Life Science Intelligence is debuting new weekly content series – the Weekly Medtech Pro Report. The Weekly Medtech Pro Review provides a preview of select market data and startups covered in the full Medtech Pro Platform, which is a comprehensive market intelligence solution for medtech executives. As a preview of the types of content found on Medtech Pro, the Weekly Medtech Pro Review will cover select market data, procedure volumes, and startups.

Click here to learn more or subscribe to the full Medtech Pro platform.

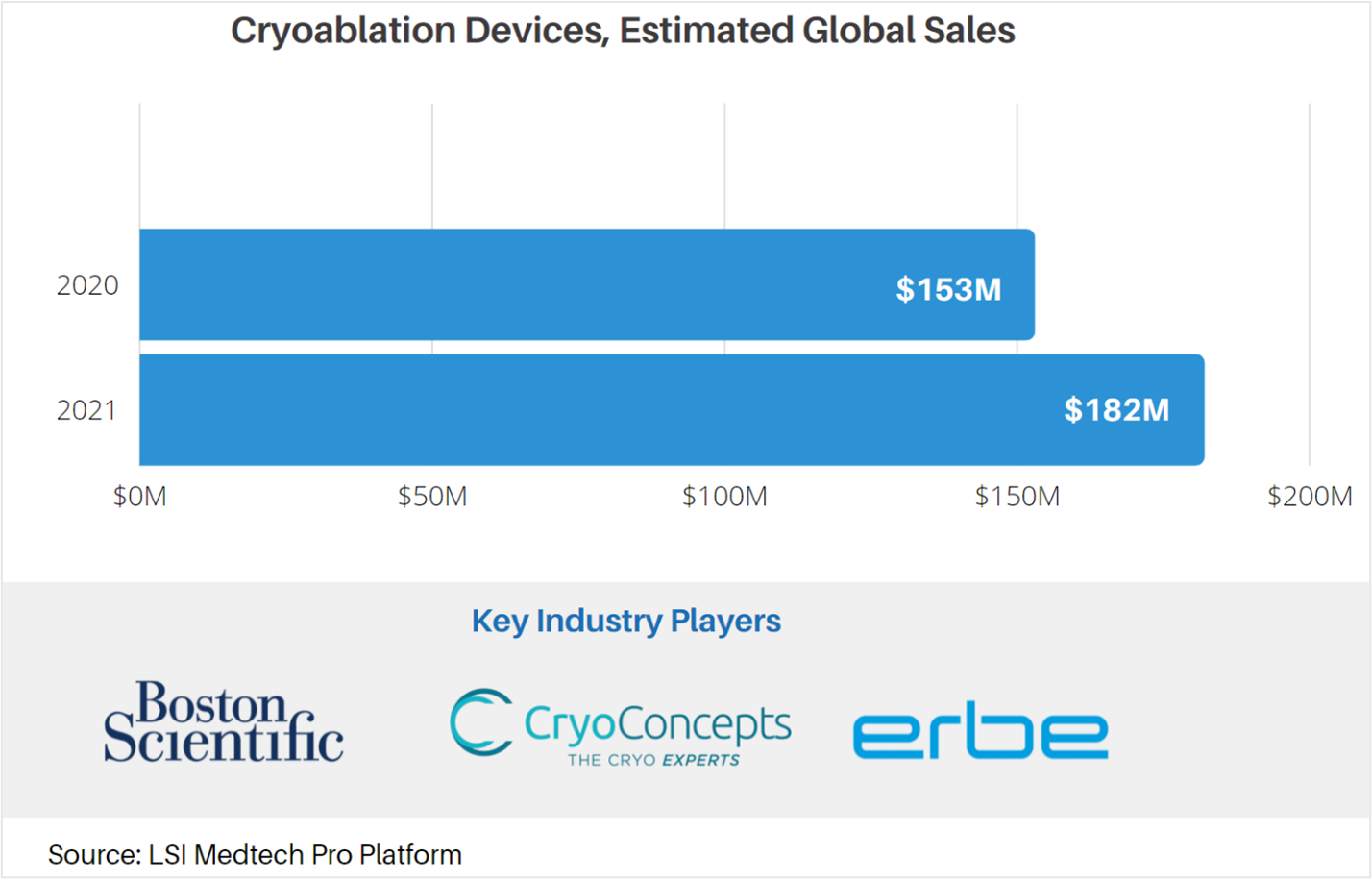

Medtech Market Snapshot - Cryoablation

Cryoablation is a therapeutic approach with multiple clinical applications, including tumor ablation, skin lesion removal, and treating menorrhagia. As with many medtech markets, LSI estimates that the COVID-19 pandemic negatively impacted global sales of cryoablation devices by approximately $30M in 2020, sliding from projected sales of $183.1M to $153M. Note that this estimate excludes the sales of cryoablation catheters for the treatment of arrhythmia – which are covered in a separate forecast.

The effects of the COVID-19 pandemic have begun to subside, with many markets expected to see a sharp rebound in total sales in 2021. Sales attributable to cryoablation catheters are anticipated to increase by 18% in 2021, reaching $181.6M by year’s end.

For more market data on the global cryoablation devices market, as well as other medtech markets, visit LSI’s Medtech Pro platform.

Trends in Surgical Procedure Volumes

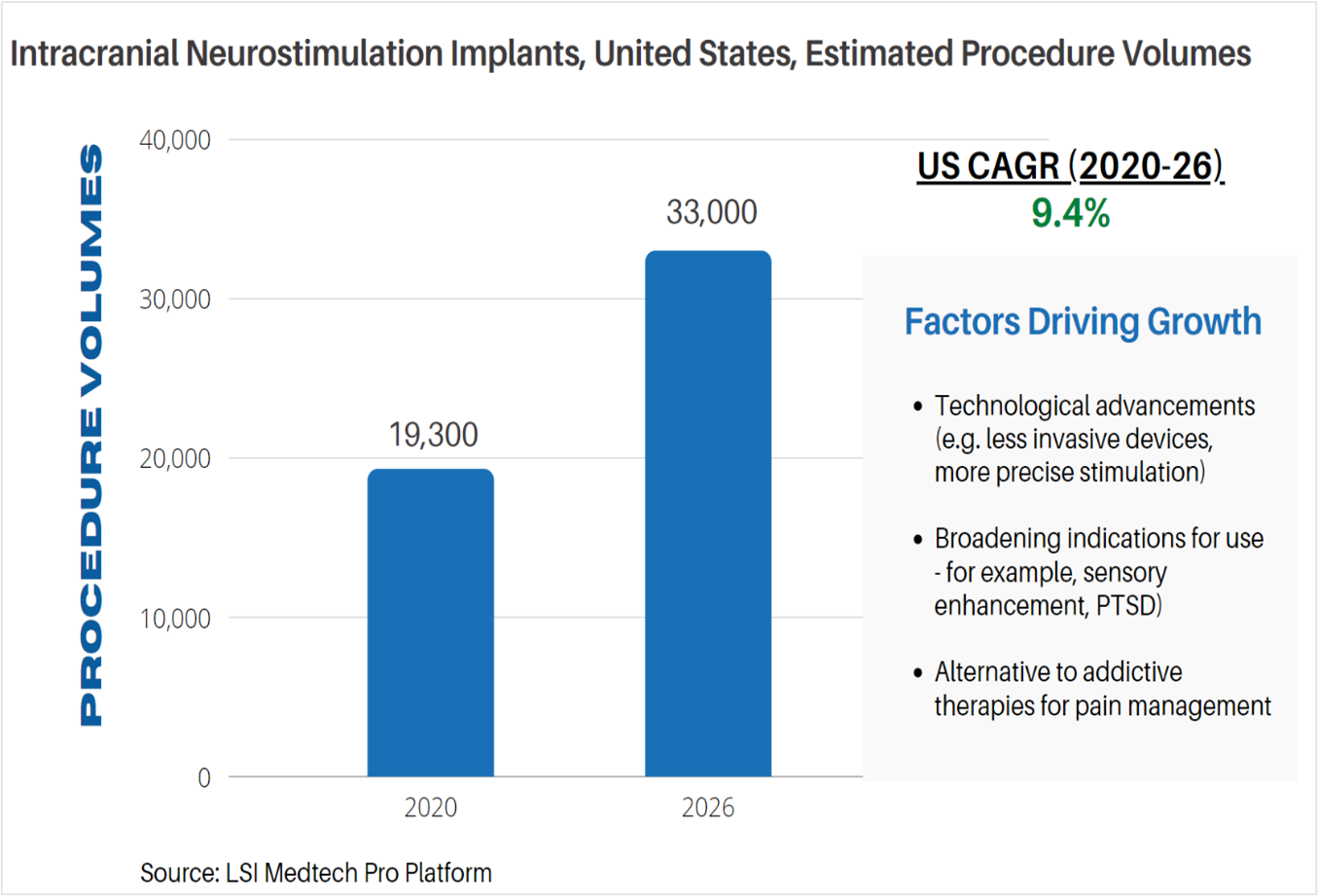

Life Science Intelligence tracks surgical procedure volumes across 37 countries and 12 major surgical markets (e.g. orthopedics, ENT, aesthetics). This week, our featured surgical procedure volume is for intracranial neurostimulation implant procedures in the United States. According to LSI’s Surgical Procedure Volumes database there were an estimated 19,300 of these procedures performed in 2020. While the COVID-19 pandemic significantly impacted the performance of these procedures in 2020, procedure volumes are anticipated to rebound and increase at a CAGR of 9.4%, reaching 33,000 neurostimulation implant procedures by 2026.

Startup Spotlight

To see a Centerline Biomedical’s presentation at the LSI Emerging Medtech Summit, click here.

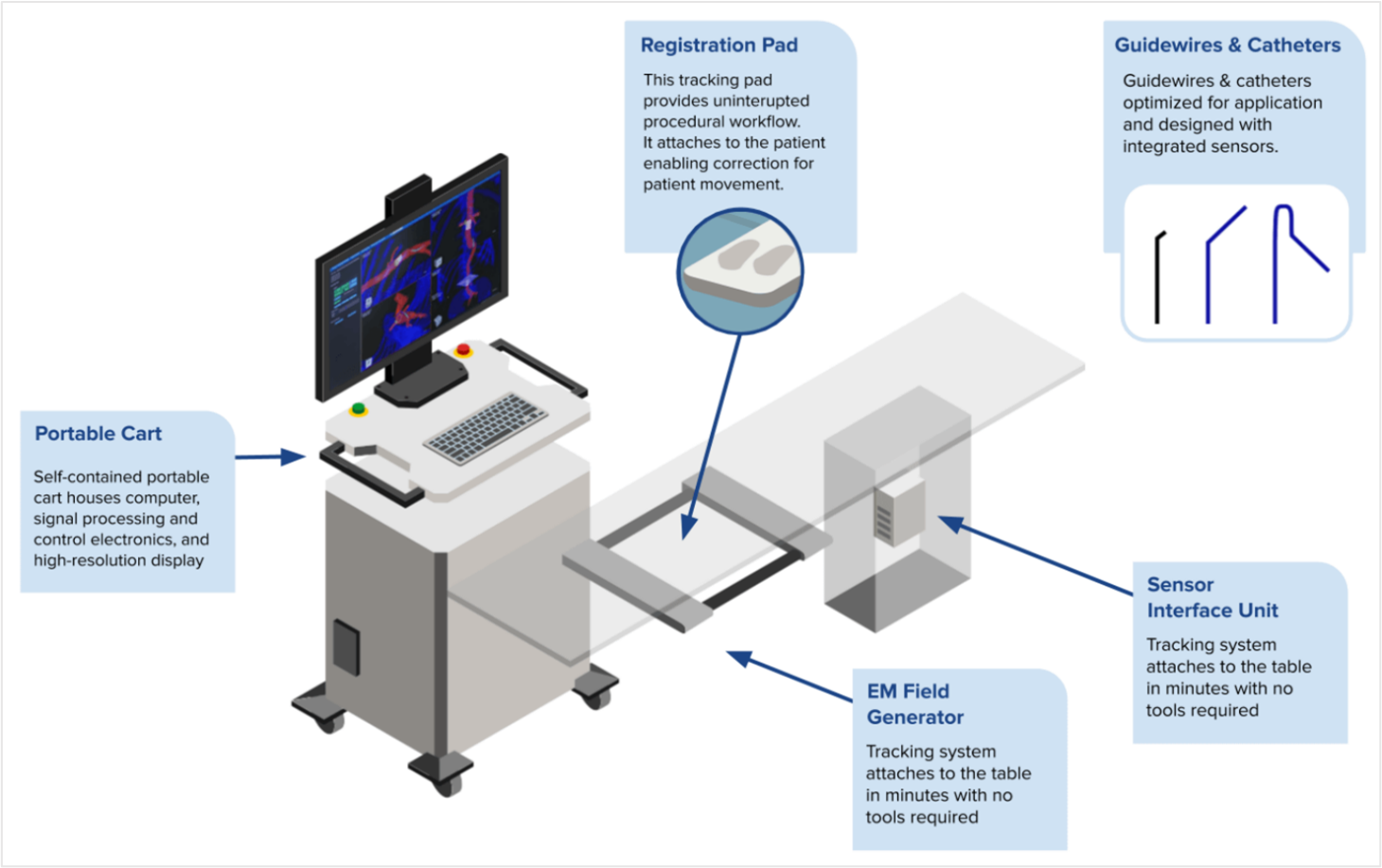

Centerline Biomedical is developing a next generation imaging system for catheter-based, endovascular procedures. Fluoroscopy remains a staple for guiding and navigating vessels during endovascular procedures. However, the fluoroscopy has numerous drawbacks, including being limited to two-dimensional visualization, poor image quality, and exposure to radiation. Centerline Biomedical’s solution to the limitations of fluoroscopy is the Intra-Operative Positioning System (IOPS).

The IOPS system is composed of a mobile cart with an electromagnetic field generator, mountable sensor unit, and consumables such as catheters, guidewires and a trackpad. The IOPS platform is agnostic, meaning it is compatible with current imaging providers. IOPS is currently FDA cleared as an adjunct to fluoroscopy during endovascular aortic repair procedures. Future markets for the use of IOPS include peripheral artery disease, structural heart (e.g. TAVR, TMVR), neurovascular, and percutaneous coronary intervention.

With over 2 million vascular procedures performed annually in the US, the potential value that the company’s technology can bring catheterization labs in the US and globally is significant. The company began to commercialize IOPS this year and is already on track to do $5M to $7M. Centerline is currently raising $25M from a Series B round.

Figure 1: Centerline Biomedical IOPS System Components

Aidoc is a developer of software support solutions platform that leverages artificial intelligence to analyze radiology images. At the heart of the Aidoc’s BriefCase software is AI that evaluates images and identifies abnormalities to help radiologists prioritize serious cases and reduce turnaround time.

Aidoc’s solution has been used to analyze over 8 million images to date. According to Aidoc, the company has more FDA cleared solutions than other competitors developing software for medical image analysis. BriefCase has received FDA approval to evaluate images for patients with pulmonary embolism, intracranial hemorrhage, large vessel occlusion, rib fractures, cervical spine fractures, and intra-abdominal free gas identification. The cross-specialty approach to AI image analysis is a compelling value proposition that Aidoc and its competitors, including Arterys and Zebra Medical Vision, have pursued in order to drive adoption of their respective platforms.

In early July 2021, the company completed a Series C round, raising $66M in funding. The investment will support Aidoc’s continuing development of its cross-specialty AI platform.

Artificial intelligence has the potential to help address the dwindling workforce of radiologists and the burden that this will place on healthcare systems. However, a survey conducted in 2020 by the American College of Radiology found that AI has been adopted by approximately 30% of American radiologists. Getting healthcare systems to recognize the benefits of implementing AI remains the main barrier that Aidoc and its competitors face.

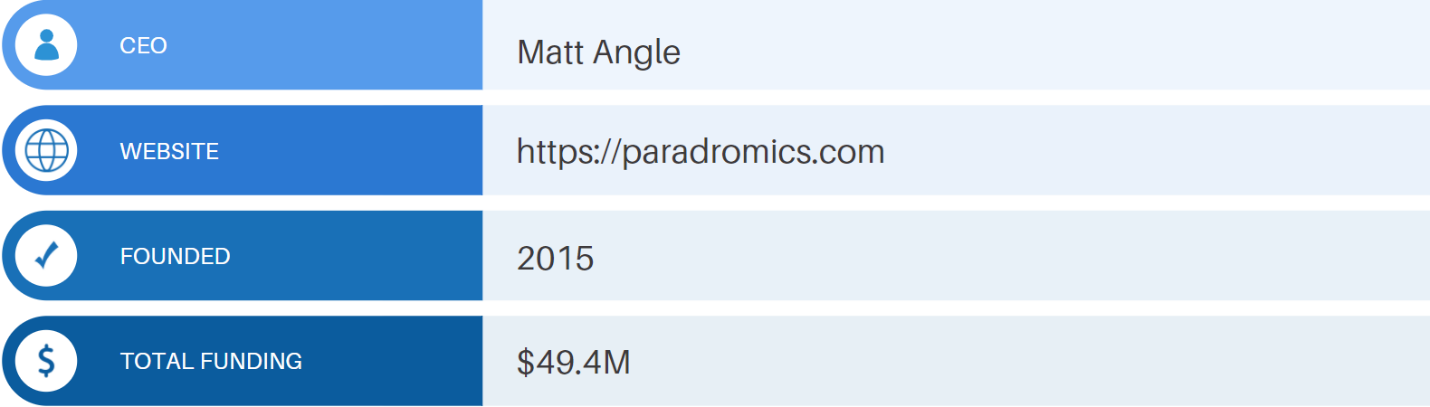

To see a Paradromics’ presentation at the LSI Emerging Medtech Summit, click here.

Paradromics is developing a next-generation brain-computer interfaces (BCIs). The company claims that there are several features that make their technology different from competing technologies, including Neuralink. Foremost among the company’s differentiators will be the technology’s support for high data-rate transfer speeds. Paradromics’ technology utilizes a combination of scalable microelectrode semiconductors and 20µm diameter microwires to rapidly translate bioelectric signals from the brain into actionable, digital signals for computers. In addition to rapid data transfer rates, the company is designing their technology to be biocompatible, support low-power rapid processing, and be discrete when compared to current BCIs.

Figure 2: Paradromics' Prototype BCI

Looking at the company’s initial indication of speech and motor paralysis, the estimated total addressable market (TAM) is approximately $120B. This assumes that there are approximately 3.2M patients that can be treated for $40k - $150k per implant. Paradromics’ go to market sequence will eventually target other patient groups, including sensory prosthetics (i.e. vision restoration & hearing loss) and drug resistant mental illness (e.g. depression & schizophrenia).

In late July 2021, the company announced that it had raised $20M from a Seed round. Funds from the round will support the development of the company’s first commercial product, the Connexus Communication Device, which will restore communication in patients who are unable to speak due to paralysis.

Schedule an exploratory call

Request Info17011 Beach Blvd, Suite 500 Huntington Beach, CA 92647

714-847-3540© 2025 Life Science Intelligence, Inc., All Rights Reserved. | Privacy Policy