| Forecast Period | 2023 - 2028 |

| Market Size in 2023 | $24.16 billion |

| CAGR | 6.5% |

| Projected Market Size in 2028 | $33.05 billion |

Gastrointestinal Endoscopy Devices Market Insights

The gastrointestinal endoscopy devices market is experiencing steady growth, driven by the ongoing shift from

open surgical procedures to less invasive laparoscopic and endoscopic techniques. Advances in device technology,

including robotic surgery systems, enhanced imaging and guidance technologies, and more effective energy-based

tools, enable these less invasive procedures. These innovations are making endoscopic surgeries increasingly

accessible, offering numerous advantages over traditional open surgery, such as reduced trauma, less

postoperative pain, shorter recovery times, and improved cosmetic outcomes.

The market is growing particularly quickly in other developing/developed regions, such as China and India. While

the overall market is expanding, prices are expected to increase at a slower rate compared to the broader

medical device market due to intense competition and price sensitivity in emerging markets.

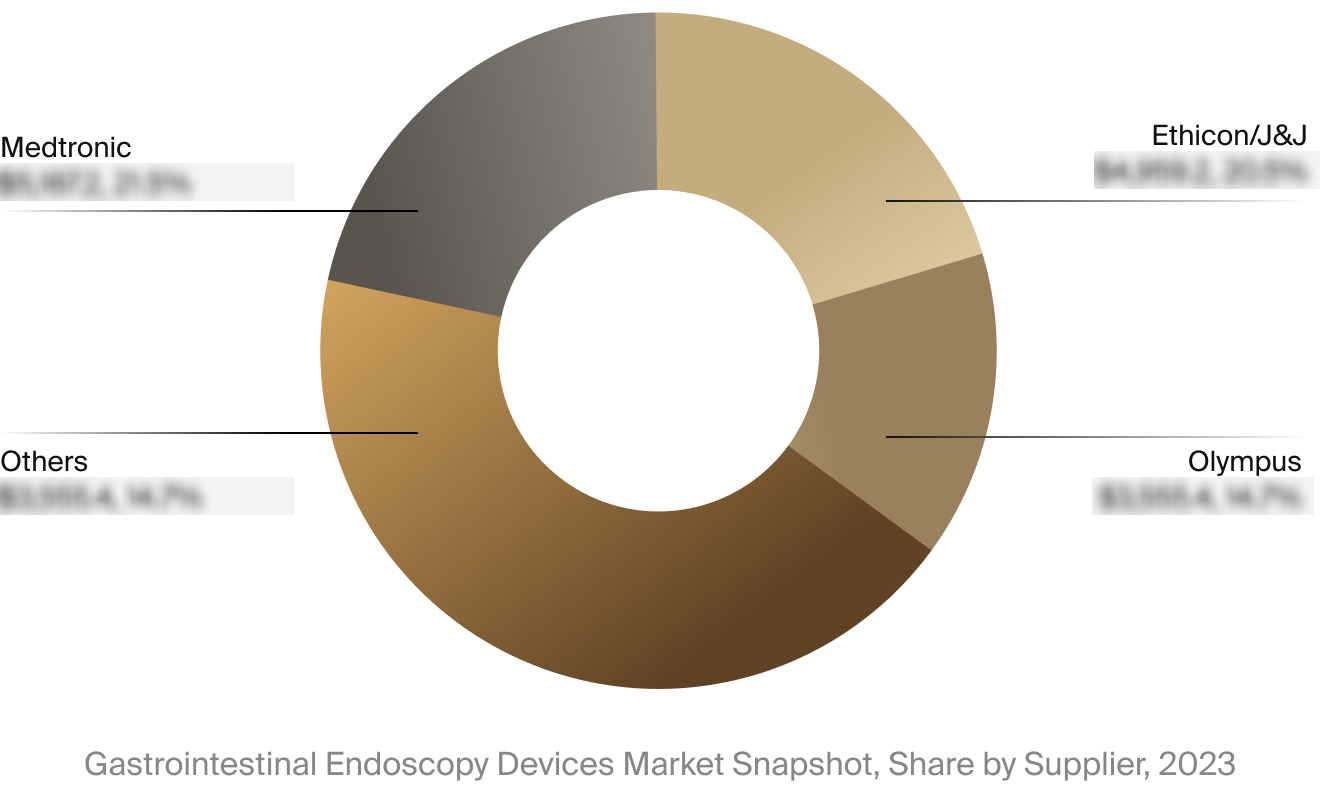

Competitive Landscape

The full Market Snapshot includes a robust analysis of the competitive landscape for the gastrointestinal

endoscopy devices market. This includes estimated market revenue and market share for key players, such as

Ethicon/Johnson & Johnson, Medtronic, and Olympus.

Select Market Events

| Company | Date | Type | Event |

|

Medtronic

|

5/2024 | Regulatory Approval | Medtronic received U.S. FDA 510(k) clearance for its PillCam Genius SB capsule kit, used in small bowel endoscopy. |

|

Olympus

|

10/2023 | Product Launch | Olympus announced the market launch of its EVIS X1 endoscopy system. |

Key Companies Covered

Applied Medical

Aqua Medical

B. Braun

Boston Scientific

ConMed

Ethicon

Integra Lifesciences

Intuitive Surgical

Johnson & Johnson

KARL STORZ

Medtronic

Olympus

Purple Surgical

Richard Wolf

Stryker

Teleflex